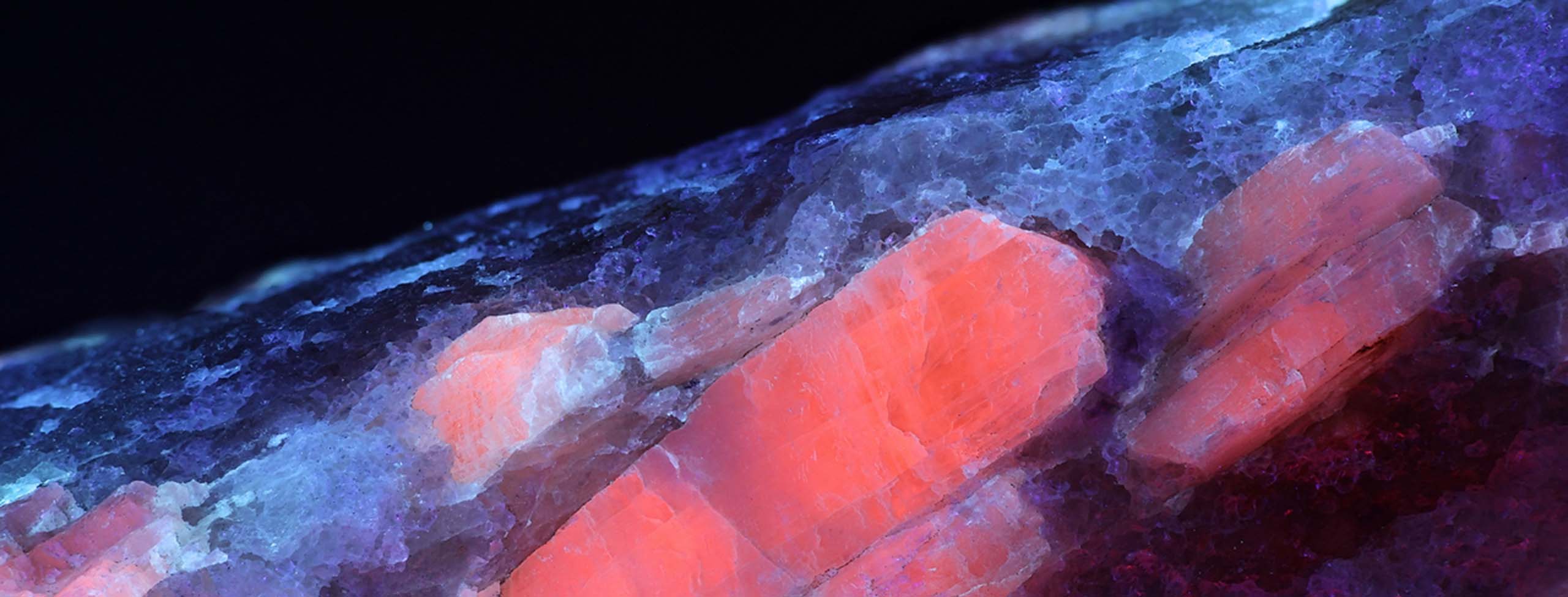

Owen brings a wealth of expertise to his role as a project finance lawyer, guiding lenders and sponsors through intricate financing transactions across diverse sectors such as infrastructure, energy, mining, and property. His forte lies in navigating complex deals in exotic niche locations, where his hands-on approach and proactive problem-solving skills shine brightest.

Owen thrives on fostering personal connections through face-to-face interactions, earning trust by delivering innovative solutions that anticipate and mitigate potential challenges.

As a young partner, Owen invests in his team's development and aims to foster growth. Driven by a sense of giving back, Owen believes in mentoring and supporting others, having benefitted from mentorship in his own journey.

Owen's forward-looking approach keeps him on the forefront of the industry. He values in-person client meetings and avoids complacency by focusing on building trust and ensuring exceptional outcomes.

His skills and expertise have earned him a reputation for finding creative solutions to complex legal problems. His dedication to his profession and collaborative approach makes him a trusted advisor.

In the realm of Project Finance, Owen thrives in securing funding for ambitious projects such as gold mines and wind farms across the globe. He balances passion, pragmatism, and sacrifice to ensure clients receive the best outcomes.