1 June 2023 • 1 minute read

IRS says regularly traded stock exception to FIRPTA applies at the partnership/fund level

The Office of Chief Counsel of the Internal Revenue Service (the IRS) recently issued a memorandum (AM 2023-003) stating that the regularly traded stock exception to the Foreign Investment in Real Property Tax Act (FIRPTA) contained in Section 897(c)(3) of the Internal Revenue Code of 1986, as amended (the Code) applies at the partnership level rather than at the individual partner level. This is a somewhat surprising result and contrary to what taxpayers had hoped for from the IRS. Although AM 2023-003 is not binding upon taxpayers, it describes the IRS’s position on a question that previously lacked clear guidance.

This client alert provides a general overview of AM 2023-003 as well as some related practical observations.

Background

Section 897 of the Code, commonly referred to as the Foreign Investment in Real Property Tax Act (FIRPTA), sets forth various rules designed to impose U.S. federal income tax payment and filing obligations on foreign persons’ gains from the sale of United States real property interests (USRPIs). USRPIs are defined to include equity interests in domestic corporations that are United States real property holding corporations (USRPHCs). Generally, a USRPHC is any corporation, including a real estate investment trust (REIT), if the value of its USRPIs represents at least 50 percent of the aggregate value of its worldwide real estate and business assets.

Section 897(c)(3) of the Code provides that, if any class of stock of a corporation is regularly traded on an established securities market, stock of such class is treated as a USRPI only in the case of a person who, at some point during the statutory holding period, held more than 5 percent (or, in the case of a corporation that is a REIT, 10 percent) of such class of stock (the regularly traded stock exception).

Although the term “person” is defined under Section 7701(a)(1) of the Code to include partnerships unless otherwise “distinctly expressed or manifestly incompatible with the intent” of the provision in which it is used, one might argue that partnerships should be “looked through” for purposes of the regularly traded stock exception, with a foreign person’s ownership percentage in stock held by a partnership determined for purposes of the regularly traded stock exception by multiplying the foreign person’s ownership percentage in the partnership by the partnership’s ownership percentage in the stock. This position is founded on language referring to beneficial ownership that is included in the Treasury Regulations interpreting the regularly traded stock exception as well as policy concerns with treating foreign persons who invest in stock through a partnership differently from foreign persons who invest in stock directly. In addition, partnerships are looked through for purposes of numerous other tax rules that are dependent on specified ownership thresholds (e.g., portfolio interest, subpart F inclusions, domestically controlled REIT status). Until AM 2023-003, however, the IRS had never issued guidance on the treatment of partnerships for purposes of the regularly traded stock exception.

Overview of AM 2023-003

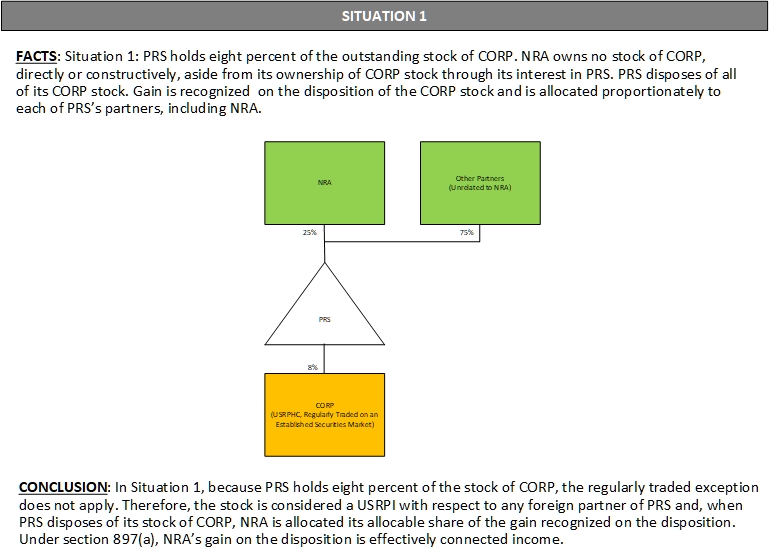

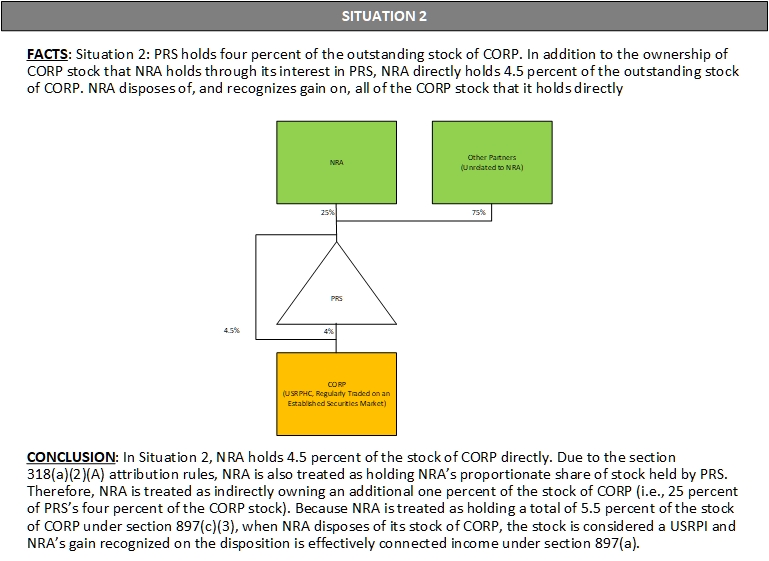

AM 2023-003 examines two scenarios and concludes that partnerships should not be looked through for purposes of the regularly traded stock exception. A summary and depiction of AM 2023-003’s two scenarios and conclusions follows.

Practical considerations

The interpretation of the regularly traded stock exception expressed in AM 2023-003 will discourage investment by foreign persons subject to FIRPTA in partnerships that own or expect to own stock in domestic USRPHCs in amounts exceeding the regularly traded stock exception’s applicable ownership threshold. In those scenarios, unless a foreign person’s ownership percentage of the stock would exceed the regularly traded stock exception’s applicable ownership threshold even when the partnership is looked through, the foreign person would be better off investing in the stock directly rather than through a partnership. Indeed, AM 2023-003 points out that it is a partner’s “choice to invest collectively” through a partnership rather than individually.

Given entities treated as partnerships for tax purposes are often the most convenient vehicles for pooling capital for non-tax purposes, the adverse tax treatment of partnerships for purposes of the regularly traded stock exception could create economic inefficiencies, particularly in today’s economic climate where large investments by partnerships in public real estate companies as part of “take private” or other transactions could be on the horizon. While certain strategies exist that would allow foreign persons to participate in these transactions without becoming subject to FIRPTA (e.g., using a managed account instead of a partnership, using multiple partnerships, etc.), these strategies require careful planning to implement and could be susceptible to IRS challenge if structured improperly. If structuring around the issue is not feasible, foreign persons may desire to interpose additional foreign entities in their investment structures to avoid incurring tax payment and filing obligations directly.

Note that AM 2023-003 does not address withholding tax. Questions remain regarding the proper application of Section 1446 of the Code to a partnership that sells regularly traded stock of a domestic USRPHC.

Conclusion

AM 2023-003 describes the IRS’s position on the treatment of partnerships for purposes of the regularly traded stock exception. As described in this client alert, the IRS’s position is less taxpayer friendly than taxpayers had hoped for, could make pooling capital and structuring investment partnerships more difficult and appears to be contrary to the policy of increasing foreign investment in U.S. real estate.

To learn more about AM 2023-003 and related issues, please contact any of the authors listed above.![]()