29 March 2024 • 6 minute read

Industrials Regulatory News and Trends - March 29, 2024

Welcome to Industrials Regulatory News and Trends. In this regular bulletin, DLA Piper lawyers provide concise updates on key developments in the industrials sector to help you navigate the ever-changing business, legal, and regulatory landscape.

Intel will receive up to $8.5 billion from US government for new plants. On March 20, the US Department of Commerce announced that the US government is granting Intel up to $8.5 billion to help fund new chip plants in four states, the largest award yet in the Biden Administration’s effort to expand American chip-making. The money will go toward new factories and expansion projects in Arizona, New Mexico, Ohio, and Oregon, the department said. Intel’s total investment in US projects in the next five years is expected to exceed $100 billion, according to the department. The grant money, set aside under the CHIPS and Science Act of 2022, aims to fund a resurgence of US manufacturing to counteract COVID-era supply-chain disruptions and address global supply chain issues.

New California rules aim to reduce single-use plastic waste. On March 15, California released draft regulations for the state rules that require producers to cut single-use plastic waste and to ensure that the packaging on products they sell is recyclable or compostable. California also will soon enter into formal rulemaking concerning another law to expand beverage container redemption with technology and partnerships. Said state Secretary for Environmental Protection Yana Garcia, “This growing source of trash [single-use plastic] ends up in our landfills or, too often, polluting our most vulnerable communities.” In addition, the California Department of Resources Recycling and Recovery will give out $55 million in grants supporting technology solutions and workforce development for California's recycling industry.

Chemistry council says US can help forge global agreement on plastic pollution. On March 14, Chris Jahn, president and CEO of the American Chemistry Council, sent a letter to President Joe Biden outlining a set of elements Jahn said are needed for a successful global plastics pollution agreement and requesting a meeting to address priority issues ahead of the fourth meeting of the United Nations Intergovernmental Negotiating Committee on Plastic Pollution (INC). “The U.S. is in a key position to help forge agreement among delegations and arrive at an effective final agreement,” Jahn wrote in the letter. “Such an outcome will require discipline at home and abroad: the U.S. must continue to use its domestic regulatory authorities to address plastic pollution constructively and intelligently, while also pressing for implementable language in the global agreement that spurs circularity and eliminates plastic pollution.” The INC was convened in 2022 by the UN Environment Assembly to develop a legally binding international instrument addressing plastic pollution, based on a comprehensive approach that addresses the full life cycle of plastic from design to disposal. Its fourth session will take place in Ottawa April 23 – 29, and the fifth session will take place in Busan November 25 – December 1.

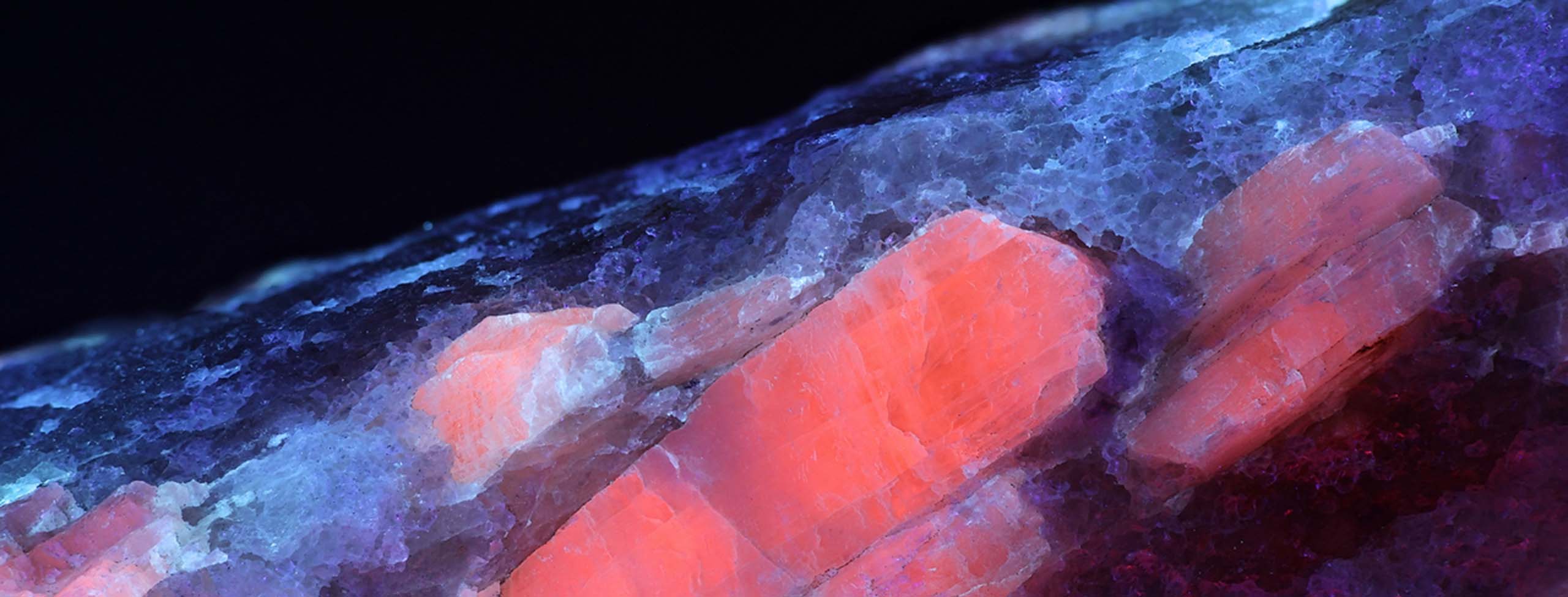

How state laws may interfere with US lithium manufacturing. On March 25, Reuters published a news analysis that discusses a key hurdle to the expansion of lithium production – the patchwork of relevant government regulation in the United States. The nation’s drive to become a major global lithium producer, said Reuters senior correspondent Ernest Scheyder, “is being held back by a confusing mix of state regulations that are deterring developers and hampering efforts to break China's control of the critical minerals sector.” He noted that in Texas, Louisiana, and other mineral-rich states, it's unclear who owns the millions of metric tons of lithium underneath the soil, how the battery metal should be valued by regulators, and who should pay to process it into a form usable by manufacturers. Such legal uncertainties, Scheyder wrote, are the latest impediment to the nation’s plans to produce more of its own lithium and to wean the US off foreign supplies of critical minerals – and the federal government, he concluded, is largely powerless, “leaving the Biden administration's aggressive electrification targets beholden to the pace at which local officials update outdated statutes.”

US biomass capabilities. On March 15, the US Department of Energy issued a finding that the United States could sustainably triple its production of biomass to more than 1 billion tons per year. DOE notes that biomass, in contrast to other renewable energy sources, can be converted directly into sustainable liquid fuels, called biofuels, to help meet transportation fuel needs. It can also be used to manufacture construction materials, insulation, personal care items, and many other products. The report – the fourth in a series of assessments of potential biomass resources in the United States since 2005 – finds that 1 billion tons of biomass could satisfy more than 100 percent of the projected demand for airplane fuel in the United States, allowing the nation to decarbonize US air transportation using sustainable aviation fuel. The report opined that the decarbonization of the nation’s transportation and industrial sectors depends on a significant increase in the production of renewable biomass for use in liquid fuel, bio-based chemicals, and other products. On March 14, the USDA released a related plan, Building a Resilient Biomass Supply: A Plan to Enable the Bioeconomy in America, that aims to promote biomass supply chain resiliency for domestic biobased product manufacturing. The USDA report finds that US biomass supplies are abundant: “This well positions the US to convert biomass into biobased products if improvements to biomass supply chain logistics and materials handling technology are made, and farmers are provided with incentives to produce biomass while reducing risk.”

DOD considered possibility of purchasing cobalt for defense stockpiles. On March 18, Reuters reported that last year, the US government seriously considered the possibility of buying cobalt on the open market for use in defense stockpiles. According to the article, even though the Defense Logistics Agency ultimately rejected the idea, it may well consider the idea again in the future. The goal of such purchases would have been to reduce US reliance on China, the world’s largest producer of cobalt – a critical element essential to the production of such defense and aerospace products as missiles, aerospace parts, and radar and guidance systems, as well as the batteries that power electric vehicles, a key plank of the nation’s transition away from fossil fuels. Reuters reported earlier this year that the Democratic Republic of Congo’s Kisanfu mine, in which China owns a minority stake, produced so much cobalt in 2023 that global supply exceeded demand; prices consequently tumbled from $40 a pound in 2022 to $13 a pound in February 2024.