11 July 2025 • 6 minute read

Relaxation of Foreign Shareholding Limit and Proposed Changes to Shareholding Rules in the Thai Insurance Industry

Relaxation of Foreign Shareholding Limit

1. History

Since 1992, Thailand has had strict rules about foreigners owning shares or being directors in insurance companies. When the original Life Insurance Act B.E. 2535 (1992) and Non-life Insurance Act B.E. 2535 (1992) came into effect, foreigners could only own up to 25% of the voting shares in an insurance company. Additionally, only one-fourth of the directors could be foreigners, with no exceptions.

2. Relaxation

2.1 Overview

2008 Relaxation

In 2008, these restrictions were relaxed.

- Approval by the Insurance Commission: Foreigners can now hold up to 49% of the voting shares in an insurance company, and the number of foreign directors can be less than half of the total directors, as long as they get approval from the Insurance Commission.

- Approval by the Ministry of Finance (MOF): Foreigners can hold more than 49% (up to 100%) of the voting shares, and the number of foreign directors can exceed half of the total directors (Majority Foreign Shareholding) if they get permission from the MOF.

However, this approval can be granted only if the insurance company is in a condition or operating in a way that may cause damage to policyholders or the public. (This is further relaxed as detailed in 2015 Relaxation below).

2015 Relaxation

In 2015, the rule on Majority Foreign Shareholding was further relaxed. The MOF can also grant approval for Majority Foreign Shareholding to strengthen the stability of the insurance company or to ensure the stability of the insurance business. This change opens up more opportunities for foreign investors to invest in insurance companies, not just in cases where the insurance company is facing difficulties.

2.2 Criteria for the approval

In 2015 and 2016, the Insurance Commission and the MOF issued regulations outlining the criteria for granting approval. The criteria for the MOF approval of Majority Foreign Shareholding are divided into two scenarios:

- Potential Damages Conditions Scenario

This scenario applies when the insurance company is in a condition or operating in a way that may cause damage to policyholders or the public. The regulation prescribes this scenario in two situations:

- Financial Rectification Orders: The insurance company has been ordered by the Registrar to rectify its financial condition or operations, increase or reduce capital, or temporarily suspend its insurance business.

- Severe Disasters: A severe disaster affects the insurance business broadly, causing the company to have a significant increase in liabilities to pay compensation to policyholders or the public, impacting the company’s capital adequacy ratio significantly.

Additionally, there must be a case where existing shareholders are unable to increase capital, and the insurance company cannot find Thai investors to bring in additional capital to ensure the insurance company’s stable and long-term business operations.

- Stability Strengthen Scenario

This scenario aims to strengthen the stability of the insurance company or the insurance business.

The details of requirements and criteria for each type of approval vary depending on the main purpose of such approval.

Insurance Commission Approval: This is the most relaxed approval, allowing foreign investors to hold up to 49%.

MOF Approval: This approval focuses on the qualifications of foreign investors. For the Potential Damages Conditions Scenario, foreign investors must demonstrate their capability from both operational and financial perspectives to improve the financial situation of the insurance company. For the Stability Strengthening Scenario, foreign investors need to show how they can contribute to the insurance company to improve sustainable and long-term business operations.

The documents and information required for each type of approval also vary, and specific advice should be sought.

Proposed Changes to Insurance Company Shareholding Rules

1.Status of the Proposed Changes

The Office of the Insurance Commission (OIC) has drafted two amendment acts to update the Life Insurance Act B.E. 2535 (1992) and the Non-life Insurance Act B.E. 2535 (1992). According to public information, these drafts are currently in the enactment process, with the targeted date for official publication still tentative.

2. Overview

Since the original acts came into effect in 1992, shareholding in insurance companies by Thai person has been quite flexible, with no strict reporting or approval requirements for certain thresholds. Typically, shareholding has been monitored through reports submitted by the insurance companies.

3. Key Proposed Changes to Shareholding Rules

3.1 Reporting Requirement for 5% Shareholding: Anyone holding 5% or more of an insurance company’s shares, directly or indirectly, must report this to the Secretary of the OIC (Registrar).

3.2 Approval for Holding More Than 10%: Anyone holding more than 10% of an insurance company’s shares, directly or indirectly, must get approval from the Registrar.

3.3 Counting Related Parties’ Shares: When calculating shareholding percentages to determine if reporting or approval is needed, shares held by related parties will be included.

The related parties are defined as a person who is related to another person in any of the following manners:

- spouse;

- a child or adopted child who is under legal age;

- a company of which such person or the person under (1) or (2) has:

(i) power of management;

(ii) power to control the majority of votes in the shareholders meeting; or

(iii) power to control the appointment or removal of directors; - (i) a subsidiary or (ii) an affiliate of the company under (3);

- a principal, agent; or

- other persons having such characteristics as prescribed by the Registrar.

Additionally, any company where a person holds 20% or more of the shares is presumed to be related to that person unless proven otherwise.

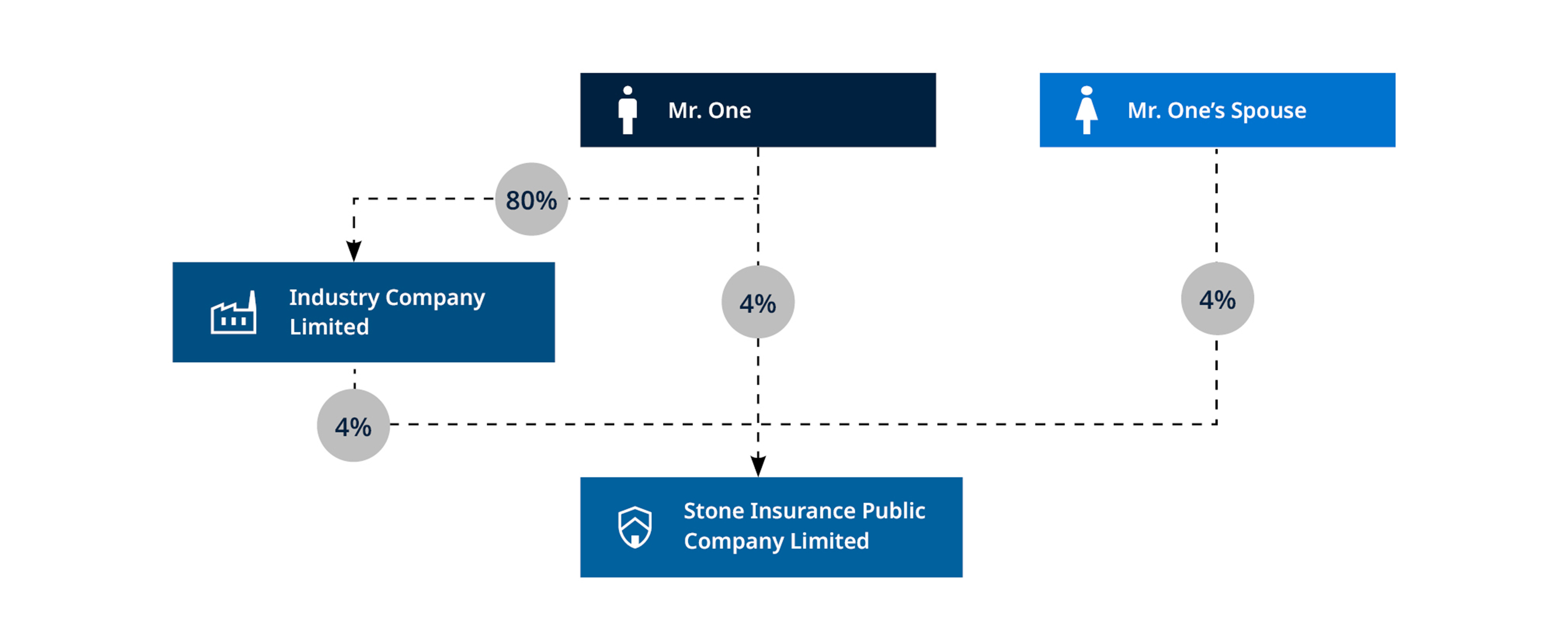

Sample

Mr. One holds 4% of the shares in Stone Insurance Public Company Limited. His spouse also holds 4% of the shares in Stone Insurance Public Company Limited. Additionally, Mr. One owns 80% of the shares in Industry Company Limited, which currently holds 4% of the shares in Stone Insurance Public Company Limited.

From Mr. One’s perspective, he will be considered as holding 12% of the shares in Stone Insurance Public Company Limited (counting the shares held by his spouse and Industry Company Limited). Consequently, he will be subject to reporting and approval requirements once the amendment acts come into effect.

4.Who Will Be Affected?

When these amendment acts come into effect, major shareholders of insurance companies will be impacted, especially those who currently hold 10% or more of the shares directly or will be deemed to hold 10% or more due to the inclusion of shares held by their related parties.

However, the amendment acts usually include Transitional Provisions. These provisions give affected individuals time to comply with the new requirements. The review the final amendment acts once they are enacted is required to understand the specific details of these Transitional Provisions.