17 May 2023 • 9 minute read

Understanding Sharia transactions

Understanding the needs of the Middle Eastern investors who intend to invest or take part in transactions in the Americas in a manner that is in accordance with their Sharia beliefs, morals, and laws is imperative to assist them successfully. This is the case whether the deal involves real estate, finance, or, indeed, any business realm.

The same can be said with respect to growing numbers of US companies, venture capitalists and private equity firms looking to invest or transact in the Middle East. For these businesses, it is important to know that doing business in the Islamic world can be quite complex, especially if one does not understand Sharia law and its significance.

Key to smooth business transactions in or related to the Middle East is a general understanding of the purpose of Sharia law, where and how Sharia laws are enforced, and how they affect the transactional system in the Middle East, as well as the rest of the globe.

Sharia law defined

Simply put, Sharia law is a body of religious law based on the governing principles of spiritual, mental, and physical behavior that must be followed by Muslims – it is Islam’s legal system.

Sharia law regulates public behavior, private behavior and beliefs, encompassing many topics, including crime, politics, and economics.

Governments around the world interpret, apply, and enforce Sharia law differently. Accordingly, before deciding to commence business in a Sharia law country, it is important to be aware of the types of Sharia law and to what extent it is practiced in each country. The same also goes for doing a Sharia compliant product or program - it is important to understand the limits of Sharia principles as identified by the client.

Application of Sharia law by country

Countries may apply Sharia law in one of several ways:

- Classic (whole country): under this system, classic Sharia law is formally considered to be the equivalent of national law and governs its substance throughout the country.

- Classic (some territories): classic Sharia law is practiced in some territories, but not the whole country.

- For Muslims only: Sharia law is applicable only to Muslims

- Mixed: there is a separate secular legal system, but it is influenced by Sharia law in some ways.

Benefits of doing business involving Sharia law

The Illinois Business Law Journal is among many publications noting that the Middle East presents lucrative business opportunities in various industries for US companies to supply their goods and services, including in areas such as finance, manufacturing, technology, and infrastructure. Needless to say, a good part of business in the Middle East involves transacting with Sharia principles and laws.

In such deals, Sharia law provides certain advantages, among them:

- Savings: The conventional global banking system is based on paying interest at a pre-determined rate on deposits of money. Because the payment and receipt of interest are both prohibited in Islamic finance, Muslims generally refrain from banking. Many US companies, private equity firms and venture capitalists can benefit from Islamic banking’s financial inclusion, which can lead to more savings.

- Risk avoidance: Sharia law forbids any investment that would support industries or activities that are considered harmful to people and to society in general. This means that businesses using Sharia financing should be paying attention to reducing harms caused by their products. These activities include but are not limited to speculation and gambling. Companies with a strong interest in sustainability and environmental protection may find that their values will be matched by their Middle East counterparts.

- Stability: Under Sharia law, Islamic banking institutions will not deal with any company whose financial status is shaky because Islamic trade focuses on reducing risks and investing safely.

- Accelerating economic progress: In Islamic banking, the focus is on investing only in promising businesses to attract more funds from depositors. As a result, this provides high returns on investments not only for the bank but also for the depositors. This concept differs from that of a conventional bank, in which depositors redeem returns on their deposits based on pre-determined interest rates.

A fetwa board will review each deal

To ensure that a product of any sort – such as a financial or real estate transaction - is Sharia compliant, it must be approved by a fetwa board or committee which is essentially a Sharia review board. Each fetwa board or committee may be different; each may have its own interpretation of, and tolerance for, various aspects of a transaction.

Transacting with Sharia law

Sharia law requires that certain principles be adhered to before engaging in any sort of transaction. Each type of transaction has its own unique set of rules and principles.

Sharia compliant businesses

Sharia-compliant businesses operate in compliance with Sharia law. To be considered compliant, businesses must comply with the basic tenets of Islam, such as not engaging in interest-based transactions or alcohol production. Businesses must adhere to specific Sharia principles relating to contracts, property rights, and other aspects of commerce.

Generally speaking, the following two principles are foundational to Sharia compliant business:

- Material finality of the transaction: In Sharia law, every transaction needs to be related to an actual and real underlying economic transaction.

- Profit/loss sharing: Every party to a contract shares the profit, the loss and any risks associated with the transaction. All parties must benefit equally from the transaction

Sharia compliant businesses are subject to special taxes and regulations and are often seen as more trustworthy and ethical than businesses that do not necessarily comply with Sharia law. However, the restrictions placed on businesses by Sharia law can make it challenging to compete in the global marketplace. For instance, Saudi Arabia’s new work plan for the National Competitiveness Center aims to address this concern, focusing on implementing new reforms to “enable the competitive environment to keep pace with new global trends based on productivity, sustainability, and inclusiveness.”[1]

Applying Sharia law: Islamic finance

Many concerns regarding Sharia law arise from misperceptions about the way it is applied to family structures. It is important to note that when it comes to Islamic finance, application of the principles of Sharia law is not generally disputed.

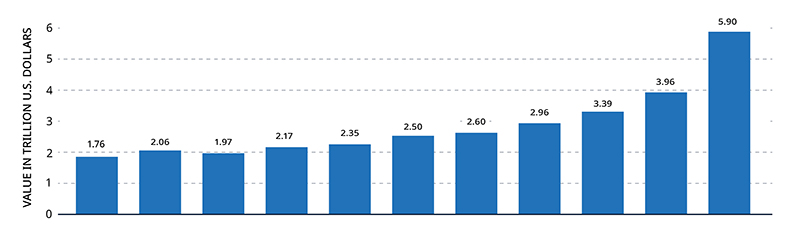

Islamic finance is a method of financing and a banking system that complies with Sharia law. It is important to understand the basics of Islamic finance because, over the past years, the global Islamic finance industry has been growing.

As noted above, the Islamic financial model works based on risk sharing: all parties share the risk and the reward. The focus is not as much on gaining profit as on protecting society.

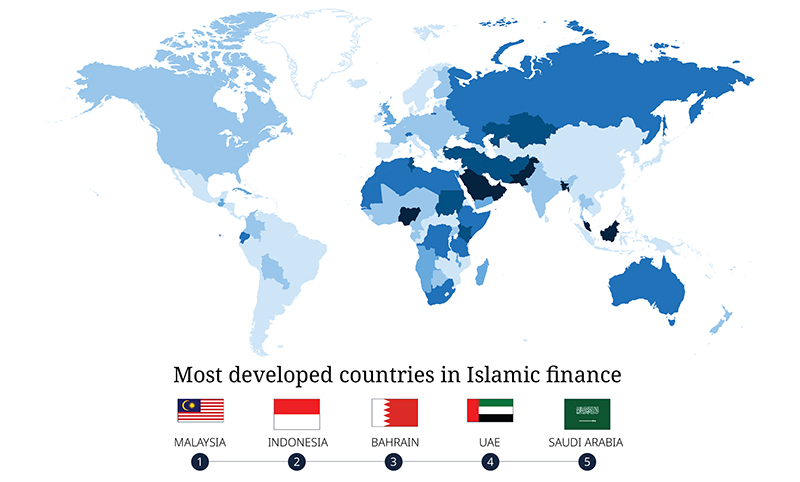

The Islamic finance development indicator shows the five most developed countries for Islamic finance in 2020:

Islamic finance is based on many prohibitions and restrictions, of which many are legal in countries where Islamic financial institutions operate, so awareness is imperative:

- Paying or charging interest: In Islam, any lending that requires payment of interest is considered an exploitative practice because it benefits the lender and disadvantages the borrower. Thus, interest is strictly prohibited.

- Investing in businesses involved in prohibited activities: In Islam, certain activities are forbidden, and investing in those activities is therefore also forbidden. These activities include producing and selling alcohol or pork.

- Speculation or gambling: Any activity, transaction or contract in which owning goods is contingent on something that is undetermined or that may not happen is prohibited.

- Uncertainty and risk: Any contracts involving excessive risk and/or uncertainty are prohibited.

Financial structures in financial and real estate transactions

Financing arrangements have been developed to assist those doing business comply with Sharia restrictions and principles. As discussed above, the concept of profit sharing is prevalent in Sharia law. Here are three popular structures:

- Mudarabah – profit-and-loss sharing partnership: Mudarabah is a profit-and-loss sharing partnership agreement in which the parties share profits in accordance with a pre-agreed ratio

- Musharakah – profit-and-loss sharing joint venture: Musharakah is a type of joint venture in which all the parties involved contribute capital and, similarly, share profit and loss on a pro-rata basis

- Ijarah – The ijarah lease structure establishes a lessor-lessee relationship rather than a creditor-debtor relationship to abide by Sharia principles.

Sharia law prohibits the payment or receipt of interest. In ijarah, there are two parties – a lessor and a lessee. The property is leased to the lessee for an exchange of rental and purchase payments. At the end of this transaction, ownership of the property is transferred to the lessee.

An ijarah resembles a conventional lease – with some important distinctions. For instance, Sharia law requires that an owner of an asset to have certain responsibilities. The owner cannot delegate such responsibilities to a lessee in the lease agreement.

These responsibilities include:

- performing major or structural maintenance

- obtaining property insurance

- paying real property taxes

Sharia law lease structures include other types, such as murabaha (sale via a markup structure),) and bai al salam (sale via a mark-up structure with delivery on a pre-agreed future date structure). However, the ijarah structure is the most common for real estate investments.

Going forward

Given the many cultural challenges, including ensuring compliance with Sharia law, investors doing business in the Middle East or with Middle Eastern investors should conduct quality due diligence and legal work using a service provider with Arabic language capabilities as well as adequate experience with Sharia law.

DLA Piper is proud to have the largest bilingual Middle Eastern capabilities group in the Americas. For more information about opportunities associated with conducting business in and preparing for transactions involving Sharia law, please contact Ehab Elsonbaty.