Chris Baird

Partner

London

View full bio

4 minute read

The energy and natural resources sector faces fresh challenges every day. A highly volatile and uncertain market is fraught with increasing regulation, price shifts, supply chain issues and geopolitical disruptions. Clients are looking for new technologies, innovative ways of doing business, efficiencies and market breakthroughs to reshape their businesses and shift to a more sustainable future.

Our Energy and Natural Resources sector team understands this fundamental change and how it affects businesses in the power, renewables, mining, oil and gas, waste and water markets as well as new technologies driven by the energy transition.

With 400+ lawyers in over 40 countries, we are one of the largest and most impactful energy and natural resources practices in the world.

Partner

London

View full bio

Partner

London

View full bio

Partner

London projects

View full bio

Partner

IKM Advocates

View full bio

Director

IKM Advocates

View full bio

Partner

Olajide Oyewole LLP

View full bio

Legal Director

Olajide Oyewole LLP

View full bio

.jpg)

Legal Director

Olajide Oyewole LLP

View full bio

Consultant Partner

Manokore Attorneys

View full bio

Head of Corporate Advisory

Chibesakunda & Company

View full bio

Consultant

Ellis Shilengudwa Inc.

View full bio

Director

Ellis Shilengudwa Inc

View full bio

Senior Partner

Rubeya & Co-Advocates

View full bio

Senior Associate

Reindorf Chambers

View full bio

Partner

Reindorf Chambers

View full bio

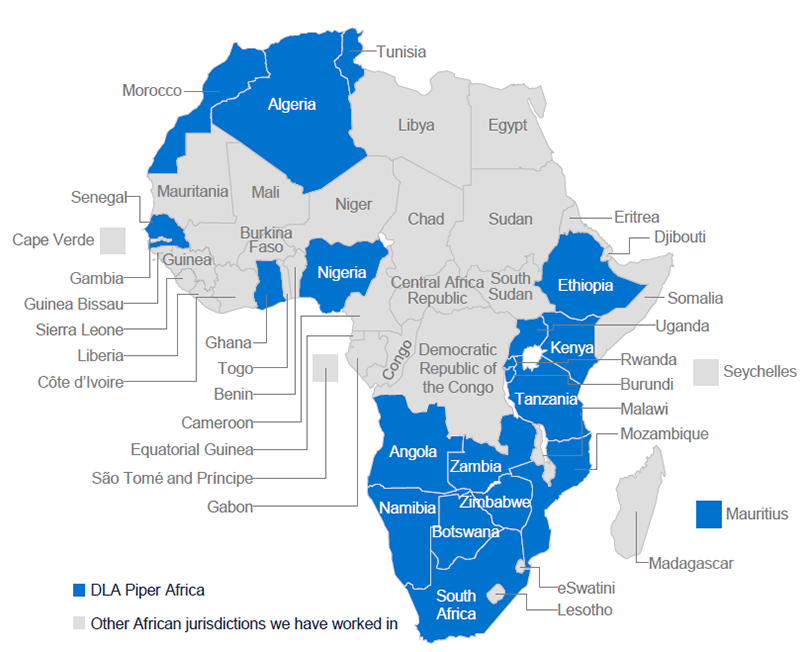

Our unrivalled Africa offering is the result of over 20 years of commitment and experience on the continent, combined with long‑standing relationships with leading national firms, many dating back to the 1990s.

These relationships have been brought together under DLA Piper Africa, a Swiss verein comprising 18 independent Africa law firms working with our two fully integrated Africa offices in Morocco and South Africa, and DLA Piper globally.

Our unique level of integration, and aligned operating and governance structures, means you benefit from: