6 February 2026

EU and India Free Trade Agreement – A Strategic Shift for the EU

The long-awaited Free Trade Agreement (FTA) between the European Union and India has reached a political conclusion. For European businesses, this marks one of the most significant diversification opportunities since the opening of the Chinese market decades ago. While the EU-Mercosur agreement currently faces a hiatus pending the European Court of Justice’s review, the conclusion of the EU-India FTA marks a pivotal acceleration in EU trade policy. The agreement was accelerated by broader geopolitical dynamics: the EU’s desire to reinforce its strategic posture and India’s intent to demonstrate leadership as an alternative economic pole to China. However, both sides softened their original demands to secure a timely conclusion, raising questions about whether the deal signals EU strength or instead highlights political constraints. It is clear that for clients analyzing their global footprint, it is crucial to understand the India agreement’s opportunity. It will offer industrial growth and demographic scale.

- Scale of Opportunity: The Mercosur bloc connects the EU under its FTA to roughly 270 million consumers with until now rather moderate growth. The India FTA unlocks the EU’s access to 1.45 billion people and the world’s fastest-growing major economy (projected ~7% GDP growth), effectively offering a market five times larger than the Mercosur by population.

- Modernization Partnership: For the EU there is significant potential on exporting EU technology, machinery, and infrastructure expertise to support India’s industrialization. Crucially, sensitive agricultural sectors (e.g., beef, dairy) have been largely excluded, potentially reducing the EU’s political friction which may have contributed to the current stalled situation of the Mercosur deal.

- Strategic Imperative: The India deal, in the longer run, may have the potential of a geopolitical and supply chain alternative for the EU. All the more, the agreement has faced minimal internal opposition – unusual for EU trade deals, which traditionally generate strong reactions from sectors such as agriculture.

Below is a detailed breakdown of the specific market potential, tariff liberalizations, and the legal roadmap for this landmark agreement.

1. Market Context

While EU exports to China have faced stagnation, India presents a trajectory of high growth.

- Demographics: 1.45 billion consumers (world’s most populous nation).

- Economic Power: 5th largest economy globally; projected to overtake Japan by 2027.

- Growth Differential: India’s GDP is growing at ~7-8% annually, compared to the EU’s ~1-2%.

- Untapped Potential:

- Current EU exports to India are disproportionately low relative to India's size (approx. EUR120bn in goods).

- Goal: The FTA aims to double EU exports by 2032.

- Tariff Savings: Estimated at EUR4 billion annually for EU exporters upon full implementation.

While the US remains India's largest export destination, the EU is India's largest trading partner overall. This FTA is designed to foster that lead and offer an alternative to the US-China polarity.

2. Sector Spotlight

The agreement focuses on dismantling India’s historically high protectionist barriers. The liberalization schedule spans a 0 to 10-year horizon.

Sector ‘Winners’ (Industrial & Luxury)

Industrial Goods: Zero Tariff

Target: Almost complete elimination of duties.

| Sector | EU Exports (2024) | Current Tariff | Deal Specifics (Timeline to 0%) |

| Machinery & Electric | EUR16.3 bn | Up to 44% | 0% within 10 years (Majority eliminated in 5-7 years) |

| Aircraft & Space | EUR6.4 bn | Up to 11% | 0% within 10 years (Majority eliminated in 5 years) |

| Chemicals | EUR3.2 bn | Up to 22% | 0% within 10 years (Majority eliminated immediately) |

| Plastics | EUR2.2 bn | Up to 16.5% | 0% within 10 years (Majority eliminated in 5 years) |

| Iron & Steel | EUR1.5 bn | Up to 22% | 0% within 10 years (Majority eliminated immediately) |

| Pharmaceuticals | EUR1.1 bn | 11% | 0% within 10 years (Majority eliminated in 5-7 years) |

Restricted Access Sectors

Target: Partial reduction or capped quotas.

| Sector | EU Exports (2024) | Current Tariff | Deal Specifics |

| Optical / Medical Instruments | EUR3.4 bn | Up to 27.5% | 0% for 90% of goods (Phased over 10 years) |

| Gems & Precious Metals | EUR2.1 bn | Up to 22.5% | 0% for 20% of goods; Tariff cuts for further 36% (Phased over 10 years) |

| Automobiles | EUR1.6 bn | 110% | Reduction to 10% (Gradual cut; Quota capped at 250,000 vehicles/year) |

Automotive Context: While the tariff reduction to 10% is a political signal, the quota of 250,000 vehicles is – economically speaking – a "drop in the ocean" compared to the millions of units sold in the EU's core export markets, China and the US. For European manufacturers, this deal is about long-term strategic positioning rather than immediate volume impact.

Excluded Sectors

To facilitate the deal, the EU agreed to exclude sensitive Indian agricultural sectors.

- Excluded: Beef, chicken, dairy, rice, and sugar.

- Impact: No tariff liberalization for these products; existing sanitary and phytosanitary (SPS) standards remain strictly in force.

Services & Non-Tariff Barriers (New Opportunities & Risks)

- Services Access: Beyond goods, the EU gains "privileged access" to the Indian financial market and maritime services, marking a significant opening of India's service economy.

- IP Note on Geographical Indications: A critical note for the food & retail sector: Due to time constraints, no agreement was reached on the protection of Geographical Indications (GIs). Products like "Parmaschinken" or "Champagne" currently enjoy no automatic protection under the FTA.

- CBAM Compliance: The EU remained firm: There are no exemptions for India regarding the Carbon Border Adjustment Mechanism (CBAM). The system is now active since 1 January 2026, and the EU shows no sign of softening its stance. However, to support compliance, the EU will provide EUR500 million to aid the decarbonization of Indian industry.

3. Legal Roadmap: Ratification & Risks

A signed political agreement is not yet law. The ratification process is the critical next phase, and recent developments with the Mercosur deal provide a cautionary tale.

Split Architecture

Potentially to avoid a ratification gridlock seen with CETA or Mercosur, the Commission may have separated the agreements:

- Trade Agreement: Covers tariffs and exclusive EU competences (Art. 207 TFEU).

- Ratification: Requires only EU Council (Qualified Majority) + European Parliament consent. No national ratifications needed.

- Investment Protection Agreement (IPA): Covers dispute resolution and portfolio investment.

- Ratification: Mixed competence; requires ratification by all 27 Member States.

- Strategic Shift: The agreement suggests a potential move regarding the classic Investor-State Dispute Settlement (ISDS) towards a State-to-State dispute mechanism. Details remain to be seen.

Next ECJ Opinion request?

The European Parliament recently passed a resolution referring the Mercosur deal to the European Court of Justice (ECJ) for an Opinion (Art. 218(11) TFEU) regarding sustainability clauses. This triggers a delay of many months. While the risk also exists with the India deal, it may be lower. The India agreement includes modern "Trade and Sustainable Development" (TSD) chapters that are more aligned with recent EP demands than the ‘older’ Mercosur text. However, one may still expect scrutiny from the EP regarding labor standards (ILO conventions) which may remain a bottleneck that could delay the Parliament's consent vote.

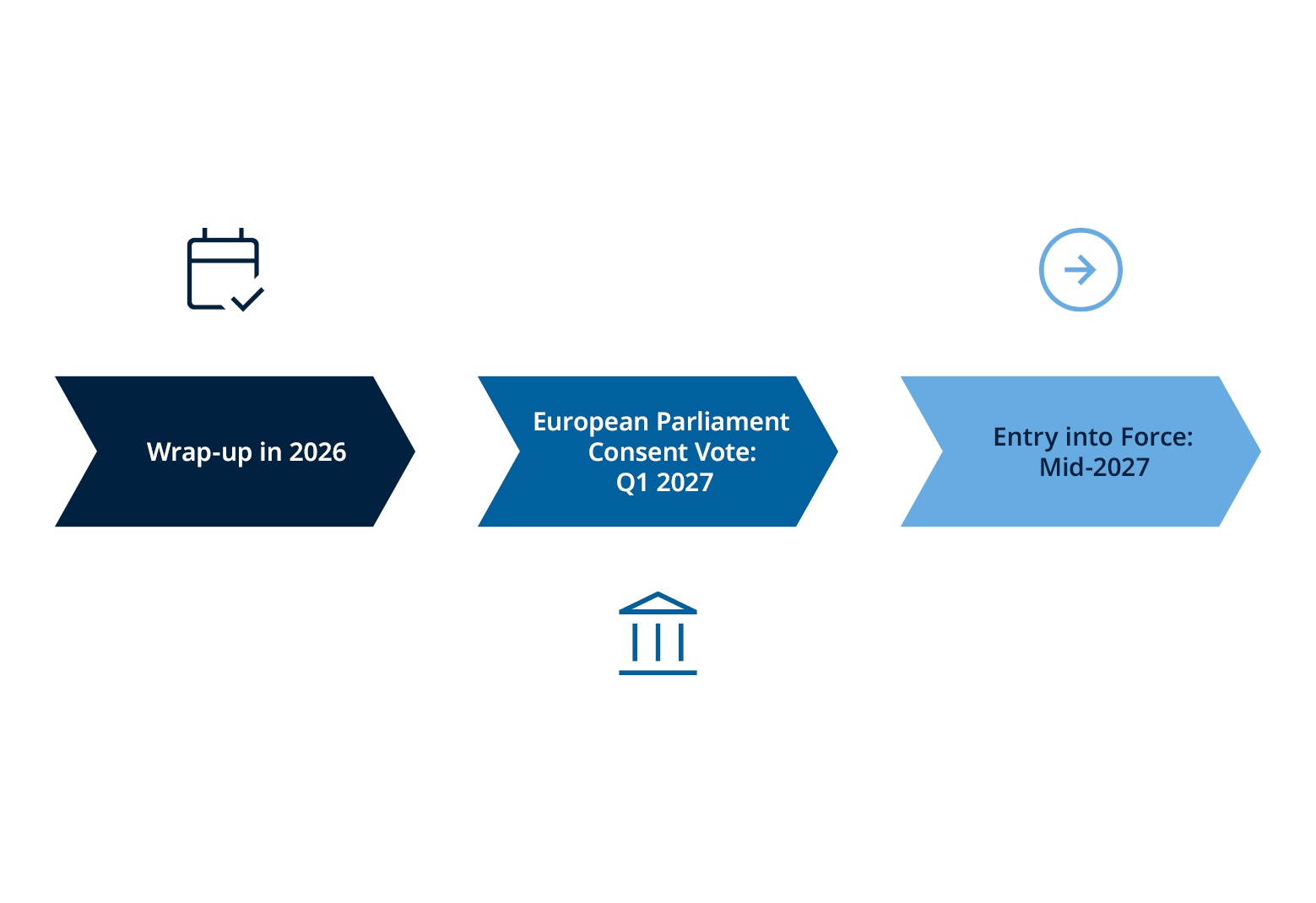

Estimated timeline

4. How DLA Piper Can Support You

As a global law firm, we have a strong connection to India and work closely with the country’s leading law firms. For many years, we have helped some of India's largest companies and conglomerates while also advising companies based outside India do business with Indian counterparties.

The FTA creates immediate strategic imperatives for EU companies. We are not just watching the law; we help you operate it, for example with:

- Customs & Rules of Origin (ROO):

Action: The preferential tariffs only apply if your goods meet specific "European origin" thresholds. We assist in auditing your supply chain to ensure you qualify for the reduced rates immediately upon entry into force.

- Supply Chain Restructuring & FDI:

Action: With machinery tariffs dropping to 0%, moving assembly or manufacturing hubs to India becomes viable. We advise on the corporate, tax, and employment implications of establishing Indian subsidiaries.

- Workforce Mobility & Employment:

Action: A parallel “Comprehensive Framework for Cooperation on Mobility” was signed and aims to simplify visa procedures across Europe. Our Global Mobility Team can assist clients in the efficient cross-border deployment of personnel navigating the ever-changing legal landscape ensuring compliance with complex regulatory requirements in the areas of employment, labor, social security, residence, and tax law.

- Contractual Updates:

Action: Reviewing long-term distribution agreements to adjust pricing mechanisms based on the anticipated tariff drops (e.g., passing on savings vs. margin retention).

- IP Strategy & Arbitration:

Action: Given the lack of automatic Geographical Indications protection and the shift in investment protection, our IP and Litigation teams can develop alternative trademark, brand and advertising strategies and analyze your recourse options for Indian investments.

- Regulatory Compliance (Sanctions, Export Control & CBAM):

Action: Navigating dual-use goods regulations and ensuring Indian suppliers meet the strict EU CBAM reporting standards.

Contact our International Trade, Government Relations and Tariffs team members for a bespoke assessment of your product portfolio, or reach out to our India Desk.