.jpg?impolicy=m&im=Resize,width=3840)

24 November 2025

Withholding Tax on Insurance Commissions Italian Revenue Agency clarifies insurance

With Ruling No. 286 of 5 November 2025, the Italian Revenue Agency clarified the withholding tax obligations introduced in 2024, which now also apply to insurance agents.

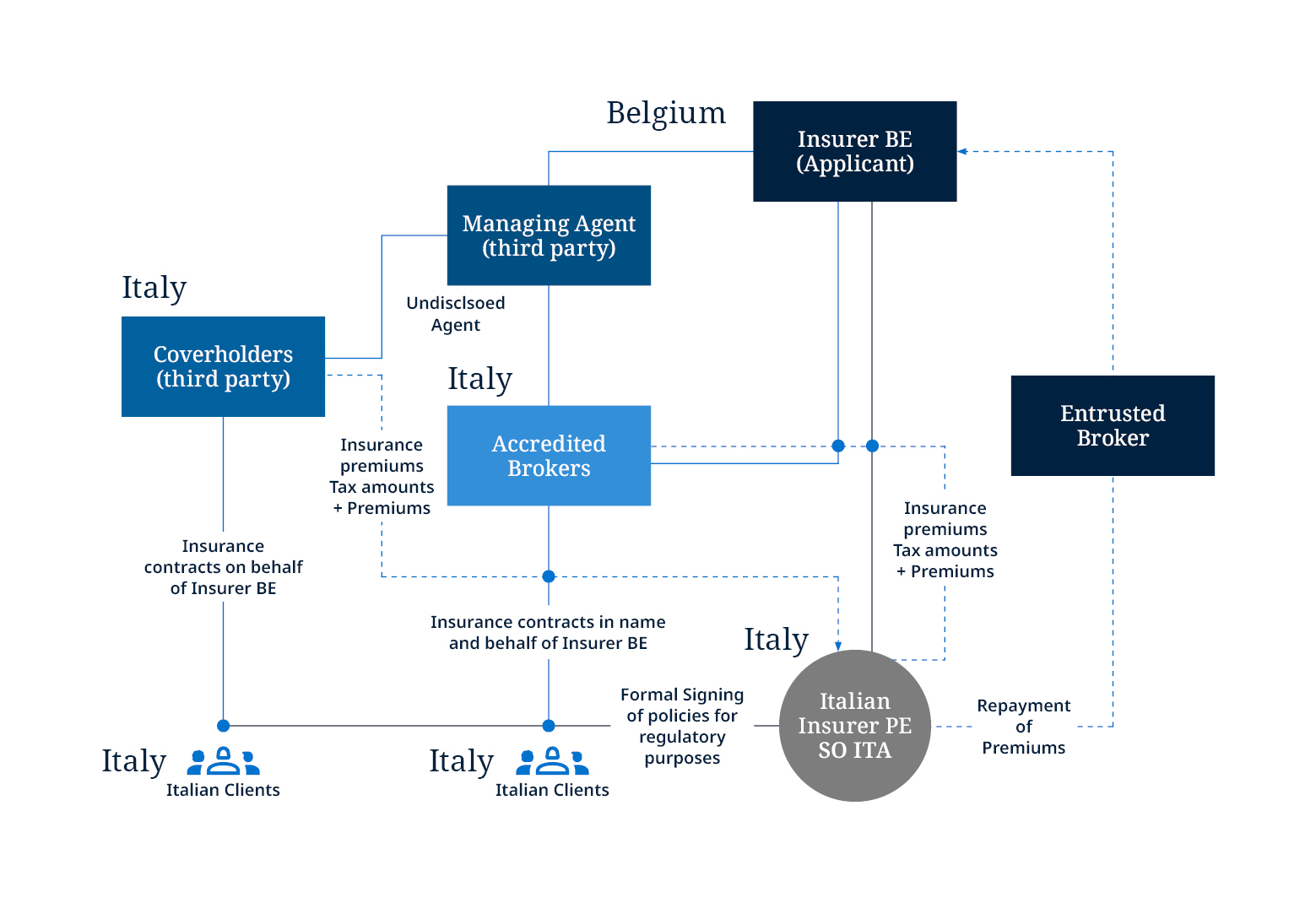

The case concerned a Belgian insurance and reinsurance company (the Applicant) operating in the EU and EEA markets through an outsourced underwriting model. The model relied on Managing Agents, Coverholders and brokers acting as intermediaries across different jurisdictions.

In Italy, the Applicant operates under two regimes:

- Freedom of services (FOS) – for contracts managed by intermediaries not established in Italy; and

- Freedom of establishment (FOE) – through a permanent establishment registered in Italy (the SO ITA), authorized by IVASS in 2018.

SO ITA provides administrative, legal and compliance support to the Belgian head office. It's also responsible for certain operational functions, including the formal signing of Italian insurance policies (as required by regulation) and compliance with Italian insurance tax obligations.

The Italian business model involves several layers of contractual relationships:

- Accredited Brokers, who collect and submit insurance proposals to the Applicant.

- Local brokers and Coverholders, who deal directly with clients in Italy.

- Managing Agents, who coordinate the network of intermediaries.

The Applicant:

- directly or through the Managing Agent, enters into agreements with Accredited Brokers who collect and submit insurance proposals to the Applicant; and

- enters into a framework agreement with the Managing Agent, which coordinates local intermediaries and, under an undisclosed agency arrangement, may appoint Coverholders acting as insurance agents in Italy.

Commissions are paid to Accredited Brokers and Coverholders as a percentage of the premiums collected. Coverholders have to remit to SO ITA the amounts related to the insurance premium tax, while the net premiums are transferred to the Applicant.

The tax question raised by the Applicant concerned the possibility – introduced for administrative simplification – that SO ITA might temporarily receive insurance premiums from Accredited Brokers and Coverholders on behalf of the Applicant, without acquiring economic ownership of those amounts, subsequently remitting them to the Belgian head office via the designated broker.

The Applicant sought clarification on the potential withholding tax implications at SO ITA level, with respect to two specific operational cases:

- Case 1: SO ITA receives insurance premiums from local brokers and Coverholders net of the commissions due to them.

- Case 2: SO ITA transfers the collected premiums to the Entrusted Brokers, which may include commissions owed to those brokers.

The Applicant asked whether, under these circumstances, SO ITA should be regarded as a withholding tax agent (sostituto d’imposta) pursuant to Article 25-bis of Presidential Decree No. 600/1973. This decree governs withholding tax on commissions paid to intermediaries such as agents, brokers and representatives.

According to the Italian Revenue Agency, in both cases SO ITA has to apply withholding tax on commission. The withholding obligation arises when the commission is paid (cash basis), even when commissions are retained by intermediaries from insurance premiums. In such cases, the commission is deemed to be “paid” when retained, and SO ITA must apply the relevant withholding tax.

The Revenue Agency emphasised that, under Articles 23 and 64 of DPR 600/1973, a foreign company’s permanent establishment in Italy (SO ITA) is treated as fiscally equivalent to the non-resident entity itself. So, when the PE manages or processes payments related to commissions earned by intermediaries – whether resident or non-resident with a PE in Italy – it has to withhold tax on those amounts.

Specifically, in this case:

- When local brokers and Coverholders remit insurance premiums to SO ITA net of commissions (Case 1), the latter must treat that moment as the payment of commissions and apply withholding tax.

- When SO ITA subsequently transfers premiums to Entrusted Brokers, which include commissions owed to them (Case 2), the same withholding obligation applies.

The Agency rejected the taxpayer’s argument that the SO ITA shouldn't be considered as making the payment of commissions, noting that the SO ITA's involvement in the financial flow and its fiscal autonomy under Italian law are sufficient to trigger the withholding requirement.

This interpretation confirms that foreign insurers operating in Italy through a permanent establishment have to manage withholding obligations on commissions paid (or deemed paid) to intermediaries in the Italian insurance market, even if the payments are made on behalf of the foreign head office.