26 May 2023 • 22 minute read

Blockchain and Digital Assets News and Trends - May 2023

This is our fifth monthly bulletin for 2023, aiming to help companies identify important and significant legal developments governing the use and acceptance of blockchain technology, smart contracts and digital assets.

While the use cases for blockchain technology are vast, this bulletin will be primarily on the use of blockchain and or smart contracts in the financial services sector. With respect to digital assets, we have organized our approach to this topic by discussing it in terms of traditional asset type or function (although the types and functions may overlap), that is, digital assets as:

- Securities

- Virtual currencies

- Commodities

- Deposits, accounts, intangibles

- Negotiable instruments

- Electronic chattel paper

- Digitized assets

In addition to reporting on the law and regulation governing blockchain, smart contracts and digital assets, this bulletin will discuss the legal developments supporting the infrastructure and ecosystems that enable the use and acceptance of these new technologies.

INSIGHTS

Crypto exchange Bittrex obtains approval of novel Bitcoin-based debtor-in-possession lending facility

By Noah Schottenstein, Rachel Albanese, Malithi Fernando

Bittrex Inc. and its three affiliates (Bittrex) filed chapter 11 petitions on May 8 in the Bankruptcy Court for the District of Delaware. Founded in 2014, Bittrex provided cryptocurrency exchange and trading services.

At its peak, Bittrex had over 600,000 active users, both retail and institutional, in 46 states, and 1.2 million customers overall. In 2018, Bittrex became a wholly owned subsidiary of its ultimate parent, Aquila Holdings Inc. Read more.

IRS confirms that cryptocurrency is still not legal tender

By Tom Geraghty and Kali McGuire

Last month, the IRS issued Notice 2023-34, which confirmed the IRS’s position set out in Notice 2014-21 that convertible virtual currency (ie, cryptocurrency) does not have legal tender status in any jurisdiction. Read more.

Do protocol upgrades have tax consequences?

By Tom Geraghty and Kali McGuire

On April 21, 2023, the IRS released Chief Counsel Memorandum 202316008 addressing whether a protocol upgrade on the blockchain that did not result in a change to the cryptocurrency held by a taxpayer would give rise to a taxable event. Read more.

STATUTORY AND AGENCY DEVELOPMENTS

FEDERAL DEVELOPMENTS

DeFi

Treasury releases 2023 DeFi illicit finance risk assessment. On April 6, the US Department of the Treasury announced publication of Illicit Finance Risk Assessment of Decentralized Finance. According to the announcement, the report is "the first illicit finance risk assessment conducted on decentralized finance (DeFi) in the world." The report considers risks associated with DeFi services and finds that "illicit actors, including criminals, scammers, and North Korean cyber actors are using DeFi services in the process of laundering illicit funds. Capturing the potential benefits associated with DeFi services requires addressing these risks." The report further notes that "DeFi services engaged in covered activity under the Bank Secrecy Act have AML/CFT obligations regardless of whether the services claim that they currently are or plan to be decentralized," and provides "recommendations for US government actions to mitigate the illicit finance risks associated with DeFi services."

Virtual currency

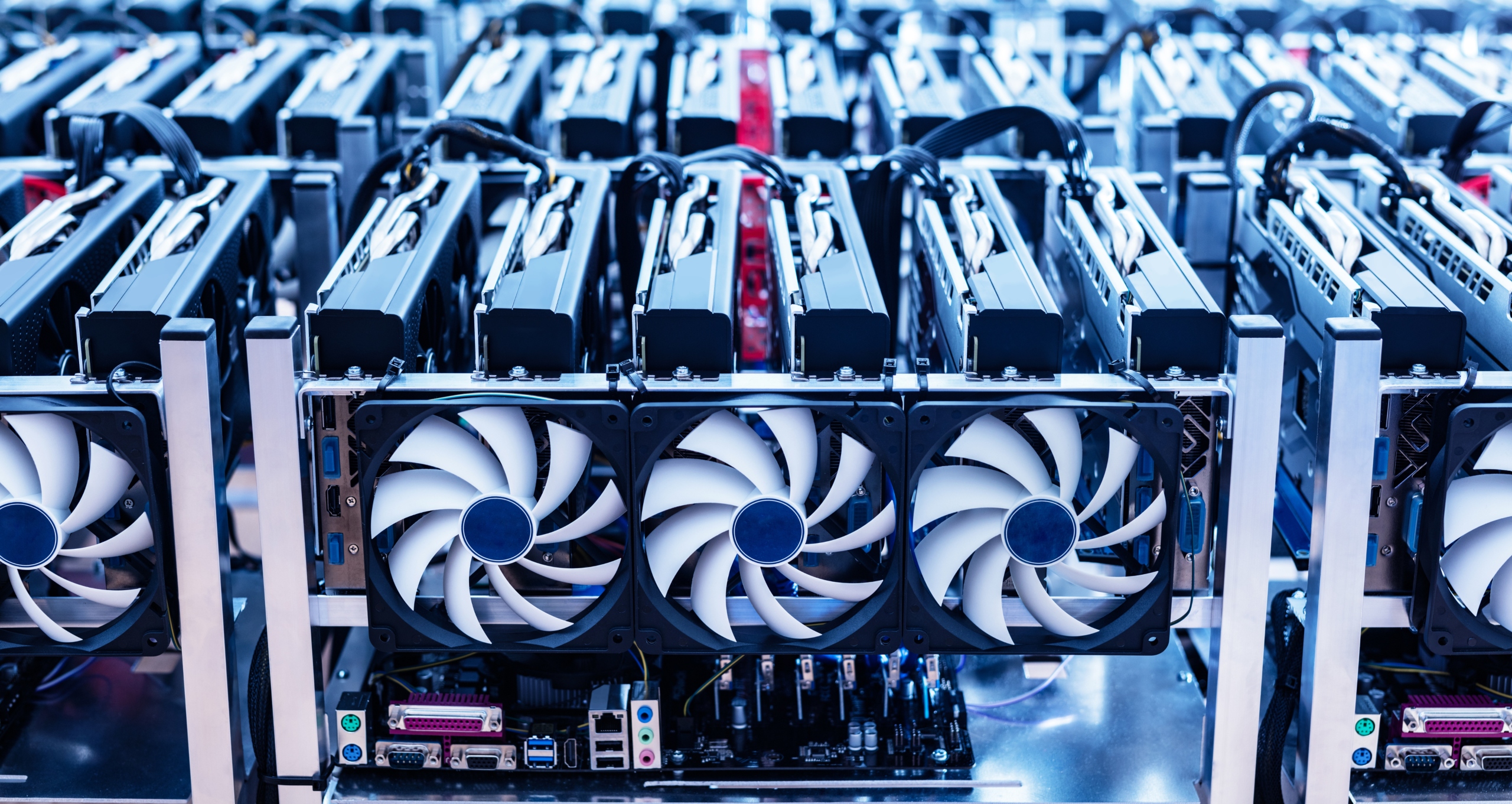

Biden Administration proposes excise tax on cryptocurrency mining. On May 2, the White House published a blog post explaining that President Joe Biden was including in his proposed Budget for Fiscal Year 2024 a Digital Asset Mining Energy (DAME) excise tax of 30 percent of the cost of electricity used in cryptomining. According to the post, the DAME tax "encourages cryptomining firms to start taking better account of the harms they impose on society" since "cryptomining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate."

STATE DEVELOPMENTS

Blockchain

Utah enacts series of bills related to blockchains and DAOs. This March, the Utah legislature passed a series of bills related to blockchain and digital assets:

- SB0160, signed March 17, creates a judicial cause of action for the reversal of certain fraudulent transactions which occurred on a blockchain

- HB0357, signed March 13, amends the state's laws on Decentralized Autonomous Organizations (DAOs) to allow a DAO that is not registered as a for-profit entity to be treated as the legal equivalent of a domestic LLC

- HB0289, signed March 13, creates a noncustodial blockchain registry

- HB0216, signed March 20 and effective July 1, 2024, establishes a Business and Chancery Court in the state with general business jurisdiction, including over cases relating to a dispute over a blockchain, blockchain technology, or a DAO

- HB0470, signed March 14, requires the Division of Technology Services to create a pilot program for "digital verifiable credentials" to access "digital verifiable records" issued or signed by a governmental entity and maintained on a blockchain.

Digital assets

Oklahoma exempts digital asset mining equipment from sales tax. Oklahoma enacted HB1600 on April 25, 2023. The bill exempts from sales tax sale of machinery and equipment and electricity used for commercial mining of digital assets beginning on November 1, 2023.

Arkansas confirms digital asset mining is not money transmission. On January 10, Arkansas enacted HB1799/Act 851 on April 13, clarifying regulation of digital asset mining businesses and confirming that persons engaged in home digital asset mining or that have a digital asset mining business shall not be considered money transmitters under the Uniform Money Services Act, § 23-55-101 et seq.

Montana updates virtual currency and digital asset laws. Montana’s SB0178, enacted on May 2, revises the state cryptocurrency laws, supports digital asset mining, prohibits taxation on the use of cryptocurrency as a payment method, and amends the Montana Code - Property Title to establish digital assets as personal property. The bill defines digital assets as "cryptocurrencies, natively electronic assets, including stable coins and nonfungible tokens, and other digital-only assets that confer economic, proprietary, or access rights or powers."

Virtual currency

Wyoming enacts stable token act. The Wyoming Stable Token Act, SF0127, was signed and became effective on March 17, establishing a Wyoming Stable Token Commission and authorizing the issuance of Wyoming Stable Tokens which are convertible 1:1 into US dollars. The Act transferred $500,000 to the Commission for its administration account to support the Act and requires the Commission to issue at least one stable token by December 31, 2023.

New York DFS active on virtual currency. The New York Department of Financial Services (NYDFS) issued announcements affecting virtual currency and Bitlicensees in the state:

- The NYDFS issued industry Guidance on Custodial Structures for Customer Protection in the Event of Insolvency for all entities licensed under New York's BitLicense law. The January 2023 guidance outlines how customer assets should be custodied using segregated accounts and separate accounting, terms for sub-custody arrangements, customer disclosures, and the custodian's limited interest in the custodied assets.

- On April 17, the NYDFS announced the adoption of a final regulation establishing how companies holding a DFS-issued Bitlicense will be assessed for costs of their supervision and examination. The regulation gives the NYDFS the authority to collect supervisory costs from licensed virtual currency businesses, similar to other licensees regulated by NYDFS.

- The New York Attorney General announced on May 5, legislation to "tighten regulations on the cryptocurrency industry." According to the release, the bill "would increase transparency, eliminate conflicts of interest, and impose commonsense measures to protect investors, consistent with regulations imposed on other financial services." In addition to expected requirements, the bill includes provisions that would prohibit crypto firms from bundling certain services and that would require celebrities wishing to endorse crypto tokens to submit a registration with personal and financial information.

Securities

California DFPI makes several announcements. On the dates listed below, the California Department of Financial Protection and Innovation (DFPI) issued press releases announcing the following:

- On April 19, the DFPI announced that it has issued “desist and refrain orders" against Maxpread Technologies and Jan Gregory Cerato, Harvest Keeper, Visque Capital, Coinbot and QuantFund "to stop fraudulent investment schemes tied to artificial intelligence (AI)." According to the release, "The entities solicited funds from investors by claiming to offer high yield investment programs (HYIP) that generate incredible returns by using AI to trade crypto assets" and “used multi-level marketing schemes that reward investors for recruiting new investors.” Specifically, "[t]he orders find that the named entities and individuals violated California securities laws by offering and selling unqualified securities and making material misrepresentations and omissions to investors." The DFPI also issued a related consumer fraud alert regarding these types of AI scams.

- The DFPI announced on April 6 that California joined multiple states in the $10.2 million settlement with Robinhood. The settlement resulted from claims that operational and technical failures harmed main street investors. Other states that are joined in the settlement include Alabama, Colorado, Delaware, New Jersey, South Dakota, and Texas. For more information on the settlement, see our April 2023 issue.

- On March 27, the DFPI announced that BlockFi Lending LLC agreed to direct its servicer to provide Californians more than $100,000 in refunds, subject to the bankruptcy court's approval. According to the release, "the refunds stem from BlockFi's conduct following the crash of the FTX cryptocurrency exchange." For more information on the BlockFi bankruptcy, see our December 2022 issue.

ENFORCEMENT ACTIONS AND LITIGATION

FEDERAL

Securities

SEC charges Bittrex. On April 17, the US Securities and Exchange Commission (SEC) announced the filing of a complaint against Bittrex, Inc., a US-based cryptocurrency trading platform, and its former CEO, William Shihara, for operating an unregistered exchange, broker-dealer and clearing agency in violation of US securities laws. The SEC also charged Bittrex’s foreign affiliate, Bittrex Global GmbH, for failing to register as a national securities exchange "in connection with its operation of a single shared order book along with Bittrex." The complaint alleges that Bittrex held itself out as a platform that facilitated the trading of crypto assets that the SEC alleges were offered and sold as securities. The complaint seeks injunctive relief, disgorgement of profits and civil penalties.

SEC settles charges against Seattle crypto-ATM provider and founder. On April 28, the SEC announced it settled charges against Seattle-based crypto-ATM provider Coinme Inc., its subsidiary Up Global, and the CEO of both companies, Neil Bergquist. The SEC accused the parties of offering and selling unregistered securities through their 2017 initial coin offering of UpToken in violation of Sections 5(a) and 5(c) of the Securities Act of 1933. The SEC further charged Bergquist and Up Global with violations under Section 17(a) of the Securities Act of 1933 and Rule 10b-5 under Section 10(b) of the Securities Exchange Act of 1934. According to the SEC’s order, UpToken was used to promote Coinme’s Bitcoin ATMs by providing special perks to holders of the token, including discounted fees and additional tokens for using Coinme ATMs. Citing these features, among others, the SEC classified UpToken as an “investment contract” within the meaning of SEC v. W.J. Howey Co., 328 U.S. 293 (1946). All three parties agreed to cease efforts related to UpToken and pay penalties totaling $3,920,000.

SEC charges crypto mining pool investment operation. On May 11, the SEC announced the filing of a complaint in Massachusetts federal court charging “GA Investors” and other unidentified co-defendants with violating the antifraud provisions of Section 17(a) of the Securities Act of 1933 and Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder. Defendants allegedly ran a fraudulent investment website that offered crypto mining pools, and other investments that the SEC classifies as securities. According to the SEC, these sites touted extraordinary short-term returns but blocked withdrawals after customers had deposited their crypto assets. Though defendants allegedly solicited investors from all over the world, SEC claims the site took in about $85,000 from US-based investors. The complaint seeks a temporary restraining order, asset freeze, permanent injunctive relief, disgorgement, and civil money penalties.

Commodities

CFTC wins record-breaking default judgment against South African CEO for operating an unregistered commodity pool. On April 27, the US Commodity Futures Trading Commission (CFTC) announced it secured a $3.4 billion-dollar default judgment in a case pending before the US District Court for the Western District of Texas. Among other things, the case charged Cornelius Johannes Steynberg and his company Mirror Trading International (MTI) with fraud in connection with retail foreign currency (forex) transactions and operating an unregistered commodity pool through which Steynberg solicited more than 29,000 bitcoin from individuals all over the world, including nearly 23,000 individuals in the US. The record-setting judgment comprises $1.7 billion in restitution, reflecting the current value of the misappropriated bitcoin, and another $1.7 billion in civil monetary penalties. Steynberg did not oppose the judgment; his company MTI is currently in liquidation in South Africa.

Virtual currency

Virtual currency platform operators may be subject to EFTA and Regulation E. In Rider et al. v. Uphold HQ, Inc. (2023 WL 2163208, USDC, SDNY, February 22, 2023), the plaintiffs brought a class action asserting claims, among others, for violation of the Electronic Fund Transfer Act (EFTA) and its implementing regulations (Regulation E), against the operator of a cryptocurrency exchange as the result of improper access to the plaintiffs' account by unauthorized actors. In response to the defendant's motion to dismiss, the court held that cryptocurrencies constituted "funds" within the meaning of the EFTA, enabling plaintiffs to proceed with their claim for violation of the EFTA and claim for negligence per se based on violation of the EFTA. The EFTA defines, in relevant part, an "electronic funds transfer" as "any transfer of funds" 15 USC § 1693a(7); however, the EFTA fails to define the term "funds." The court stated, "Under its ordinary meaning, the term 'cryptocurrency' means a digital form of liquid, monetary assets that constitute 'funds' under the EFTA" based on the dictionary definitions of the terms "funds" and "cryptocurrency." The court also noted another case finding that "funds" encompasses "any currency that can be used to pay for things" for purposes of a money laundering statute.

DOJ charges five persons in virtual asset scheme. On April 24, the US Department of Justice (DOJ) announced the unsealing of an indictment charging three persons with conspiring to manipulate the market for HYDRO, a virtual asset created by the Hydrogen Technology Corporation. Two other persons were also charged for their roles in the scheme. "The defendants allegedly used a trading bot to place thousands of orders that they did not intend to execute, or 'spoof orders,' and thousands of orders where the bot bought and sold tokens to itself through the same account, or 'wash trades' … which created "the false appearance of supply and demand for HYDRO to induce other market participants to trade." The defendants allegedly "reaped $2 million in profit" through the scheme.

FBI takes nine cryptocurrency exchange sites offline for facilitating criminal activity. On April 25, the Detroit field office of the Federal Bureau of Investigations (FBI) announced a coordinated take down of nine cryptocurrency exchange websites with lax anti-money laundering and Know-Your-Customer requirements. The FBI worked with Ukrainian police and prosecutors to identify the sites and disable their US-based servers. According to the FBI, these sites offered anonymous cryptocurrency exchange services and were used to support cybercrime such as ransomware scams operating out of the US and Russia. The FBI discovered these exchanges on forums dedicated to discussing criminal activity, and reports that its investigation is ongoing.

OFAC

OFAC settles with Poloniex. The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) announced on May 1, through an enforcement release, a $7,591,630 settlement with Poloniex, LLC, a cryptocurrency exchange, for “65,942 apparent violations of multiple sanctions programs.” The release asserts that, between January 2014 and November 2019, the Poloniex platform "allowed customers apparently located in sanctioned jurisdictions to engage in online digital asset-related transactions … with a combined value of $15,335,349, despite having reason to know their location based on both Know Your Customer information and internet protocol address data." The announcement notes that the settlement amount reflects OFAC's determination that "Poloniex's apparent violations were not voluntarily self-disclosed and were not egregious."

NFTs

Yuga Labs wins injunctive relief through summary judgment on NFT trademark infringement claims. On April 21, 2023, the District Court for the Central District of California granted Yuga Labs wins summary judgment against Ryder Ripps and Jeremy Cohen. The US District Court for the Central District of California issued a ruling on April 21, in the case of Yuga Labs, Inc. v. Ripps, et al., which granted in part, and denied in part, the summary judgment motion of Yuga Labs. The court issued summary judgment in favor of Yuga Labs's claims of false designation of origin on ownership of its Bored Ape marks (ie, Bored Ape Yacht Club, BAYC, Bored Ape, BAYC Logo, BAYC Bored Ape Yacht Club Logo and Ape Skull Logo), and granted injunctive relief in Yuga Labs's favor. The court found that (1) NFTs are "goods" for purposes of the Lanham Act (2) Yuga Labs used the marks in commerce and (3) Yuga Labs did not transfer or abandon its trademark rights in the marks. The court also agreed that the Ryder Rips/BAYC collection was created to mislead and Ripps’s use of BAYC trademarks does not amount to fair use or artistic expression. The court deferred determining damages. The court also rejected certain affirmative defenses of Ripps and Cohen: (1) First Amendment (including the Rogers doctrine); (2) fair use; and (3) unclean hands based on lack of copyright and sale of unregistered securities, and rejected the defendants' counterclaim that Yuga Labs knowingly misrepresented infringing activity in Digital Millennium Copyright Act (DMCA) "takedown" notices, finding that the notices were not issued under the DMCA as Yuga Labs alleged a trademark and not a copyright violation.

Yuga Labs’s motion was denied in part on the issue of whether the case deserved an award of enhanced damages and attorney’s fees, because Yuga Labs had reserved the issue of damages for trial. For more information on the case, see our February 2023 issue.

Celebrity sued for promotion of NFT project. In another Friel v. Dapper Labs copycat suit, Shaquille O’Neal was sued in federal district court for the Southern District of Florida on May 23 for promoting his Astrals NFT project. Astrals is a collection of 10,000 metaverse avatars that could be staked to earn GLXY tokens. The tokens may be used to participate in “DAO” governance or raffles, among other things. Mr. O’Neal allegedly took a very active role in the promotion and recruitment of the team behind the project, and his son was credited as the head of investor relations. Most of the complaint discusses Mr. O’Neal’s promotion of Astrals on social media and in his DJ sets. The Astrals project is still active, although Mr. O’Neal has not been actively involved in the project for some time. The complaint also alludes to promotional efforts by the Astrals project itself, although the project is not named as a defendant.

Astrals NFTs were minted in March 2022. The plaintiff, a Virginia resident, purports to represent a class of Astrals purchasers and has purchased more than 100 Astrals NFTs. However, the complaint’s Howey allegations are light and lack specific features alleged in cases such as Dapper Labs (ie, a private blockchain with an exclusive marketplace) or DraftKings (ie, a tightly controlled proprietary marketplace). In general, the complaint alleges that Astrals NFTs are unregistered securities because:

- Purchasing Astrals is an investment of money

- In a common enterprise because holders’ fortunes were linked to each other and to the Astrals project overall

- Holders had a “reasonable expectation of profit” through “the appreciation of their digital assets” and

- That expectation of profit was derived from the efforts of the Astrals project’s managerial efforts and Shaq’s celebrity status.

STATE

Securities

Texas securities regulator coordinates states to stop AI investment scam. On May 3, the Texas State Securities Board announced entry of an emergency cease and desist order against Horatiu Charlie Caragaceanu and his organizations, The Shark of Wall Street and Hedge4.ar, to stop a fraudulent investment scheme purportedly powered by artificial intelligence and cryptocurrencies. According to the order, the defendants are promoting TruthGPT Coin, a cryptocurrency that purportedly uses an artificial intelligence model which "analyze[s] various cryptocurrencies, predict[s] future digital asset prices, and differentiate[s] profitable investments from scams." Additionally, the scheme uses fraudulent endorsements by well-known figures in the AI and cryptocurrency industries. The Texas SSSB coordinates with the Alabama Securities Commission, the Montana State Auditor, the Kentucky Department of Financial Institutions, and the New Jersey Securities Bureau in bringing coordinated actions against the defendants.

SPOTLIGHT ON INTERNATIONAL DEVELOPMENTS

EU parliament agrees on new cryptoassets regulation. The parliament of the European Union has approved the Regulation on Markets in Crypto-Assets (MiCA) and the Regulation on information accompanying transfers of funds and certain crypto-assets on April 20, 2023. This legislative step, originally planned for February, took place after a provisional agreement in June 2022 and several months of editorial amendments and translations.

The MiCA regulation covers cryptoassets that are not regulated by existing financial services legislation. It includes provisions for issuing and exchanging cryptoassets (including asset-reference tokens and e-money tokens) in the areas of transparency, disclosure, authorization and supervision. In addition, the transfer of funds regulation is intended to ensure that crypto transfers can be traced and suspicious transactions blocked. The "travel rule," already used in traditional finance, will also cover transfers of cryptoassets.

The new regulations have also been adopted by the European Council on 16 May 2023. The next steps are the publication of the new regulations in the Official Journal of the EU before formally entering into force 20 days later and directly applying in all EU member states 12 to 18 months later. This transitional phase provides the opportunity for crypto businesses to apply to the new requirements.

RECENT EVENTS

DLA Piper’s Commodities, Digital Assets, and Carbon Compliance and Enforcement team draws on decades of collective experience in the commodities and securities industry to help companies navigate new and complex commodities enforcement matters, including those related to agriculture, metals, energy, digital assets, and carbon/sustainable commodities, among others.

DLA Piper attorneys presented at the following events:

- NFT Legal Overview: Copyright, trademark, and Uniform Commercial Code (Articles 2 & 12) [Part I], available on demand, with Mark Radcliffe and Tom K. Ara

- New UCC Article 12 and Transfers of Interests in Digital Assets, Federal Bar Association webinar, March 15, 2023, with Margo Tank and David Whitaker

- NFT Legal Deep Dive: Copyright, trademark, and Uniform Commercial Code (Articles 2 & 12) [Part II], available on demand, with Mark Radcliffe, Margo Tank and Gina Durham

UPCOMING EVENTS

DLA Piper attorneys will be presenting at the following events:

- NFT Legal Deep Dive: Securities law, entertainment unions, and licensing [Part III], May 24, 2023, 12:00 – 1:00 pm ET, with Mark Radcliffe, Martin Bartlam, Katherine Imp and Michael Fluhr

- The Future of Stable Coins, CBDCs, & Crypto, held at The Future of Money, Governance, & The Law conference, Washington, DC, May 25, 2023, 1:40 – 2:20 pm ET, with panelist Benedetta Audia

- "Chuck Yates Needs a Job" podcast on Digital Wildcatters, with Deanna Reitman discussing trends in the voluntary carbon markets, including the creation of digital carbon commodity assets and platforms to trade such assets

PUBLICATIONS

Cryptocurrency and Digital Asset Regulation, published by the American Bar Association and co-edited by Deborah Meshulam and Michael Fluhr, includes chapters by Meshulam and Fluhr and by Margo Tank

Terms of Service Are Instrumental in Determining Rights to Digital Assets – The Holding in Celsius Network LLC, published in The Computer & Internet Lawyer, May 2023, by Margo Tank, David Whitaker, Liz Caires and Emily Honsa Hicks

Read

Takeaways from the Silicon Valley Bank and Signature Bank receiverships

10 key points coming out of the stabilisation of Silicon Valley Bank UK Limited

SDNY holds NBA Top Shots NFTs might be unregistered securities under Howey

Supreme Court opens door to challenging FTC and SEC in district court

Banking regulators release joint statement on liquidity risks with cryptoassets

Contacts

Learn more about our Blockchain and Digital Assets practice by contacting any of our editors:

Margo H.K. Tank

Mark Radcliffe

Liz Caires

Martin Bartlam

Contributors to this issue

The editors send their thanks and appreciation to Marc Aronson and Raymond Janicko for their contributions to this and prior issues.