22 March 2024 • 7 minute read

Sustainability has become a legal obligation: New ESG Act in Hungary

Hungary has adopted the new ESG Act (ESG Act), Act CVIII of 2023, in December 2023. Its provisions laying down the sustainability due diligence and reporting obligations are applicable to certain undertakings as of 1 January 2024.

The ESG Act establishes a comprehensive Sustainability and ESG framework and covers two main areas, taking into account fundamental principles, such as the double materiality and the supply chain principle. On the one hand, the ESG Act lays down rules on the ESG due diligence obligations and the ESG Ecosystem. On the other hand, it incorporates sustainability reporting obligations by amending Act C of 2000 on Accounting and Act LXXV of 2007 on the Chamber of Hungarian Auditors, the Activities of Auditors, and on the Public Oversight of Auditors.

The ESG Act has been drafted in accordance with the relevant EU legislation, including the Taxonomy Regulation and it implements the Corporate Sustainability Reporting Directive ('CSRD'). The sustainability due diligence obligations, however, do not entirely correspond with the proposal for the Corporate Sustainability Due Diligence Directive, in terms of scope, certain obligations pertaining to the supply chain and the rules on liability for the failure to comply with the sustainability due diligence obligations.

SCOPE OF APPLICATION

With regard to the sustainability due diligence obligations, the ESG Act shall apply to the following undertakings established in Hungary:

- Undertakings exceeding the threshold for large undertakings, which qualify as public-interest entities,

- Undertakings exceeding the threshold for large undertakings,

- Small and medium-sized undertakings, which qualify as public-interest entities.

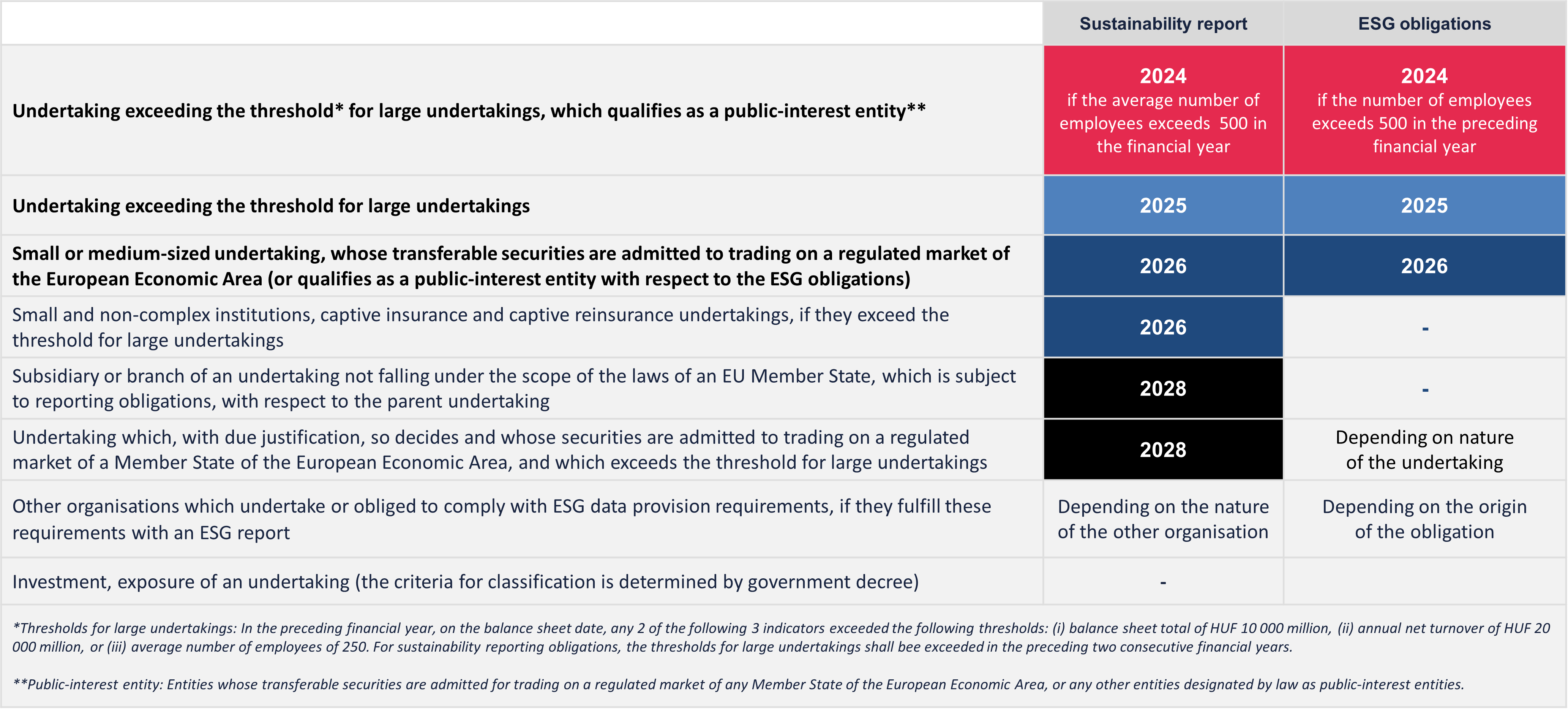

The scope also covers the investments of undertakings, and other organisations, which undertake to comply with ESG reporting obligations voluntarily or in contract, or if it is required by law. Large undertakings, which qualify as public-interest entities, shall prepare their first ESG report in 2025 (in relation to year 2024), other large undertakings in 2026 and small and medium-sized undertakings, which qualify as public-interest entities in 2027.

Sustainability reporting is required from undertakings which fall under reporting obligations due to their size, undertakings listen on the stock exchange, except for micro undertakings, and subsidiaries and branches of parent companies operating under the law of a member state of the EU or a third country.

SUSTAINABILITY DUE DILIGENCE OBLIGATIONS

Sustainability due diligence obligations include:

- Establishing a risk management system, to efficiently address environmental (E) and social responsibility (S&G) risks, covering all aspects of the undertaking's operations, including its business, internal processes, exposures, investments and supply chain;

- Establishing an internal responsibility strategy and system, which will determine the roles and responsibilities of the undertaking's bodies, departments and individual employees in implementing sustainability aspects and fulfilling sustainability due diligence obligations;

- Regular risk assessment, enabling the regular monitoring of risks which may arise in the undertaking's operations and in the supply chain, as well as the identification of new risks;

- Determining preventive and corrective actions within the undertaking's own business competence and with respect to its direct suppliers, to effectively prevent and correct the adverse impacts of social responsibility and environmental risks;

- Compliance with ESG data provision obligations;

- Obtaining declaration from direct suppliers to ensure compliance with the ESG requirements set forth by the undertaking's management and that these requirements will be duly addressed throughout the supply chain (i.e. with respect to other suppliers); and

- Establishing an internal or external complaint management system, allowing anyone to submit a complaint in connection with social responsibility and environmental risks or breaches of obligations with respect to the economic activities of the undertaking, its subsidiaries or its direct suppliers.

In line with the relevant EU legislation, the ESG Act attributes great importance to ensuring that sustainability principles will not only apply to the undertaking's own activities, but also to the entire supply chain, in particular to the direct suppliers. Therefore, under certain circumstances, in order to minimize the sustainability risks, undertakings are required to suspend the business relationship with direct suppliers for 3 months and to even terminate the business relationship with respect to activities that involve an increased risk of adverse impacts.

ESG REPORT AND SUSTAINABILITY REPORT

Undertakings shall prepare an annual ESG Report on the fulfilment of their sustainability due diligence obligations from the previous business year in electronic form, through the ESG management platform, which shall be reviewed and certified by an ESG certifier. The ESG Report shall include information necessary to understand the impact of the undertaking's activities on sustainability issues and the information on how sustainability and social issues affect the development, performance and position of the undertaking and its relationship with society. Undertakings may also involve a registered ESG advisor in preparing the ESG Report. Should undertakings fail to comply with the ESG reporting obligations, the Supervisory Authority for Regulated Activities may impose financial penalties. The detailed requirements for the content of the ESG Report will be regulated by lower-level legislation, yet to be adopted.

In addition, the ESG Act implements CSRD and obliges undertakings to prepare and file sustainability reports using European Sustainability Reporting Standards (ESRSs). In principle, as part of their annual report, undertakings shall include data and information on sustainability issues related to their activities, including the relationship between their business model, strategy and sustainability issues as well as climate objectives, roles and responsibilities related to sustainability issues, sustainability risks, opportunities and adverse impacts, and the means of addressing them. The sustainability report shall also include information on the value chain including products and services, business relationships and supply chain. Undertakings may omit information from the sustainability report relating to impending developments or matters in the course of negotiation with due justification under certain circumstances.

COORDINATION AND SUPERVISION – THE ESG ECOSYSTEM

The governmental coordination tasks related to the sustainability due diligence obligations fall within the competence of the Minister for Economic Development (i.e. Minister of National Economy), whereas the Supervisory Authority for Regulated Activities supervises the compliance with sustainability due diligence obligations and the transparency of the ESG reporting processes, including the keeping of registers.

In addition to the governmental regulatory side, the ESG Act also regulates the activities of significant market operators in the Hungarian ESG Ecosystem, including:

- ESG advisors (and their training institutions) who provide ESG related information and advisory services for covered undertakings,

- ESG certifiers, who review and certify ESG reports,

- ESG qualifiers who provide a rating for undertakings, based on their own business decision, considering the ESG compliance and progress,

- Companies distributing and manufacturing ESG software.

In light of the above, it can be concluded that a completely new and forward-looking ESG system is emerging in Hungary. The ESG Act, however, only lays down the foundations and cornerstones of this complex framework, therefore a number of supplementary rules remain to be adopted by the legislator.

DLA Piper Hungary is committed to follow and monitor the latest developments with the view to provide comprehensive legal and business advisory services to our clients with an integrated approach in connection with the applicable ESG rules and helping to covert these new obligations into opportunities for a better and more sustainable future.