28 June 2023 • 6 minute read

In expansive reading of IRS guidance, Tax Court holds that indirect grants of profits interest may be made without current tax

A recent Tax Court decision indicated that taxpayers may take an expansive reading of IRS guidance when services are provided “for the benefit of” a partnership, including when carry recipients provide services to a private equity fund and receive carried interest in a general partner entity of the fund, or when employees of an operating company receive profits interests in a partnership that owns such operating entity.

On May 3, 2023, in ES NPA Holding, LLC v. Commissioner, T.C. Memo. 2023-55[1], the US Tax Court held that Revenue Procedure 93-27 applies to a partnership interest granted to ES NPA Holding, LLC (the Taxpayer) in exchange for services that the Taxpayer provided indirectly for the benefit of an operating partnership in a tiered partnership structure. In applying Revenue Procedure 93-27, the Tax Court held that the indirect receipt of the partnership interest was a profits interest and, therefore, excludable from the Taxpayer’s income.In this alert, we look at the key details of the case and its implications for taxpayers.

Background

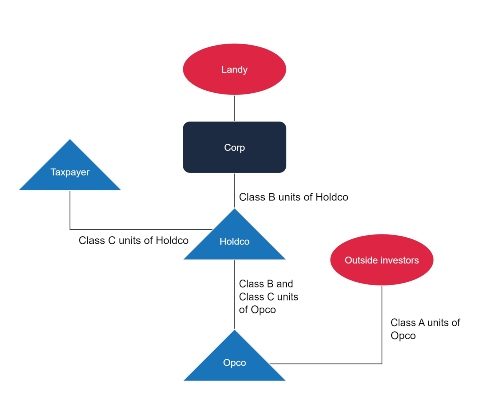

Joshus Landy owned 100 percent of the outstanding stock of NPA, Inc. (Corp), which conducted a consumer loan business. In connection with Landy’s agreement to sell 70 percent of his Corp interest, Corp formed two limited liability companies: (i) IDS, LLC (Holdco) and NPA, LLC (Opco).

Holdco had two classes of membership units: Class B and Class C. Opco had three classes of units: Class A, Class B, and Class C. Per Holdco’s operating agreement, the Class B and Class C units in IDS track the Class B and Class C units in Opco, respectively. This meant that the owner of IDS Class B units was entitled to 100 percent of the payments received by Holdco because of its ownership of Opco Class B units, and the owner of Holdco Class C units was entitled to 100 percent of the payments received by Holdco because of its ownership of Opco Class C units.

Corp then contributed substantially all of its business assets to Opco in exchange for all three classes of units (Classes A, B, and C) in Opco. Following that, Corp contributed all three classes of Opco units to Holdco as a capital contribution to Holdco in exchange for Class B and Class C units of Holdco. Holdco sold the Class A units of Opco to outside investors.

Then, pursuant to an option agreement with the Taxpayer, Corp transferred the Class C units of Holdco to the Taxpayer in exchange for “strategic advice for the purpose of enhancing the performance of [Corp’s] business and to assemble an investor group that would purchase 40 [sic] percent of [Corp’s] business . . .” Opco’s operating agreement provided for pro-rata sharing among its Class A, Class B, and Class C units, but Class C unit holders could not participate in liquidating distributions until Class A unit holders received aggregate distributions equal to their investment.

The ownership structure following these transactions is depicted below:

The case

A profits interest is a partnership interest that gives the owner the right to receive a percentage of future profits (but not existing capital) from the partnership. Most commonly, a profits interest is granted to a partner in exchange for a contribution of services.

The IRS’s position on profits interests, set forth in Revenue Procedure 93-27, is that a person may receive a profits interest without current tax where the profits interest is received in exchange for the provision of services to or for the benefit of a partnership in a partner capacity (or in anticipation of being a partner).[2] The IRS challenged the Taxpayer’s treatment of the Class C units in Holdco on two grounds, but the Tax Court rejected both challenges.

First, the IRS argued that, while the Taxpayer ostensibly provided services to Corp and Opco, it did not provide services to Holdco, thereby failing the requirement of Revenue Procedure 93-27 that the profits interest be granted in exchange “services provided to or for the benefit of the partnership.”

The Tax Court explicitly rejected as too narrow the IRS’s reading of its own guidance, noting that “the evidence supports a finding that [the Taxpayer] directly (or through its principals), before and after formation, provided services to or for the benefit of [Holdco] in a partner capacity or in anticipation of being a partner. It is undisputed that the material assets of [Holdco] are held in NPA, LLC, and the activities [the Taxpayer] performed were to and for the benefit of the future partnership. It is of no material consequence that [the Taxpayer]’s interest in [Opco] is held indirectly through [Holdco], which is a mere conduit since the liquidation rights in the class C units in both [Holdco] and [Opco] are identical.”

The IRS then argued that the interest received by the Taxpayer was not, in fact, a profits interest, but a capital interest. Revenue Procedure 93-27 provides that a capital interest as a partnership interest that gives “the holder a share of the proceeds if the partnership’s assets were sold at fair market value and then the proceeds were distributed in complete liquidation of the partnership.”

The effect of this deemed liquidation is assessed at the time the partnership interest is received. The Tax Court held that the best evidence for the fair market value of a partnership in a hypothetical liquidation is an actual arm’s-length transaction made proximate to the valuation date (in this case, the sale of the Class A units of Opco to the outside investors).

The IRS contended that Landy “lacked knowledge of the value of his business, performed minimal due diligence, and did not understand the terms of the transaction,” essentially arguing that the transaction was not made at arm’s-length. The Tax Court provided that, absent compelling evidence, an arm’s-length transaction even without a formal appraisal is sufficiently reliable, a position long held by taxpayers and tax advisors.

Key takeaways

Although the Tax Court’s holding with respect to valuation of profits interest is informative for taxpayers, far more interesting is the expansive reading of the category of persons to whom services may be rendered in order to qualify as a profits interest.

Profits interests granted through tiered partnership arrangements are increasingly common. For example, many general partners of private equity funds issue interests in their carry to employees who sit at a level or two above the general partner itself. Other investment managers establish separate special limited partnerships to serve as carried interest vehicles for one or more investment funds. Further, tiered arrangements are used where an operating company wants to grant incentive equity to employees without causing these employees to lose their status as such for tax purposes.

The Tax Court’s ruling should provide some peace of mind that the profits interests issued through these tiered arrangements will not, solely as a result of such structures, fail to qualify as such for tax purposes.

For more information, please contact any of the authors.

[1] T.C. Memo. 2023-55

[2] Rev. Proc. 93-27 provides other requirements that must be met in order for a partnership interest to qualify as a profits interest, but those requirements were not at issue in this case.