.jpg?impolicy=m&im=Resize,width=3840)

18 October 2023 • 11 minute read

Funds – The Liquidity Conundrum

With fundraising at it is slowest in over 20 years, lower portfolio valuations, record high inflation rates, cost of funding issues due to higher interest rates, the collapse or withdrawal of key bank lenders from the market and geopolitical issues, funds are increasingly likely to hold their investments for longer and therefore require access to liquidity. As a result, the fund finance market continues to evolve apace and is rapidly accelerating from simple bridging facilities to increasingly sophisticated tools used for NAV, GP, LP financing, CFOs and back leverage products.

Consequently, there has been a rise in the number of fund clients seeking advice on liquidity options, including information on which lenders are the most active in this specific space and assistance with introductions. This two part series will set out the key liquidity options (including both fund finance facilities and back leverage products - such as loan on loans and structured repos or TRS transactions) available to funds.

The below article focuses on the fund finance options and the upcoming second article will cover back leverage.

Capital Call/Subscription Facilities

A capital call facility is the most well-known financing tool for a fund and has become the ‘go to’ strategy for managers seeking to generate liquidity. It is a bridge/short term loan, typically provided on a revolving basis, to permit a fund to bridge the period between the close of the fund/the making of investments and the date capital contributions from the fund's limited partners (‘LPs’) are received following a capital call (which can be as long as 90 days after a call is made).

A capital call facility can also be used to provide funding pending a close of the fund, in achieving investment objectives and/or helping manage the administration of LP drawdowns (such as to avoid multiple small drawdowns).

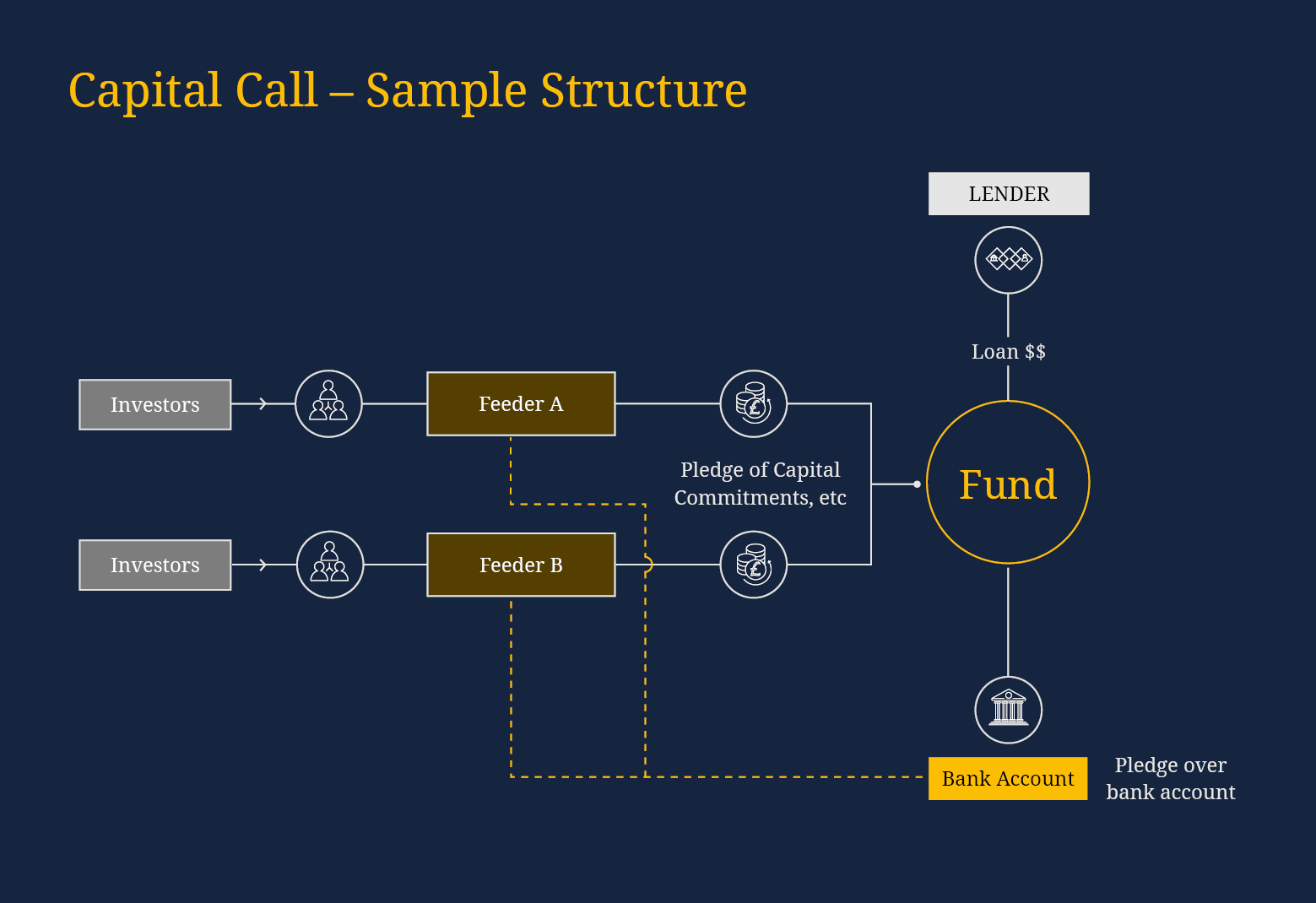

A typical security package (subject to the fund structure) for a capital call facility would be:

- An assignment or pledge over the unfunded capital commitments of LPs to a lender.

- A fixed charge or pledge over the accounts into which LPs pay capital contributions.

- An assignment or pledge of the right to deliver capital call notices / take enforcement rights against LPs.

The lender's risk is therefore on the creditworthiness of the LPs and the enforceability of the rights of the fund against the LP.

The lender's obligation to make loans will typically be contingent upon the fund's compliance with a borrowing base test requiring that collateral (including unfunded commitments) exceeds the outstanding loans by a certain percentage.

After determination of which LPs are included in the borrowing base, the lender will ascribe an advance rate against the uncalled capital commitment of the relevant LP. The general market standard advance rates are broadly:

- 90% for insurance funds, pension funds, corporates and sovereign wealth funds (subject to due diligence and quality of underlying LP);

- 65% for family offices and fund of funds (subject to due diligence and quality of underlying LP) and

- 0% for UHNW and HNW.

Spreads for capital call facilities are wider than 18 months ago. In Europe, average spreads are currently 1.9-2.4% above the relevant base rate and 2.6-2.8% above base rate in the US. And although funds aren’t getting terms as attractive as was the case prior to Q2 2021, deals are still being closed.

As a result of market conditions, the quality of LPs has become an increasingly important factor (i.e., the credit worthiness and ability to rate the LP by the lender). Whether this is determined by a rating agency or not has become a moot point - generally lenders are seeking to focus on advancing against higher-quality LPs only. Leverage restrictions under the fund documents or the European alternative investment manager directive and applicable law should also be considered.

With several lenders either exiting the market or retrenching, due to balance sheet constraints, focus has shifted to large top tier managers with strong track records. For other managers, deals continue to be done but there is a growing trend for ancillary products to also form part of the relationship (for example, the requirement for a minimum deposit with the lender during the term of the facility, fund administration services or treasury products such as hedging or FX products). However, for big name sponsors there is capacity and liquidity available. Although generally, lenders are being more conservative.

Other key market trends include:

- The tendency for borrowers (both current and prospective clients of banks) to request smaller ticket sizes.

- A greater level of collaboration between lenders, post-SVB’s collapse amidst banks’ balance sheet restrictions.

- A growing number of club deals (i.e., two or more banks) for traditional bi-lateral size facilities.

- A dampening of appetite to lend to funds in the VC or CRE sectors.

- In some jurisdictions, there is a growing trend for the lender to request certain changes to fund documentation to improve the lender’s position. For example, a provision whereby the LPs expressly waive any rights of set-off, counterclaim and defence as well as any other defences they may raise towards the fund. Alternatively, this can be done via an investor notice at closing.

Asset Backed Facilities (NAV Based)

Unlike a capital call facility, a NAV facility is not secured against LP commitments but instead the underlying investments, cash flows and distributions that flow up to LPs from the underlying assets. Therefore, the creditworthiness of the LPs of the fund has little importance (if any) compared to the value of the underlying assets. Also, unlike capital call facilities which are typically revolving, NAV facilities tend to be term loans.

A fund will typically use a NAV facility to:

- To address liquidity squeeze due to the slower fund raising environment and higher costs of capital.

- To support underperforming assets (defensive) or take advantage of market dislocation (offensive).

- To generate recallable distributions.

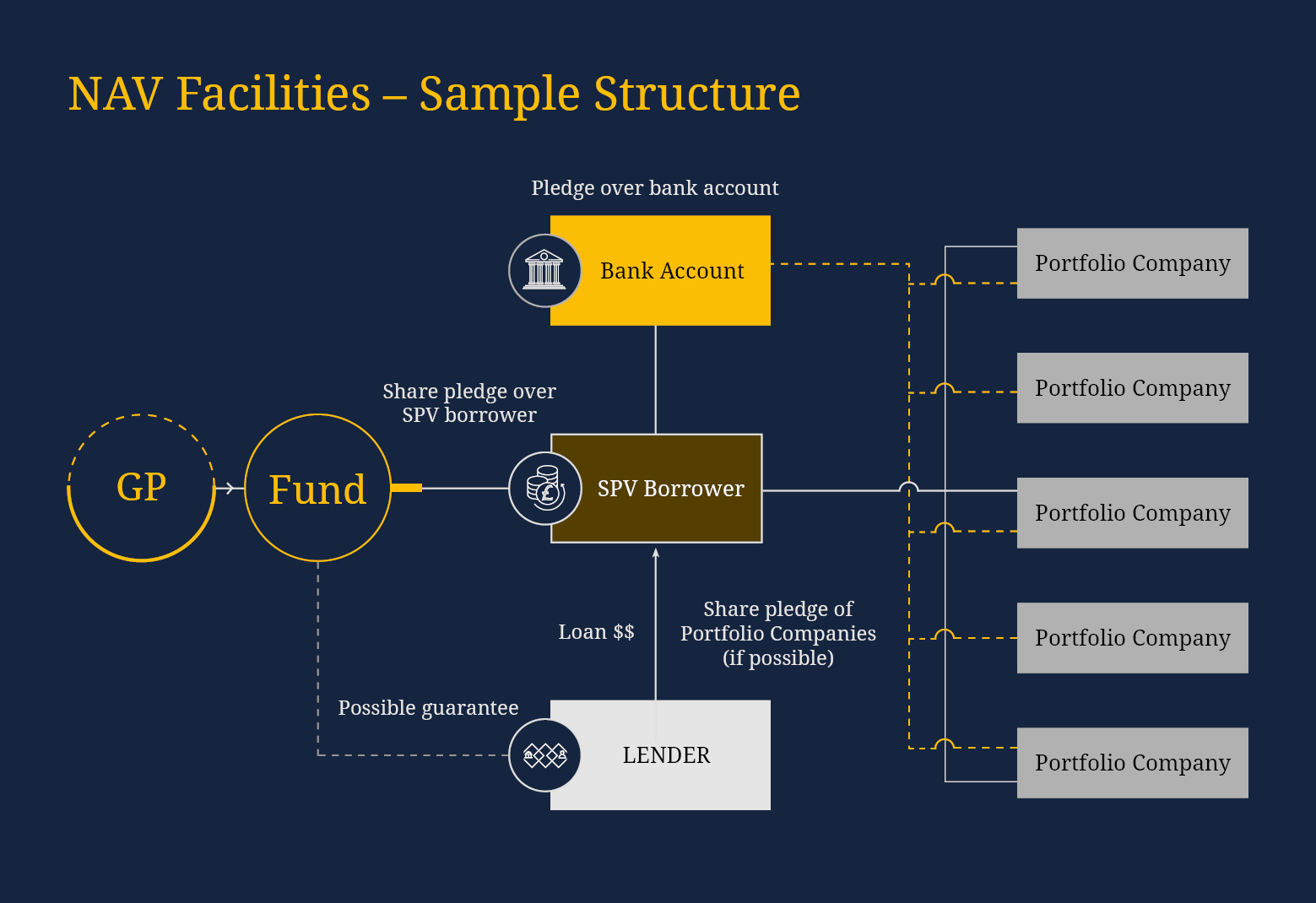

A key characteristic of this type of facility is that it is granted at the fund level or directly below the fund level. Repayment comes directly from the income derived from or the sale of the underlying investments in priority to a return to LPs.

Security packages for NAV facilities vary depending on the type of fund. A lender will look to try and take security as close to the portfolio company level assets as possible. The typical security package for a non Pref Equity NAV deal is:

- Pledge of the equity of the SPV holding the assets (most common).

- Pledge over bank accounts (specifically accounts into which proceeds of the underlying assets are paid at the fund level) (most common).

- Portfolio assets directly (to the extent feasible).

- All asset security granted by the holding SPV/investment vehicle (to the extent feasible).

- Guarantees from the fund or other fund entities (less common).

Spreads for NAV facilities range between 4-10+% above the relevant base rates; with the typical interest rate between 5-7% above the base rate.

On average, LTV ratios range from 5-20% for concentrated (less than ten assets) / illiquid portfolios, to 60%+ for very liquid / diverse portfolios (more than 10 assets).

Typical covenants for NAV facilities include minimum LTV, minimum number of portfolio investments test and concentration adjustments. Some lenders also require cash sweeps.

Valuation of portfolios/portfolio assets challenges is also a hot topic. The current market standard is for lenders to have a couple of challenges a year. The payee will depend upon how differentiated the fund’s own valuation of its portfolios/portfolio assets are versus the external valuation.

Over the past year, lenders reported an increase in over 80% of deal flow. Market reports state that approximately USD21-25bn was lent in 2022, with predictions for the size of the market to increase to between USD250-700bn by 2030.

Transaction size has grown 40% in the 12-month period to 30 September 2022. Prior to 2021, deal sizes were up to USD500m but 2022 saw single deal sizes over USD1bn (this year, Vista Equity Partners entered into a USD4.8bn NAV loan of which it used USD1bn to pump into one of its portfolio companies).

Despite the increasing popularity of NAV facilities, reportedly only a small minority of managers are currently using NAV-based products and only 20-25% are even aware of its potential advantages.

Whilst LPs are becoming more accepting of NAV financing, there is still some way to go, and some LPs continue to push back on funds using these types of facilities.

Alongside the large investment banks, NAV financing is a growth area for private credit funds with new entrants such as Apollo Global, Ares, HPS and Pemberton all recently joining 17 Capital, Whitehorse Liquidity Solutions and Hark Capital in the space.

Hybrid Facilities

Less commonly used, hybrid facilities are a combination of a capital call and NAV facility. Hybrid facilities look down at the underlying assets (as for a typical asset backed facility), as well as looking up to the undrawn commitments of investors (as for a capital call facility).

Whilst hybrids are a tool for funds to discuss, they are not as popular as capital call facilities or NAV facilities given the sweet spot required in a fund’s life in which such a loan can be used. Hybrids are only suitable for funds that still have uncalled capital commitments available but where the relevant fund has also started to build up its portfolio.

The two most common structures are:

- a slight variant on a capital call facility in which only an additional net asset value covenant is included. This type of covenant will then only apply if the undrawn investor commitment vs the total amount drawndown under the loan is over a certain level; or

- a true style hybrid which includes full security over both the investors capital call commitments and the underlying assets (and associated cash flows) of the fund.

Hybrid facilities vary significantly from lender to lender. Each transaction is highly tailored and there is no market standard approach. Therefore, for true hybrid deals, funds will need to consider the points above in relation to capital call facilities and NAV facilities.

GP / Management Fee Facilities

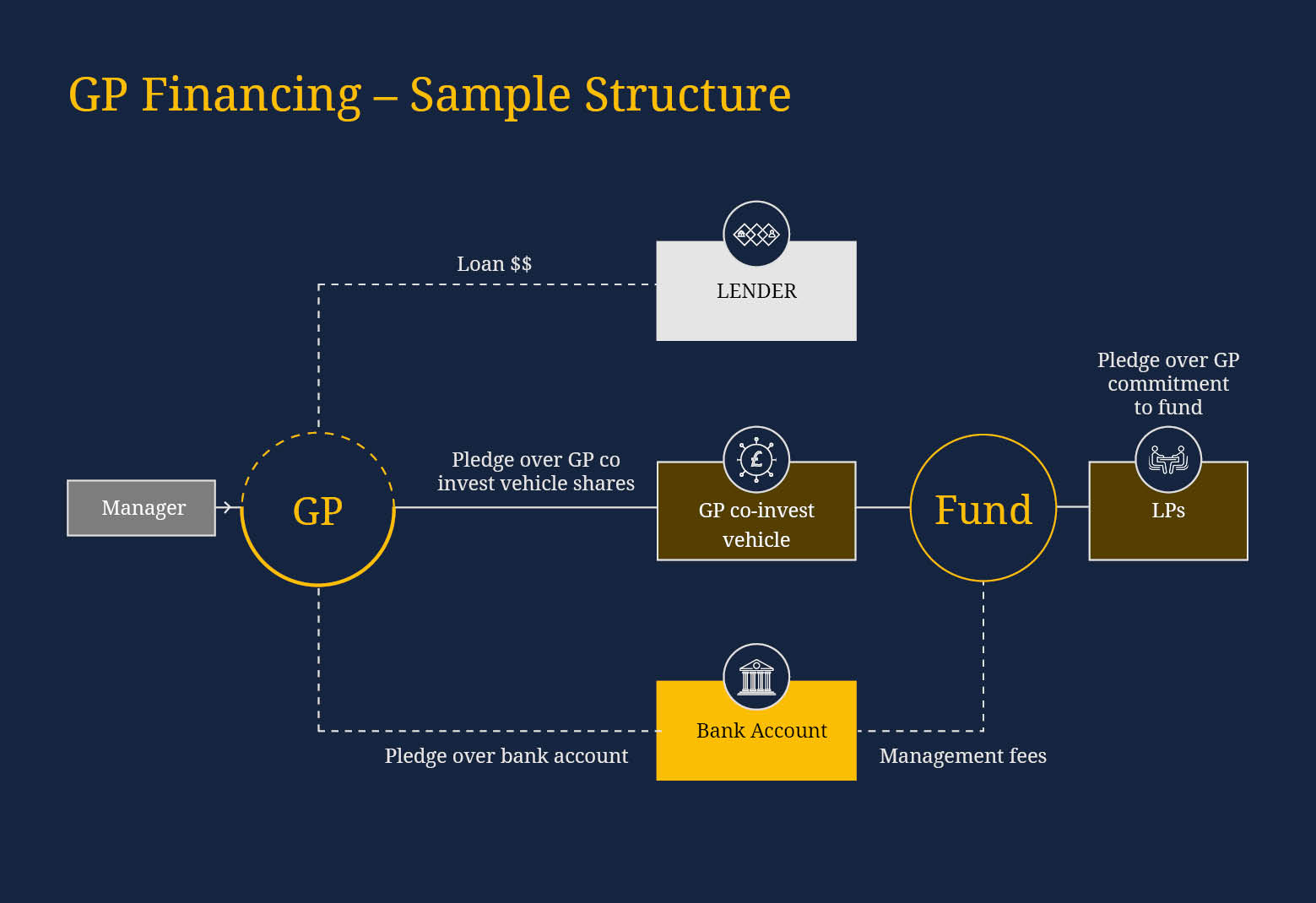

Whilst GP/Management Fee Facilities have been available for many years, they are becoming an increasingly important tool in the current market conditions. A GP/Management Fee Facility will usually be entered into alongside the fund’s capital call facility.

The demand for GP/Management Fee Facilities has increased due to:

- A replacement for a stake sale, allowing a GP to achieve objectives such as funding GP Commitments, launching new strategies, expanding into new territories etc.

- As new partners join or are promoted, those partners require cash to fund their capital calls.

- Pressure on GPs to have more skin in the game.

- If a GP is managing several strategies, this can lead to multiple capital commitment obligations occurring at the same time.

- Working capital purposes.

GP/Management Fee Facilities are bespoke products and there is no set market standard.

Commonly seen security packages for GP/Management Fee Facilities are:

- Pledge of the LP interests held by the GP (specifically for skin in the game facilities).

- Pledge of the bank accounts into which management fees or other cash flows are paid (for both types of facilities).

- Assignment of the GP’s priority profit share paid from the fund.

- Assignment of carried interest entitlements.

Target margin rates are between 4-8% above the relevant base rates. Loan maturities are between 3-8 years and will include amortisation and cash sweep features.

Points for GPs to be aware of are, the repayment waterfall is individually tailored and heavily negotiated, the scope for management fees to be used to pay essential expenses of the sponsor following a default which is continuing; and the clean-down requirements (i.e., the facility must be periodically reduced to USD0).

Typical covenants for GP/Management Fee Facility include, minimum operating cash flow; minimum AUM, minimum annual management fee, limits on amendments to the management fee and carry structure, and leverage ratio triggers.

Please contact the author of this Alert if you would like more information regarding a specific product.