7 May 2025 • 25 minute read

Unlocking value through India: A listing strategy for global companies and financial sponsors

Why list in India?

In 2024, India led the global capital markets with 327 IPOs raising approximately $19.9 billion — with an average deal size of $275 million and as many as 11 IPOs priced at above $500 million. This level of activity accounted for approximately 30 percent of global IPO listings in 2024 and surpassed the 225 IPOs in the US, 25 in Canada, 57 in Europe and 18 in Europe. India overtook Hong Kong as the world's fourth-largest stock market in 2024. The increase in IPO activity in India has been attributed to several key factors, including a growing base of domestic retail and institutional investors, strong domestic economic growth, and the adoption of proactive regulatory reforms which have streamlined the IPO process.

India presents a compelling opportunity for international companies, including those headquartered in Canada with material operations, revenue, or growth potential in India and Southeast Asia to list and raise capital in India. This opportunity extends to private equity and pension fund backed portfolio companies that meet similar criteria. This article provides an overview of why international companies may want to explore a listing in India as a liquidity route, the strategic rationale for pursuing a listing on an Indian stock exchange, the profile of companies suited for such listings and key regulatory and structuring considerations.

Strategic rationale

Domestic liquidity and depth: One of the key factors for the growth in IPOs in India has been the growing domestic retail and institutional investor base — which has contributed to a deep pool of available capital. Two-thirds of the capital funding for IPOs in 2024 was domestic, compared to a quarter three years earlier. A significant driver of domestic liquidity in India’s capital markets has been the strong inflow of retail savings into mutual funds and market-linked investments through what are called systematic investment plans (“SIPs”). In 2024, SIP inflows averaged approximately $US2.7 billion per month — a record high. This in turn has provided domestic mutual funds with a steady and reoccurring source of capital to deploy both in the primary and secondary markets, resulting in mutual funds emerging as key domestic institutional investors, offsetting to some degree the volatility caused by foreign investor outflows and making the Indian markets less reliant on foreign institutional capital. In 2024, retail investors were allocated approximately 35 percent of the IPO shares, which underscores the substantial domestic capital base of retail investors in India’s capital markets.

Material valuation arbitrage: Recent IPO comparables in India have demonstrated strong valuations, particularly in high-growth sectors such as healthcare, infrastructure and technology. In the technology sector, pre-IPO valuations often reflect aggressive revenue multiples, particularly for platforms with high user stickiness or digital payments integration. Public market investors in India have a strong risk appetite for scale over profitability models, particularly in fintech, digital health, clean energy and SaaS based platforms given the size of the market and potential for scalability in India. In 2024, median Price-to-Earnings (P/E) ratio for Indian IPOs were approximately 21.5x, with a range spanning from 0.8x to 96x. In comparison, US and European IPOs tend to be more conservative, with median P/E ratios of 14x and 12x, respectively.

This valuation environment creates a compelling arbitrage opportunity for international companies and financial sponsors with India-centric assets to execute a domestic spin-out or IPO strategy targeting India’s public markets, and by doing so unlocking superior market multiples — which may provide better returns than a global listing or a conventional M&A exit.

Notable Indian IPOs

|

Company |

Sector |

Issue Size (USD) |

Listing Valuation (USD) |

Subscription |

|

Indian subsidiary of a South Korean Automobile Manufacturer |

Automotive |

3.3 billion |

18.2 billion |

2.3 times |

|

Swiggy |

Consumer/Food-Tech |

1.4 billion |

12.1 billion |

3.5 times |

|

NTPC Green Energy |

Renewable Energy |

1.2 billion |

12.1 billion |

2.4 times |

|

Bajaj Housing Finance |

Financial Services |

775 million |

16.5 billion |

63.6 times |

|

Ola Electric |

Electric Vehicles |

734 million |

4.8 billion |

4.3 times |

|

Dr. Agarwal’s Health Care Ltd. |

Healthcare |

363.8 million |

1.53 billion |

1.5 times |

Exposure to high growth economy: India is projected to be one of the fastest growing economies in 2025, as it is expected to grow at a rate of 6.2-6.5 percent annually over the next five years. This sustained growth, combined with an expanding middle class and rising consumption demand create a conducive environment for digital and consumption led IPOs. India’s middle class is expected to constitute over 50 percent of the population by 2030, driven by rising incomes and urbanization. The emerging middle class in India are early adopters of digital services, including, edtech, fintech, food delivery and e-commerce platforms, sectors that are increasingly represented in the pipeline of IPOs in India. At the same time, India’s household financial savings increasingly favour equity-linked products, which has strengthened demand for new public offerings.

Regulatory and structural reforms

In the recent years, the Indian Ministry of Corporate Affairs (“MCA”) and the capital markets’ regulator in India, the Securities and Exchange Board of India (“SEBI”) have continued to proactively undertake a range of reforms to streamline the IPO process, strengthen governance, and improve investor protection. Recent notable changes include:

- Fast-track reverse flipping: Effective September 17, 2024, the MCA eased reverse flipping norms by allowing foreign companies to merge into their Indian subsidiaries through a fast-track route. The trend of ‘reverse flipping’ has become increasingly popular, particularly amongst start-ups in India. Start-ups which were initially set up overseas due to favourable local tax and regulatory frameworks are returning to India to take advantage of the growing IPO markets which provide desirable valuations and exit strategies for investors. Under the standard merger route, inbound mergers where the resulting entity is an Indian company require a prior approval of the Reserve Bank of India (“RBI”) and the National Company Law Tribunal (“NCLT”). Obtaining an approval from the NCLT is often time consuming due to the backlog of cases, resulting in a delay in the mergers. The new merger rules eliminate the need for NCLT approval for a merger between a holding company and its wholly owned subsidiary, cutting merger timelines from 12–18 months to just 3–4 months. Additionally, any mergers undertaken in compliance with foreign exchange control laws are also deemed to have the prior approval of the RBI, subject to fulfilment of certain conditions. Dream Sports Inc. (USA), the parent of popular fantasy sports platform Dream11, successfully completed a reverse flip through the fast-track route in March 2025. A further discussion on various structuring options is provided below.

- Changes to requirements for promoters: Under the listing regulations in India, promoters are required to contribute at least 20 percent of post-issue capital in an IPO, locked in for three years. This rule previously applied even to companies with no identifiable promoters. SEBI has now exempted professionally managed, VC/PE-backed companies from this requirement and further relaxed the rules to allow promoter group entities and large non-individual shareholders (holding more than 5 percent) to contribute toward the promoter contribution, without being categorized as promoters. Under the earlier rules, any non-promoter contributing to the promoter contribution was automatically classified as a promoter, triggering additional disclosure, compliance, and lock-in obligations.

- Removal of one percent security deposit: As a part of the broader ease of doing business, SEBI removed the security deposit requirement previously imposed on companies initiating public offerings. Companies were previously mandated to deposit a security amount equivalent to one percent of the total issue size. This move is aimed at reducing upfront costs and facilitating greater participation in India’s capital markets.

- Standardized IPO documentation: SEBI recently announced the proposed introduction of "fill-in-the-blank" IPO offer documents to simplify, standardize and expedite the IPO document approval process, in addition to reducing the time and associated costs for completing IPO offer documents. The regulator is also developing a mechanism to use AI for a faster IPO-approval process.

- Retail investor reforms: SEBI has introduced important reforms aimed to protect retail investors including restricting the size of the secondary offer component in IPOs by companies not yet profitable, tightening disclosure norms for key performance indicators in offer documents and emphasising the requirement for loss-making or pre-profit companies to demonstrate a credible and clearly defined path to profitability. As a result, investor confidence has increased, contributing to a rise in retail participation in IPOs.

Ideal candidates

As India’s capital markets mature and valuations remain attractive for high growth companies, the following profile of companies are suitable candidates for an IPO in India:

- Global companies with large Indian operating subsidiaries: multinational businesses with material operational presence, revenue and headcount in India would be a strong candidate for an IPO in India. This would include companies with substantial research and development operations in India. Potential structures could include either a reverse-flip of the global parent company or a carve-out/spin-out of its Indian business on a standalone basis, both aimed to access the favourable valuation metrics in India for businesses with a long-term commitment to India and local visibility.

- Scalable technology companies: an IPO in India could provide a liquidity event for a financial sponsor or seed shareholders of a portfolio company at a premium valuation to an offshore listing or a traditional M&A exit. Ideal companies include those with asset-light and scalable business models that can leverage the large consumer base in India and align with its consumption trends and key long-term policy initiatives such as Digital India and Make in India. India is home to over 800 million internet users who are digitally connected through a significant mobile and mobile payments infrastructure. Ideal companies would include those in ecommerce, fintech, health-tech and SaaS. They would also include financial sponsors from Japan, Singapore and the Middle East which have successfully tapped the Indian capital markets through domestic IPOs to monetize their investments, creating an established path that Canadian and other global sponsors may consider as the India IPO market continues to grow.

- Prominent consumer brands with significant market share in India: established consumer brands with strong market share and recognition with Indian households would be well positioned to IPO in India. In particular, consumer brands which operate in fashion, food, home products and personal care are suited given the growing middle class and domestic consumption in India.

Structuring options

Reverse flipping/domiciliation: India currently does not permit companies incorporated overseas to list directly on its stock exchanges. A 'reverse flip' refers to a strategic restructuring by an Indian business with ownership structures initially incorporated overseas, whereby the parent entity is re-domiciled back to India in anticipation of a domestic IPO. This approach is increasingly common among companies with substantial assets, operations, or customer/user bases in India, as it offers several advantages including streamlined regulatory compliance, access to deep and growing pools of domestic capital, and enhanced valuation multiples. Notable examples include Zepto, PhonePe, and Groww, while several other prominent companies are currently in different stages of the reverse flipping process.

Two main structures for a reverse flip:

- Cross border merger: This involves the foreign entity merging into an Indian entity with the merged Indian entity being the surviving company. In this structure, the assets and operations of the foreign entity are ultimately controlled by the Indian entity, and the shareholders of the foreign entity receive shares in the Indian entity as consideration. Cross border mergers in India follow a court-driven process, requiring approval from the NCLT unless an exemption is available under the recently introduced fast-track route as discussed above.

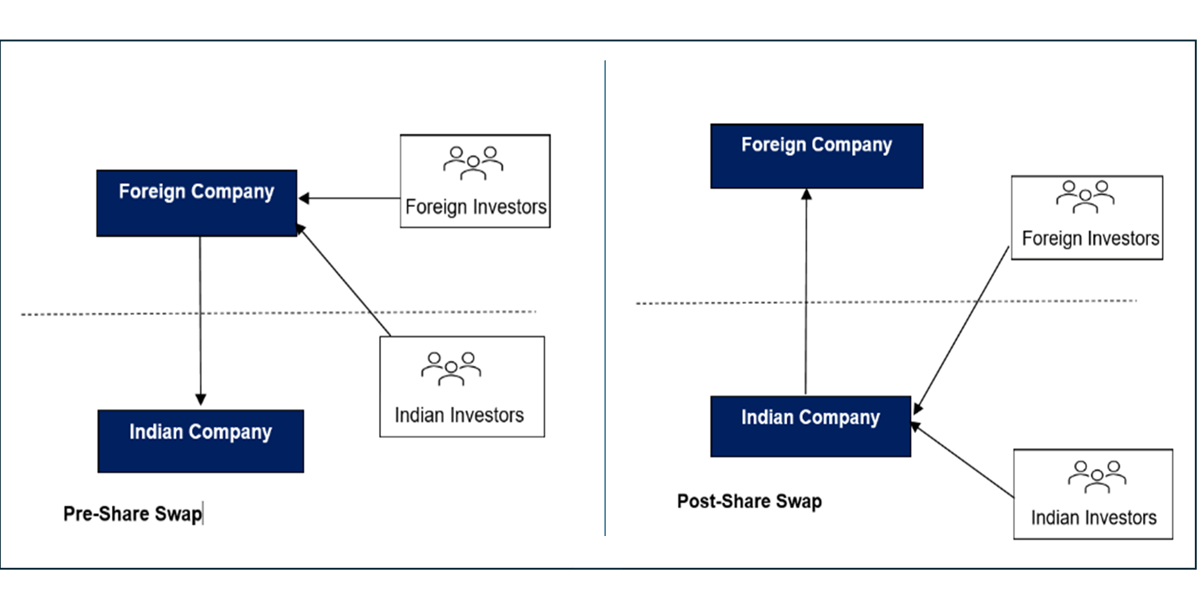

- Share swap: A share swap arrangement would involve shareholders of the foreign entity exchanging their shares in the foreign entity for shares in the Indian entity. Companies may find this method favourable to conserve cash or provide added value to shareholders of the acquired company.

Certain other alternative structures, such as a cash-based approach or asset sale, could be explored depending on the business model of a company, objectives of its investors and relevant regulatory considerations.

The choice of reverse flip structure should be carefully assessed from both a regulatory and tax standpoint. Generally speaking, if a reverse flip is executed through an inbound merger, shareholders of the foreign amalgamating entity could claim capital gains tax exemptions, but only if the transaction meets the specific conditions under the Indian Income Tax Act, 1961 (“IT Act”). Groww, a prominent Indian investment app startup that transitioned its domicile back to India from the US in 2024 followed this particular approach. In contrast, when the reverse flip is implemented through a share swap, foreign shareholders will be subject to tax in India on the difference the fair market value of the Indian shares received and the original cost of acquisition of their shares in the foreign entity. PhonePe, an Indian fintech company backed by one of the largest US retailers, used this structure during its redomiciling process. The reported capital gains taxes paid by the shareholders of PhonePe is estimated at nearly US$ 945 million. PhonePe is now preparing for an IPO in India, targeting a valuation of $15 billion significantly higher than the $12 billion valuation from its 2023 funding round.

Carveout/Spin-out of Indian business: Global companies with significant operations in India are increasingly exploring listing of their Indian businesses as a strategic route to access capital and monetize their investments in India. A leading example is the listing of the Indian subsidiary of a leading South Korea Automobile Manufacturer. The IPO was the second-largest IPO in the world and the largest-ever Indian IPO raising approximately $3.3 billion. It was oversubscribed 2.37 times, driven by robust demand from institutional investors. Other examples include the proposed IPOs of a South Korean electronics conglomerates’ India business and PhonePe.

An interesting example is, International Gemological Institute (IGI), a global provider of gemological services, owned by a prominent US private equity firm which successfully raised USD 477 million through its IPO in India in 2024. As part of this IPO, the majority of the use of proceeds were allocated for IGI India (previously responsible for IGI’s business in India and Turkey) to acquire the global operations of IGI Belgium and IGI Netherlands, which led to the consolidation of its entire global business structure under its Indian entity. The move not only supported a successful listing, oversubscribed 33.78 times, but also reflects the growing appeal of India as a base for funding global operations. As domestic liquidity continues to rise, similar structures are expected to become increasingly attractive to global companies looking to align with India’s economic growth.

While India’s regulatory environment does not permit direct listing of foreign-incorporated companies on domestic exchanges, these strategies offer a practical and proven pathway for global businesses to adapt their corporate structures to benefit from India’s capital markets.

Dual listings: Under the current Indian regulatory framework, the opportunity for direct overseas listings for Indian companies remains very limited. While the Indian government recently implemented a scheme to allow public companies in India to directly list their shares on ‘recognised international exchanges’, so far only the India International Exchange and NSE International Exchange, both located in GIFT-IFSC, are recognised as international exchanges. GIFT-IFSC, established as India's first international financial services centre, is a special economic zone with tax and regulatory benefits comparable to offshore financial hubs like Singapore and Dubai.

Similarly, as of now, companies incorporated outside India cannot directly list their equity shares on Indian stock exchanges. However, by leveraging strategic structuring options discussed above, global companies with a presence in India may explore opportunities to access the country’s robust and growing capital markets.

Next Steps and how can DLA Piper assist?

The India Practice team at DLA Piper (Canada) — in close collaboration with our global colleagues across 90 offices in 40 countries — offers a uniquely integrated platform to advise global companies on accessing India’s dynamic capital markets. With our regulatory insight, transactional experience, and relationships in India, our team is well-positioned to structure, facilitate, and execute listings and capital-raising strategies tailored to companies with Indian operations, revenue, or strategic ambitions.

India’s capital markets are now at a stage where global companies with a meaningful regional footprint can leverage public listings to fund their grow, realize shareholder value and extend their presence in Asia.

If your company or portfolio company is interested in accessing India’s capital market or looking into a strategic capital markets presence in India, please contact us to explore an engagement for an initial feasibility and structure review, which includes:

- analyzing your India business readiness and relevant portfolio companies;

- evaluating potential listing strategies and structures; and

- facilitating introductions to pre-IPO investments and domestic investment banks to evaluate valuation benchmarks, arrange pre-marketing and assess investor appetite.

DLA Piper has a market-leading India practice that regularly advises Indian clients on outward investments and international clients regarding investment flows into India. We advise our clients on a wide range of corporate matters, including private and public M&A, equity and debt capital markets, private equity, tax, as well as corporate and financial restructurings.

Due to the existing regulatory framework, we do not practice Indian law, nor do we have an office in India. Instead, we work with leading Indian commercial law firms with whom we have built excellent relationships over many years. We also have a dedicated group of partners committed to building trusted relationships with key clients in India.