23 May 2025 • 12 minute read

Lifecycle of a Transaction: Transfer Pricing considerations

This article was originally published in the Tax Journal, May 2025 and is reproduced with permission from the publisher.

Continuing from the previous article on the lifecycle of a transaction series, this article considers the key transfer pricing considerations in funding an acquisition. Transfer pricing relates to the pricing of intra-group transactions: for example, loans, services, supply of goods and licensing of intellectual property. This pricing is governed by the arm’s length principle, which requires that transactions take place under conditions that are comparable to that of independent enterprises dealing with comparable transactions in comparable circumstances. Transactions that are not in line with the arm’s length principle can have adverse tax and reputational consequences. In turn, undertaking a transfer pricing analysis, and adhering to the arm’s length principle, can allow groups to maximise interest deductibility, achieve optimum pricing and potentially improve cashflows and profitability. It is therefore critical that the arm’s length standard is adhered to.

The majority of transfer pricing rules around the world, including the UK, are based on the guidance set out in the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (‘OECD Guidelines’). UK legislative transfer pricing provisions need to be applied when dealing with an intra-group transaction involving a UK tax resident entity (TIOPA 2010 Part 4).

From a real estate perspective, there are various transfer pricing issues that must be considered. Following the case study set out in the first article in this series, we have sought to bring these issues and aspects to light below.

Case study

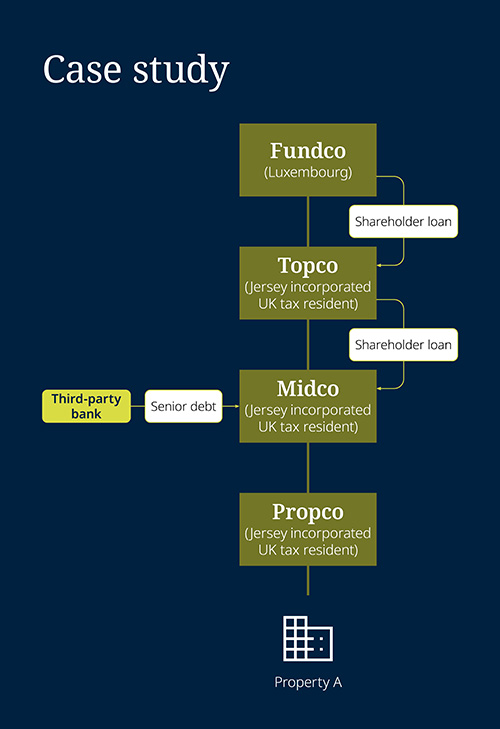

Fundco, a Luxembourg Fund holds property rental assets via special purpose vehicles across Europe, and is looking to expand its UK investments and acquire a partially completed mixed-use development in Leeds, known as Property A via the acquisition of shares in a Jersey incorporated but UK tax resident company.

Fundco is keen to ensure flexibility in its structure going forwards, particularly with a combination of third-party finance and intra-group debt to help fund Jersey Propcos’ ongoing development of Property A. Accordingly, Fundco considers the following acquisition and financing structure suitable as presented in the figure (above right).

The first step in any transfer pricing review is to ascertain the relevant intra-group transaction(s). Looking at the figure above, the relevant intra-group transaction is the shareholder loan between Fundco in Luxembourg and the UK tax resident subsidiaries, flowing through to Jersey Midco. Whilst flow-through entities such as Jersey Topco, generally need to be assessed and compensated from an arm’s length perspective, the focus of the article is the shareholder loan between Fundco and the ultimate borrower, Jersey Midco. Once the intra-group transaction has been identified, the legal and economic factors set out below need to be reviewed:

Intra-group legal agreements

The starting point for any transfer pricing analysis is the legal agreement. Given the growing overlap between tax, transfer pricing and the legal aspects of any intra-group transaction, tax authorities meticulously review intra-group agreements and compare them with what happens in practice. The credibility of the legal agreement is in jeopardy when there is a divergence between the actual conduct of the parties and the terms outlined in written agreements.

Written agreements versus actual conduct

For example, the parties might informally agree to modify terms such as extending repayment periods or adjusting interest rates without formally amending the relevant loan agreement; or lenders might accept consistent late payments by borrowers without enforcing penalties, contrary to the terms of the loan agreement. Verbal agreements or informal modifications may be difficult to enforce legally, leaving parties without recourse if disputes arise. Likewise, accepting overdue payments, not enforcing penalties, or failing to adjust interest rates in response to economic changes, can lead to cash flow issues for lenders resulting in financial losses. Misalignment between actual conduct and the terms of the legal agreement can lead tax authorities to question the basis of a transaction – potentially leading to denial of full or partial interest deductions and resulting in double taxation (without corresponding adjustments). It is therefore advisable that the related parties iron out the terms and conditions of any legal agreements early in the transaction process.

Terms and conditions

One of the most critical terms in a shareholder loan agreement is the ‘interest rate’. The interest rate is a result of various other terms and conditions, and each of these can have a significant impact on the percentage rate to be ascertained. Usually, instruments with longer maturities carry higher risks and can therefore require higher interest rates. The repayment schedule and maturity date of the loan are often key in the loan agreements. As financial institutions are unlikely to grant loans without a defined repayment schedule or specified maturity date, a roll-forward clause in the loan agreement that extends the loan automatically each year without adjusting the interest rate may not reflect arm’s length behaviour. In case a roll-forward clause is included, it should ideally allow for interest rate adjustments to align with prevalent economic conditions, ensuring the arrangement mirrors third-party behaviour.

“It is advisable that the related parties iron out the terms and conditions of any legal agreements early in the transaction process.”

Another critical clause is the ‘purpose’ of the loan, which forms the basis of the transaction. Each purpose has a different risk profile that needs to be considered when determining or assessing the interest rate. For example, the interest rate on a working capital loan will generally be lower than the interest rate on an acquisition loan due to lower risks involved with working capital financing. Turning back to our case study, Jersey Midco is borrowing funds to acquire real estate in the UK, therefore the transfer pricing analysis for the shareholder loan should reflect the acquisition purpose.

Where intra-group loans are intended for non¬commercial purposes or for no purpose at all, a tax authority might assess the transaction to be non-arm’s length and accordingly seek to recharacterise the transaction and deny interest deductibility. Unallowable purpose rules have been the subject of recent scrutiny by HMRC. In Blackrock HoldCo 5, LLC v HMRC [2024] EWCA Civ 330, HMRC successfully challenged the deductibility of interest on an intra-group loan, arguing that the primary purpose of the loans was to secure a tax advantage (CTA 2009 s 441). This decision reinforces the importance of ensuring that legal agreements should reflect genuine commercial purpose.

Another crucial element to consider in a shareholder loan agreement is the use of certain covenants, i.e. the agreement between two parties that particular actions will or will not be carried out. Some common examples of covenants include maintenance and disclosure of proper documentation, maintenance of certain financial ratios, or restrictions from issuing dividends. Covenants can provide an additional layer of certainty to the lender that the borrower ‘s credit standing will not deteriorate, and that the borrower will not undertake activities that could affect its ability to service its obligations under the relevant shareholder loan. These can affect the creditworthiness and financial stability of the borrower, which in turn influence the pricing of the transaction.

Any transfer pricing analysis needs to consider the underlying terms and conditions set out in the legal agreement beyond simply the ‘interest rate’ – and it is critical that such terms and conditions are consistent with the arm’s length principle. In other words, it is essential that the legal agreement is in line with the arm’s length principle.

Arm’s length debt capacity

Transfer pricing analysis of a shareholder loan must also consider whether the quantum of the loan is arm’s length. In making that assessment in the UK, regulatory considerations such as the thin capitalisation rules (for HMRC’s guidance, see International Manual at INTM413010 onwards) and Corporate Interest Restriction (CIR) rules (TIOPA Part 10 and Sch 7A) play a key role. A UK company is thinly capitalised when it has more debt than it either could or would borrow (without group support) acting in its own interests (INTM511015). Under thin capitalisation rules, HMRC may challenge debt levels that exceed what an independent lender would provide, or a prudent borrower may borrow, potentially recharacterising part of the loan as equity. Accordingly, any excessive portion of debt may not qualify for interest deductions thereby directly impacting the borrower’s effective tax position. Under the CIR rules, interest deductions are limited based on a group’s UK-taxable EBITDA. Compliance with these rules requires careful structuring of intra-group financing arrangements through determination of an appropriate debt-equity mix. Therefore, when putting intra-group finance in place, it is essential to determine the overall split between debt (shareholder loan and third-party debt) and equity. By undertaking a financial analysis, it is possible to establish the appropriate arm’s length quantum of intra-group debt (shareholder loan), with the remaining funding to be advanced by way of equity and third-party debt as the case may be. Such an analysis involves assessing the financial strength of the borrower, economic circumstances, and industry trends.

The borrower’s capital structure should align with that of comparable independent businesses. Independent lenders rely on financial metrics to evaluate a borrower’s ability to service debt, and tax authorities expect similar deliberations for shareholder loans. Metrics like leverage ratios, interest coverage ratios, and debt service coverage ratios help assess financial resilience. Weak ratios may indicate over-leverage.

In high-interest-rate environments, independent lenders may impose stricter terms and lower debt ceilings. Inflation can also affect rental yields and asset valuations, affecting debt serviceability. Arm’s length review of debt levels should be based on comparable assets/businesses in the market. Given the cyclical nature of the real estate market, there are frequent market developments that impact the terms of funding provided by independent lenders and need to be incorporated in the analysis when determining arm’s length level of debt.

The arm’s length nature of a transaction can only be ascertained when all the factors are reviewed. Looking at legal or economic aspects in isolation will not suffice to be compliant with the arm’s length principle.

“Looking at legal or economic aspects in isolation will not suffice to be compliant with the arm’s length principle.”

Arm’s length interest rates

Determining and applying an arm’s length interest rate to a shareholder loan is critical to comply with transfer pricing rules. HMRC, similar to other tax authorities, expect interest rates to reflect independent market conditions. From a real estate perspective (and so turning back to Jersey Midco), factors such as the borrower’s risk profile, asset characteristics, and the prevailing economic environment need to be evaluated. Each of these factors is discussed in high-level terms below.

Borrower risk profile

Independent lenders adjust loan terms and pricing based on their perceived probability of default of the borrower. Similarly, arm’s length interest rate on a shareholder loan should also consider the risk profile of the borrower. In the real estate context, it is usually based on borrower’s potential to service debt measured through financial projections. Therefore, it is paramount that financial forecasts are developed based on business commerciality and objective market data.

Underlying asset

Characteristics of the underlying asset, such as the property type, location, rental yield, investment purpose, influence the associated risk and hence the arm’s length interest rates. Properties with steady tenant occupancy tend to offer predictable rental income, leading to more favourable interest rates. Similarly, properties in prime locations like central business districts benefit from strong demand, high occupancy, and easier disposal, result in more favourable borrowing costs contrary to secondary locations with lower liquidity and higher vacancy risks which tend to drive interest rates higher. The investment purpose may also impact interest rates: long-term rental properties could be associated with stable leases and steady cash flows resulting in lower interest rate, while (re)development projects may carry additional risks from construction uncertainties and market conditions leading to a higher interest rate.

Economic environment

Economic and market circumstances at the time of the transaction also play a critical role in determination of arm’s length interest rates. For example, the prevalent interest rate environment sets the baseline with benchmark rates. Lower rates lead to lower financing costs, whereas higher base rates lead to increased overall interest rates. Inflationary pressures also impact arm’s length interest rates as that feeds into asset valuations, financial projections, benchmark rates, etc. It is important to reiterate that arm’s length interest rates are dependent on a number of factors and overlooking such factors may lead to incorrect interest rates being applied. This will result in the transaction being non-arm’s length which ultimately may lead to tax adjustments and penalties.

Transfer pricing documentation

Once a transfer pricing analysis has been performed, putting in place appropriate transfer pricing documentation detailing the process and the results should not be overlooked. Whilst any legal agreement which documents the relevant transaction (for example, a shareholder loan agreement) forms part of the transfer pricing documentation, it does not fully comply with the UK transfer pricing rules. Required documentation broadly includes relevant background information about the transaction, a summary of important terms of the legal agreement, functional profile of the parties involved, details of the economic analysis performed for debt capacity and interest rates with results and conclusions. Lack of documentation, when required, can lead to penalties resulting in financial cost and reputational damage.

As the Government has proposed to consult further on reforms to transfer pricing rules, legislation might change, and future developments should be monitored. HMRC recently hosted a webinar on common risks in transfer pricing approaches where the importance of assessing and including UK specific facts in the transfer pricing documentation was highlighted. Further, as a practical point, when the real estate assets are sold, a buyer may request transfer pricing documentation as part of its due diligence exercise. If a seller is unable to provide appropriate documentation, it may result in a request for specific indemnities or potentially a price chip to account for future potential risks of challenge by tax authorities. Therefore, it makes prudent business sense to prepare adequate documentation to meet financial objectives and compliance requirements.

Looking forward

Once the funding mechanics of an acquisition have been analysed and confirmed, a buyer will look towards the acquisition documents and any appropriate protections necessary. There are of course other transactions beyond funding that should be carefully reviewed from a transfer pricing perspective, such as the arm’s length remuneration of management services, which will be covered in a future article in this series.