10 October 2022

The road to CORRA: Sunset on CDOR

Refinitiv Benchmark Services (UK) Limited (“RBSL”) marked one of the biggest changes to Canadian financial markets in recent memory, when it announced that it would permanently stop publishing the Canadian Dollar Offered Rate (“CDOR”) by June 28, 2024.

As the primary interest rate benchmark in Canada for over 40 years, CDOR is referenced in over $20 trillion of gross notional exposure across the Canadian financial system. Organizations whose financial instruments currently reference CDOR have less than two years to adjust to this change, which may be particularly challenging for those that lack adequate fall-back language. Without this language, financial instruments may be unclear as to which rate applies, or may fail to reference a valid benchmark rate altogether once CDOR ceases.

The White Paper

RBSL’s announcement was partly in response to the Canadian Alternative Reference Rate Working Group’s (“CARR”) white paper (the “White Paper”), released on December 16, 2021. The White Paper determined that CDOR, as it is currently structured, is not a sustainable long-term benchmark. CDOR applies far more broadly than the data that underlies it, and is based on expert judgement rather than observable arms-length transactions. This construct lacks transparency and is inconsistent with the global shift towards transaction-based approaches. Further, CDOR’s reliance on the bankers’ acceptance (“BA”) market may become increasingly eroded as fewer banks voluntarily submit rates, given the increased costs and obligations to do so.

The White Paper also found that it was unfeasible to enhance or reform CDOR, so it proposed the following: (1) RBSL cease calculating CDOR after June 30, 2024, and (2) Canada implement a two-stage transition to the Canadian Overnight Repo Rate Average (“CORRA”).

Transition to CORRA - the Roadmap

While CORRA has not been confirmed as the next benchmark rate in Canada, it is largely predicted to replace CDOR as the next Canadian risk-free overnight reference rate. Based on actual market transactions in the Government of Canada’s repo market, CORRA is administered by the Bank of Canada and closely follows the Bank of Canada’s policy rate.

However, unlike CDOR, CORRA lacks a risk and term component, meaning an additional benchmark may be required for certain loan and hedging agreements. In response to this concern, CARR has introduced a consultation to determine the need for Term CORRA, which would be limited to 1-month and 3-month tenors. This consultation could lead to Term CORRA’s introduction in Q3 of 2023.

The first phase of CARR’s recommendation provides that all new derivative contracts and securities should transition to CORRA by June 30, 2023, with no new CDOR exposure after that date. This excludes derivatives that reduce CDOR exposures, securities transacted before June 30, 2023, or loan agreements transacted before June 30, 2024.

The second phase provides for the continuation of CDOR-based loans until June 28, 2024, provided they have robust fall-back language. During this period, loans can reference CORRA in arrears, Term CORRA, or any other available alternative rate. After June 28, 2024, no new CDOR rates will be published and any exposure will revert to the CDOR fallbacks.

How the transition to CORRA will proceed

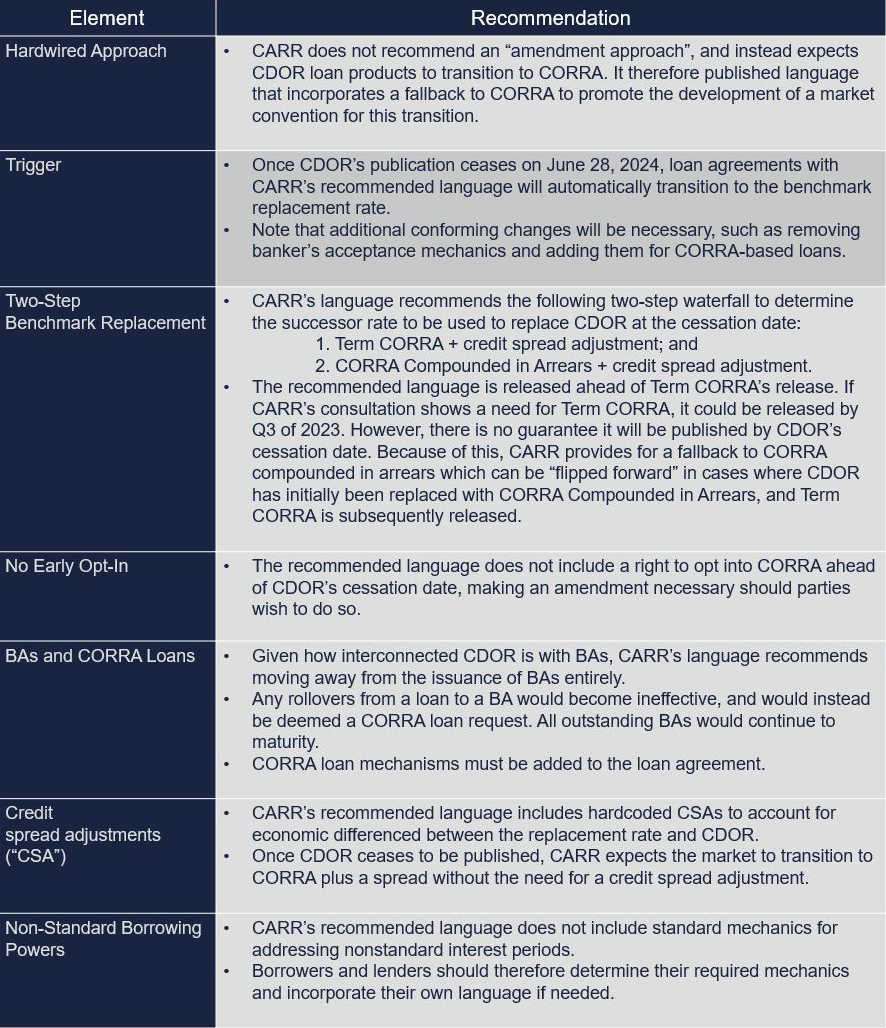

The transition from CDOR is a significant task that requires financial contracts, systems, and processes to migrate to an alternative reference rate on a tight timeline. However, CARR has attempted to facilitate this transition by addressing the difficulties that can arise when a major benchmark is changed without adequate fallback language, as was the case following LIBOR’s cessation in the U.S. CARR therefore released its recommended fallback language in August of 2022, to be used in new and existing loan documentation that currently reference CDOR. This will ensure that contracts contain robust benchmark rates following CDOR’s cessation.

Overview of Fallback Language

This loan fallback language is entirely voluntary, and can be amended as required. The following is an overview of the recommended language:

Going forward: Parties’ next steps

Parties should consider including the CARR recommended language in financial instruments, either through amendments or by creating new documents. Parties should be sure to modify the language as necessary to conform to the specifics of their agreements.

Parties to loan agreements, where borrowing is done under a BA facility, should also note that CARR’s recommended language is not to be relied on to transition contracts from CDOR to CORRA. Parties must also include CORRA loan mechanisms to their loan agreements ahead of CDOR’s cessation.

Market participants should also monitor market developments, as CARR’s recommended language is subject to change.

This article provides only general information about legal issues and developments, and is not intended to provide specific legal advice. Please see our disclaimer for more details.