21 February 2023 • 26 minute read

Blockchain and Digital Assets News and Trends - February 2023

Achieving Digital Transformation and Securing Digital AssetsThis is our second monthly bulletin for 2023, aiming to help companies identify important and significant legal developments governing the use and acceptance of blockchain technology, smart contracts and digital assets.

While the use cases for blockchain technology are vast, this bulletin will be primarily on the use of blockchain and or smart contracts in the financial services sector. With respect to digital assets, we have organized our approach to this topic by discussing it in terms of traditional asset type or function (although the types and functions may overlap), that is, digital assets as:

- Securities

- Virtual currencies

- Commodities

- Deposits, accounts, intangibles

- Negotiable instruments

- Electronic chattel paper

- Digitized assets

In addition to reporting on the law and regulation governing blockchain, smart contracts and digital assets, this bulletin will discuss the legal developments supporting the infrastructure and ecosystems that enable the use and acceptance of these new technologies.

INSIGHTS

Coordinated DOJ, Treasury and international law enforcement actions against crypto exchange Bitzlato and its founder highlight laser focus on combatting illicit activity involving digital assets and Russia

By David Stier, Katrina Hausfeld, David Peyman and Emily Honsa Hicks

On January 18, 2023, the US Department of Justice (DOJ) and US Treasury Department (Treasury) held a joint midday press event announcing the takedown of Bitzlato, a China-based cryptocurrency exchange, and the arrest of and charges against its alleged founder, Anatoly Legkodymov, a Russian national. Although neither Bitzlato nor Legkodymov were household names, DOJ and Treasury quickly revealed their relevance: Bitzlato was a go-to crypto-exchange for cybercriminals, including Hydra, the world’s largest darknet market until April 2022 when DOJ took it down and Russia-affiliated Ransomware-as-a-Service (RaaS) providers including Conti, a recently sanctioned group that provided RaaS malicious software to enterprising criminals.

DOJ worked with international law enforcement to seize Bitzlato’s servers on the day of Legkodymov’s arrest, but, for Legkodymov himself, DOJ leveraged a powerful statutory tool:18 U.S.C. Section 1960 (Section 1960). Under that section, the DOJ charged Legkodymov with operating a money transmission business without a license and transmitting funds derived from a criminal offense or intended to be used to promote or support unlawful activity. Treasury deployed an equally impressive tool of its own for the first time by identifying Bitzlato, a financial institution operating outside of the US, to be “of a primary money laundering concern” in connection with Russian illicit finance pursuant to section 9174(a) of the Combating Russian Money Laundering Act of 2021 (Public Law 116-283) (the Act) by the Financial Crimes Enforcement Network (FinCEN) (the Order). Read more.

IRS addresses deduction of crypto losses in recent advice

By Tom Geraghty and Kali McGuire

The IRS has released a Chief Counsel Advice Memorandum addressing whether taxpayers may deduct losses derived from cryptocurrency that has declined in value, even precipitously, without a sale or other disposition event.

In an unsurprising analysis, issued on January 13, 2023, the CCA provides that a taxpayer may not claim any such loss if the cryptocurrency continues to be traded on an exchange and has a value greater than zero and the taxpayer has not taken some affirmative step that fixes the amount of the loss, such as abandonment, sale, or exchange.

The CCA also notes that, even if a taxpayer properly established a worthlessness or abandonment deduction for cryptocurrency for 2022, deductions for worthlessness or abandonment are generally disallowed for tax years from 2018 through 2025. Accordingly, individual taxpayers holding cryptocurrency for investment appear to be unable to deduct any losses without a disposition event. Read more.

IRS clarifies requirement for appraisals for charitable donations of cryptocurrency

By Tom Geraghty and Kali McGuire

The IRS released a Chief Counsel Advice Memorandum which provides that where a taxpayer seeks a deduction of more than $5,000 for charitable contributions of cryptocurrency under Section 170(a) of the Code that is derived from a donation of cryptocurrency, the taxpayer must obtain a qualified appraisal under section 170(f)(11)(C) to value the donation. Read more.

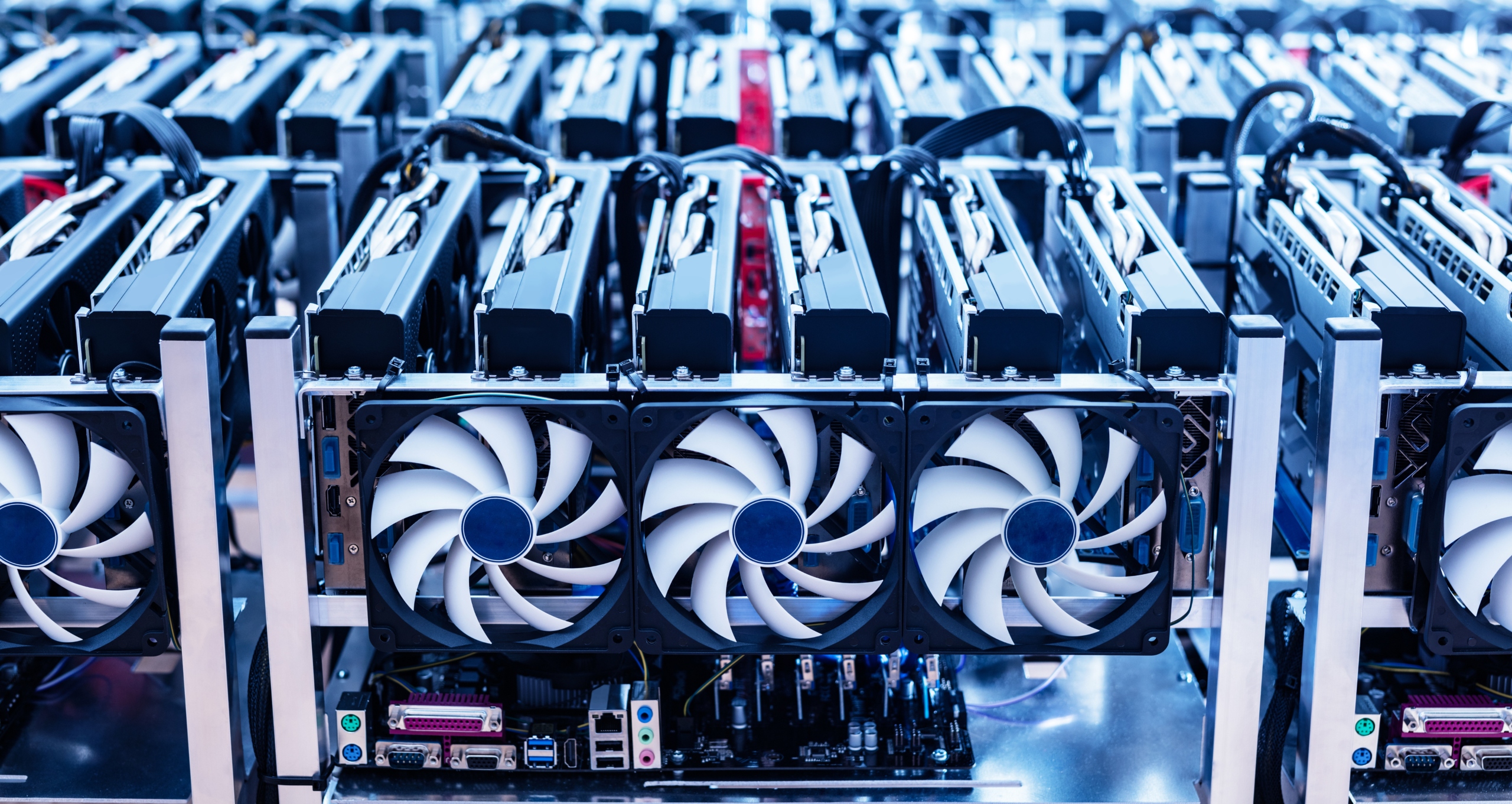

The role of Bitcoin mining in renewables projects

By Kit Lloyd

There's been a lot of talk lately about Bitcoin's energy consumption and its impact on the environment. The narrative from many politicians, media outlets, and industry critics is that mining is cooking the earth and that Bitcoin is gobbling up the world's precious energy and is responsible for a large amount of carbon emissions.

But is there another side to this story? Read more.

STATUTORY AND AGENCY DEVELOPMENTS

FEDERAL DEVELOPMENTS

Securities

SEC announces 2023 examination priorities include cryptoassets. On February 10, the Securities and Exchange Commission (SEC) announced the 2023 examination priorities for its Division of Examinations. The examination priorities include emerging technologies and crypto-assets. For more information, see SEC Announces 2023 Examination Priorities: Key Takeaways.

SEC, NASAA and FINRA issue joint investor alert on risks in self-directed IRA investments. On February 7, the US Securities Exchange Commission (SEC) Office of Investor Education and Advocacy, the North American Securities Administrators Association (NASAA), and the Financial Industry Regulatory Authority (FINRA) published an investor alert on the risks associated with investing through self-directed individual retirement accounts (IRAs), which allow investments in “alternative assets,” such as crypto assets, including virtual currencies, coins and tokens. The alert flags risks of lack of information and liquidity with respect to such “alternative assets,” including the false impression that such assets have been registered with the SEC.

SEC rejects another Bitcoin ETF. On January 26, the SEC issued an Order Disapproving a Proposed Rule Change to List and Trade Shares of the ARK 21Shares Bitcoin ETF. The order rejects approval for a Bitcoin exchange-traded fund (ETF) which sought to allow retail investors to purchase shares in a publicly traded fund that invests in the spot Bitcoin market. According to the order, the applicant “has not met its burden under the Exchange Act and the Commission’s Rules of Practice to demonstrate that its proposal is consistent with the requirements of Exchange Act Section 6(b)(5), which requires, in relevant part, that the rules of a national securities exchange be ‘designed to prevent fraudulent and manipulative acts and practices’ and ‘to protect investors and the public interest.’” The order cites prior SEC orders rejecting Bitcoin exchange-traded products (ETPs) and concluded that the current Bitcoin ETF application failed to meet the standards and failed “to establish that other means to prevent fraudulent and manipulative acts and practices will be sufficient.”

Virtual currency

White House issues roadmap to mitigate risks of cryptocurrencies. On January 27, the White House issued The Administration’s Roadmap to Mitigate Crytocurrencies’ Risks, describing the Biden Administration’s actions and positions on cryptocurrency risks. The statement notes the Administration’s proposal of the “first-ever” framework for developing digital assets in a safe, responsible way. Additionally, the statement describes how agencies are “using their authorities to ramp up enforcement where appropriate and issue new guidance where needed.” The Administration encourages these regulatory actions. It also sets out priorities for digital assets research and development, aiming to “help the technologies powering cryptocurrencies protect consumers by default.” Finally, the statement requests Congress to “step up its efforts,” including by “expanding regulators’ powers to prevent misuses of customers’ assets,” and strengthening “transparency and disclosure requirements for cryptocurrency companies” as well as penalties for violating illicit-finance rules.

White House issues RFI on digital assets research and development. On January 26, the White House Office of Science and Technology Policy issued a request for information seeking public comments “to help identify priorities for research and development related to digital assets, including various underlying technologies such as blockchain, distributed ledgers, decentralized finance, smart contracts, and related issues such as cybersecurity and privacy (eg, cryptographic foundations and quantum resistance), programmability, and sustainability.” The RFI seeks information on “specific R&D opportunities” related to:

- Goals, sectors or applications that could be improved with digital assets and related technologies

- Goals, sectors or applications where digital assets introduce risks or harms

- Federal research opportunities that could be introduced or modified to support efforts to mitigate risks from digital assets

- R&D that should be prioritized for digital assets

- Opportunities to advance responsible innovation in the broader digital assets ecosystem

- Other information that should inform the R&D Agenda.

Comments are due on or before 5 pm ET on March 3.

Digital assets

New Congressional subcommittees formed to address digital assets.

- On January 12, the Financial Services Committee announced the creation of the Digital Assets, Financial Technology and Inclusion Subcommittee. The subcommittee’s jurisdiction will cover, among other things:

- Providing clear rules of the road among federal regulators for the digital asset ecosystem

- Developing policies that promote financial technology to reach underserved communities

- Identifying best practices and policies that continue to strengthen diversity and inclusion in the digital asset ecosystem

- Providing clear rules of the road among federal regulators for the digital asset ecosystem

- On February 2, the Agricultural Committee announced the creation of the Commodity Markets, Digital Assets and Rural Development Subcommittee. The subcommittee’s jurisdiction will cover, among other things:

-

Policies to promote rural prosperity by improving rural energy and development programs authorized through the 2023 Farm Bill

- Policies to bring robust oversight and retail customer protections to digital commodity markets

- The impacts of inflation, global conflict, and trade distortions on global commodity markets

- Operations and authorities of the Commodity Futures Trading Commission and legislation to reauthorize the Commission, and

- Policies to promote robust risk-mitigation, resiliency, and recovery planning for derivatives markets, intermediaries, and participants.

-

Policies to promote rural prosperity by improving rural energy and development programs authorized through the 2023 Farm Bill

STATE DEVELOPMENTS

Virtual currency

New York DFS issues virtual currency guidance. On January 23, the New York Department of Financial Services (DFS) issued Guidance on Custodial Structures for Customer Protection in the Event of Insolvency. The Guidance applies to entities with licenses under New York banking law that custody virtual assets and focuses on customer protection relating to:

- Segregation of and separate accounting for customer virtual currency

- The custodian’s limited interest in and use of customer virtual currency

- Sub-custody arrangements

- Customer disclosures

ENFORCEMENT ACTIONS AND LITIGATION

FEDERAL

Securities

SEC charges Kraken for failing to register crypto staking service as a security. On February 9, the SEC announced charges against Payward Ventures, Inc. and Payward Trading Ltd., commonly known as Kraken, for the unregistered offer and sale of their crypto staking-as-a service program under Section 5(a) and 5(c) of the Securities Act of 1933. The complaint alleges that Kraken offered and sold an investment product to the public where investors transfer crypto assets to Kraken for staking purposes, in exchange for annual investment returns. SEC Chair Gary Gensler stated, “Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws.” Kraken agreed to settle the SEC’s charges without admitting or denying the allegations of the complaint, ceased their staking services and paid a $30 million penalty.

Court dismisses class action against Coinbase. On February 1, the US District Court for the Southern District of New York entered an Opinion & Order dismissing with prejudice a putative class action under the federal securities laws against Coinbase. The complaint alleged Coinbase made sales of unregistered securities and failed to register as a broker-dealer. Assuming for purposes of the motion that the tokens listed on Coinbase’s exchange were securities, the court determined that dismissal for failure to state a claim was warranted on the grounds that Coinbase, as an exchange that did not take title to the assets traded, is not a statutory seller liable for an unregistered sale. Additionally, the court dismissed claims under the Exchange Act to rescind illegal contracts to pay transaction fees to and purchase securities from an unregistered exchange on grounds that the only contract applicable to the token sales was the Coinbase user agreement and the user agreement did not necessitate any illegal acts. Additionally, the user agreement also governed trading of Bitcoin and Ethereum, which are undisputedly not securities.

The dismissal is without prejudice as to the plaintiffs’ state law claims.

Guilty plea in cryptocurrency insider trading case. On February 7, the US Attorney for the Southern District of New York announced that Ishan Wahi, a former product manager at Coinbase Global, Inc., pled guilty to two counts of conspiracy to commit wire fraud in connection with a scheme to commit insider trading in cryptocurrency assets by using confidential Coinbase information about which crypto assets were scheduled to be listed on Coinbase’s exchanges. Wahi faces a maximum sentence of 40 years in prison.

Wahi carried out the conspiracy with his brother Nikhil, who was sentenced in January to 10 months in prison for his participation in the scheme. For more information on Nikhil Wahi, see our January 2023 issue.

US promoter of foreign cryptocurrency companies sentenced. On January 31, the US Attorney for the Southern District of New York announced that John DeMarr was sentenced to 60 months in prison for his participation in a cryptocurrency and securities fraud scheme. The court also ordered DeMarr to pay $3,513,305.41 in forfeiture. Demarr pled guilty to the charges on July 30, 2021. For more information on the case, see our February 2021 and August 2021 issues.

SEC charges and settles with Nexo Capital for over $22 million. On January 19, the SEC announced charges and settlement with Nexo Capital Inc. for failing to register the offer and sale of its retail crypto asset lending product, the Earn Interest Product (EIP). The SEC alleges the EIP is a security. According to the order, Nexo offered and sold EIP, which allowed investors to tender their crypto assets to Nexo in exchange for Nexo’s promise to pay interest. Nexo allegedly exercised its discretion to use investors’ crypto assets in various ways to generate income for its own business and to fund interest payments to investors. Nexo agreed to a cease and desist order without admitting or denying the SEC’s findings, and agreed to a $22.5 million civil money penalty.

For information regarding the CFPB investigation of Nexo and its EIP, see our December 2022 issue.

Commodities

CEO of cryptocurrency and forex trading platform pleads guilty. On February 10, the DOJ announced the guilty plea of Eddy Alexandre, the leader of a purported cryptocurrency and forex trading platform called EminiFX, to one count of commodities fraud and agreed to pay forfeiture in excess of $248 million, as well as restitution in an amount to be specified by the court. Alexandre allegedly solicited more than $248 million in investments from tens of thousands of individual investors after making false representations in connection with the EminiFX trading platform which did not exist. Alexandre faces a maximum sentence of 10 years. For more information on the complaint, see our June 2022 issue.

NFTs

Yuga Labs obtains consent judgment for alleged copying of NFTs. On February 6, Yuga Labs obtained a consent judgment and permanent injunction against Thomas Lehman, an alleged “copycat,” in federal court in the Northern District of New York. Yuga is the creator of the widely known Bored Ape Yacht Club (BAYC) NFTs. Yuga alleged that Lehman participated in an enterprise selling the same images used in their NFTs for a substantial discount. The consent judgment only authorizes injunctive relief against Lehman, who agreed to take down his portion of the business operation.

Yuga’s complaint against Lehman also mentions Ryder Ripps, a nonparty to the action, but a party to another Yuga lawsuit arising from similar facts in the Central District of California. The Ripps complaint alleges that Ripps and many other individuals, one of whom is Lehman, created a business venture to profit off of Yuga’s trademarks and goodwill by selling identical NFTs. The venture sold tokens called RR/BAYC NFTS, and Yuga alleges that it sold these counterfeit NFTs along with authentic BAYC NFTs. Yuga also adds ten unknown defendants to the lawsuit, five of whom were part of Ryder Ripps’s business venture, and five of whom are resellers of RR/BAYC NFTs. These resellers allegedly sell RR/BAYC NFTS despite knowing they are fake.

The Ripps complaint resembles the Lehman complaint with respect to factual allegations, but differs as to claims. Yuga’s claims against Lehman arose under the Lanham Act and included cybersquatting and false designation of origin. In the Ripps complaint, Yuga’s claims also included false advertising, trademark infringement, unfair competition, unjust enrichment, conversion, and tortious interference. It is unlikely that the Lehman consent judgment can predict the outcome in the Ripps case with respect to those defendants.

NFT developer charged in fraud scheme. On January 5, the Department of Justice announced the unsealing of a criminal complaint at a federal court in Brooklyn, New York, charging Aurelien Michel, a French national residing in the United Arab Emirates (UAE), with defrauding purchasers of Mutant Ape Planet NFTs, a type of digital asset, of more than $2.9 million in cryptocurrency. The NFTs were marketed to purchasers, who were falsely promised numerous rewards and benefits designed to increase demand for, and the value of, their newly acquired NFTs. After selling out of the NFTs, Michel pulled out before the project was complete. The millions raised were diverted for Michel’s personal benefit.

Money transmission

My Big Coin founder sentenced by Massachusetts federal court in fraud scheme. On January 31, the US Attorney’s Office for the District of Massachusetts announced that the founder of My Big Coin, a purported cryptocurrency and virtual payment services company in Las Vegas, was sentenced to 100 months in prison and ordered to pay forfeiture of approximately $7.6 million and restitution of an amount to be determined. A federal jury found him guilty in July 2022 of four counts of wire fraud, three counts of unlawful monetary transactions, and one count of operating an unlicensed money-transmitting business. According to the press release, Randall Crater’s fraudulent scheme lasted nearly four years and resulted in victim losses of more than $7.5 million. For more information, see our August 2022 issue.

Wire fraud

Federal court orders BitConnect to pay over $17 million. On January 12, the DOJ announced a federal district court in San Diego ordered that over $17 million in restitution be distributed to approximately 800 victims from over 40 different countries due to their investment losses in BitConnect, a massive cryptocurrency investment scheme, which defrauded thousands of investors worldwide. The founder of BitConnect was previously indicted for his role in the multimillion-dollar fraud. For information on related BitConnect litigation, see our March 2022, December 2021, September 2021, and June 2021 issues.

Bankruptcy

Examiner finds Celsius operated like a Ponzi scheme. On January 30, the court-appointed examiner in the bankruptcy of cryptocurrency lender, Celsius Network, issued her final report following four months of investigation. Filed in In re Celsius Network LLC, et al., 22-10964-MG (S.D.N.Y), Dkt. No. 1956, the report – which runs 689 pages – described the examiner’s findings, including that Celsius lacked proper risk management and accounting controls “[i]n every key respect – from how Celsius described its contract with its customers to the risks it took with their crypto assets – how Celsius ran [its] business differed significantly from what Celsius told its customers.” (Report at pg. 22). For example:

- Starting in 2020, Celsius substantially expanded its purchases of its native CEL token currency to increase CEL’s price – timing its purchases so that they would prop up CEL’s price by creating activity in the market, all without telling its customers.

- Regarding its rewards program, Celsius promised customers that they could earn high rates of return on their investments platform because Celsius would distribute up to 80 percent of its revenues to customers; however, “for most of Celsius’ existence, the rewards it paid exceeded by substantial amounts the revenues Celsius could earn.” (Report at pg. 14).

The examiner determined that, because of a billion-dollar hole in its balance sheet, Celsius lacked liquidity to cover anticipated future withdrawals and, in some instances in June 2022, “directly use[d] new customer deposits to fund customer withdrawal requests.” (Report at pgs. 29-30).

STATE

California federal court upholds arbitration in false advertising and unfair competition case against Coinbase. On February 3, the US District Court for the Northern District of California entered an order granting arbitration in the case of Pearl et al. v. Coinbase Global, Inc. et al., 2023 WL 1769190, (USDC ND Calif. February 3, 2023). The plaintiffs alleged violations of California’s unfair competition law and false advertising law, among other state law claims, based on Coinbase’s assertions regarding a digital currency called Terra USD. The court held that Coinbase’s user agreement contained a “clear and unmistakable” clause authorizing arbitration which was not unconscionable. The court stayed the litigation pending the completion of arbitration.

Texas and Alabama also settle charges against Nexo. On January 19, the securities commissions of Alabama and Texas announced settlement terms with Nexo Capital Inc. and related entities for failing to register the offer and sale of its retail crypto asset lending product, the Earn Interest Product (EIP). The state commissions allege the EIP is a security. Nexo agreed to pay an additional $22.5 million in fines to the 53 NASAA member jurisdictions – or $424,528.30 per jurisdiction.

Homeowner’s insurance does not cover stolen cryptocurrency. In Sedaghatpour v. Lemonade Ins. Co., No. 1:22-CV-355, 2023 WL 1783771, at *3 (E.D. Va. Feb. 6, 2023), the plaintiff alleged $170,000 of cryptocurrency was stolen from his APYHarvest hot wallet which was accessible via the internet. Plaintiff filed a claim under his homeowner’s insurance policy and filed suit after the claim was denied. Plaintiff argued that the policy did not explicitly exclude cryptocurrency from coverage and the insurer included specific language in subsequent policies limiting coverage for the loss of cryptocurrency. The court rejected these arguments and found the policy to be limited to direct physical losses. However, “cryptocurrency, by its nature, exists only virtually or digitally and has no physical or tangible existence.” Consequently, the court held that a homeowner’s insurance policy limited to physical losses does not cover stolen cryptocurrency.

SPOTLIGHT ON INTERNATIONAL DEVELOPMENTS

Dubai regulatory authority issues virtual asset regulations. On February 7, the Virtual Assets Regulatory Authority of Dubai (VARA) announced the launch of its Virtual Assets and Related Activities Regulations 2023. According to the announcement, the regulations “set out a comprehensive Virtual Asset (VA) framework built on principles of economic sustainability and cross-border financial security.” DLA Piper is proud to announce it advised VARA on this world’s first virtual assets specific regulatory framework.

WEF publishes DAO toolkit. On January 17, the World Economic Forum (WEF) announced publication of a Decentralized Autonomous Organization (DAO) Toolkit. The toolkit provides “resources for developers, policy-makers and other stakeholders seeking to engage with the DAO ecosystem.” WEF described the DAO toolkit as “a set of adaptable resources for key stakeholders to help realize the full potential of this emerging form.” The toolkit explains DAOs, including their characteristics, opportunities and challenges, DAO operations, governance, and legal structures. The toolkit also provides WEF recommendations, and “a set of insights and resources for developers and policy-makers … for this “significant new mechanism for managing and allocating capital or other valuable digital assets.”

Hong Kong issues consultation conclusion on cryptoassets and stablecoins. On January 31, the Hong Kong Monetary Authority (HKMA) announced the issuance of the “consultation conclusion” to its prior discussion paper on cryptoassets and stablecoins. The conclusion summaries feedback received in response to the discussion paper and provides HKMA’s response. The conclusion indicates broad support for “the need to take into account the latest market developments and draw reference from the discussion of international regulatory bodies when developing the relevant regulatory regime.” The press release states that, “in drawing up the specific regulatory arrangements, the HKMA will consider the feedback received, latest market development[s] and international discussion, ... [and will] engage with stakeholders and market participants.”

Japan

Thailand securities authority issues rules on custody and digital wallets. On January 17, the Securities and Exchange Commission, Thailand (SEC-T) announced the issuance of regulations requiring digital asset business operators that provide custody of clients’ digital assets “to establish a digital wallet management system to accommodate efficient custody of digital assets and keys and ensure safety of clients’ assets.” The regulations require policy, guidelines and procedures for management of digital wallets and their keys, and a contingency plan “in case of occurrence of any event that may affect the management of digital wallets and keys.” The regulations became effective January 16, 2023.

United Kingdom

- Cryptoassets – The English law position in January 2023

- HM Treasury launches consultation on future financial services regulatory regime for cryptoassets

- HM Treasury publishes a review and call for evidence on the Payment Services Regulations 2017 - issues flagged include “whether the scope and definitions of the regime are future-proofed for the rapidly changing payments and data sector, including ensuring that the definitions are enabled for cryptoassets (including initially fiat referenced stablecoin) where relevant”

RECENT EVENTS

DLA is proud to announce it advised the Dubai VARA on the world’s first virtual assets specific regulatory framework.

DLA Piper ranked in Chambers FinTech Guide 2023. DLA Piper is pleased to announce that the firm's FinTech Legal: Blockchain & Cryptocurrencies practice has been ranked nationwide by the prestigious legal publisher Chambers and Partners. Margo Tank and Mark Radcliffe each received individual rankings. Overall, the firm received 21 practice rankings and 16 individual lawyer rankings in the 2023 guide.

UPCOMING EVENTS

DLA Piper attorneys will be presenting at the following events:

- #NFTNYC2023, April 12-14, 2023, at Times Square and Hudson Yards, with Mark Radcliffe, Michael Fluhr, Christoph Engelmann and Dr. Nico Brunotte

PUBLICATIONS

Cryptocurrency and Digital Asset Regulation, published by the American Bar Association and co-edited by Deborah Meshulam and Michael Fluhr, includes chapters by Meshulam and Fluhr and by Margo H.K. Tank and Andrew Grant.

Read

Digital assets regulation in 2023: Is a new regulatory framework finally emerging?

Mark it: 6 big trademark, copyright and advertising trends we are watching for 2023 (includes NFT use cases)

Transferring digital assets under UCC Article 8

Listen to our podcasts and webinars

Casey Sobhani joined Neil Mandt, Founder and CEO of Metaverse Rights, and Steve Weikal, Industry Chair at MIT Real Estate Technology Initiative (RETi), for Digital & Physical: What the Metaverse Means for Real Estate.

Tech Disputes – Looking to the Future: podcasts

- In the first episode of Tech Disputes – Looking to the Future, Phillip Kelly and Dan Jewell discuss NFTs from an English law perspective, covering issues relating to the rights acquired when purchasing NFTs, the risk of fraud and how to guard against it, and the regulatory framework applicable to NFTs and how it might develop. The podcast is on Apple Podcasts, Spotify, LinkedIn, and the DLA Piper website.

- In the second episode of Tech Disputes – Looking to the Future, Phillip Kelly and Dan Jewell discuss smart legal contracts from an English law perspective and the issues businesses need to be aware of when embedding smart contract technology into their legal agreements. The podcast is available on Apple Podcasts, Spotify, LinkedIn, and the DLA Piper website.

Law of Code podcast Can't Be Evil NFT licenses featuring Mark Radcliffe.

Contacts

Learn more about our Blockchain and Digital Assets practice by contacting any of our editors:

Mark Radcliffe

Martin Bartlam

Contributors to this issue

The editors send their thanks and appreciation to Marc Aronson and Raymond Janicko for their contributions to this and prior issues.