29 December 2022 • 1 minute read

IRS issues proposed regulations impacting the determination of domestically controlled REIT status

I. Introduction

On December 29, 2022, the Treasury Department and the Internal Revenue Service (the IRS) published proposed regulations (the Proposed Regulations) in the Federal Register under Section 897 of the Internal Revenue Code of 1986, as amended (the Code),[1] that would significantly modify the interpretation of the definition of “domestically controlled” real estate investment trust (REIT) status.

In particular, the Proposed Regulations would disallow the common practice of foreign investors using a foreign-owned domestic corporation to create a domestically controlled REIT which was permitted under prior guidance.

This alert will review the determination of domestically controlled REIT status under prior guidance and the proposed changes under the Proposed Regulations.

II. Overview and background

Under the Foreign Investment in Real Property Tax Act of 1980 (commonly known as FIRPTA), foreign investors are generally taxed on gain or loss upon disposition of US real property investments in the same manner as if the foreign investor were engaged in a trade or business within the US and if such gain or loss were effectively connected with such trade or business.

One of the exceptions to the application of FIRPTA frequently relied on by foreign investors is the sale of stock in a domestically controlled REIT. A domestically controlled REIT is a REIT in which non-US persons hold directly or indirectly less than 50 percent of the interests in the REIT. Accordingly, foreign investors frequently acquire US real estate through a domestically controlled REIT and structure their exit in US real estate as a sale of shares in such domestically controlled REIT instead of a sale of a fee simple interest in order to avoid the FIRPTA tax. Therefore, the determination of whether a REIT is domestically controlled is often critical to a foreign investor’s investment decision.

III. Determination of domestically controlled REIT status under prior guidance

Section 897(h)(4)(B) generally provides that a domestically controlled REIT is a REIT in which less than 50 percent in value of the stock is held “directly or indirectly” by foreign persons. The Code does not provide specific guidance interpreting the words “directly or indirectly.”

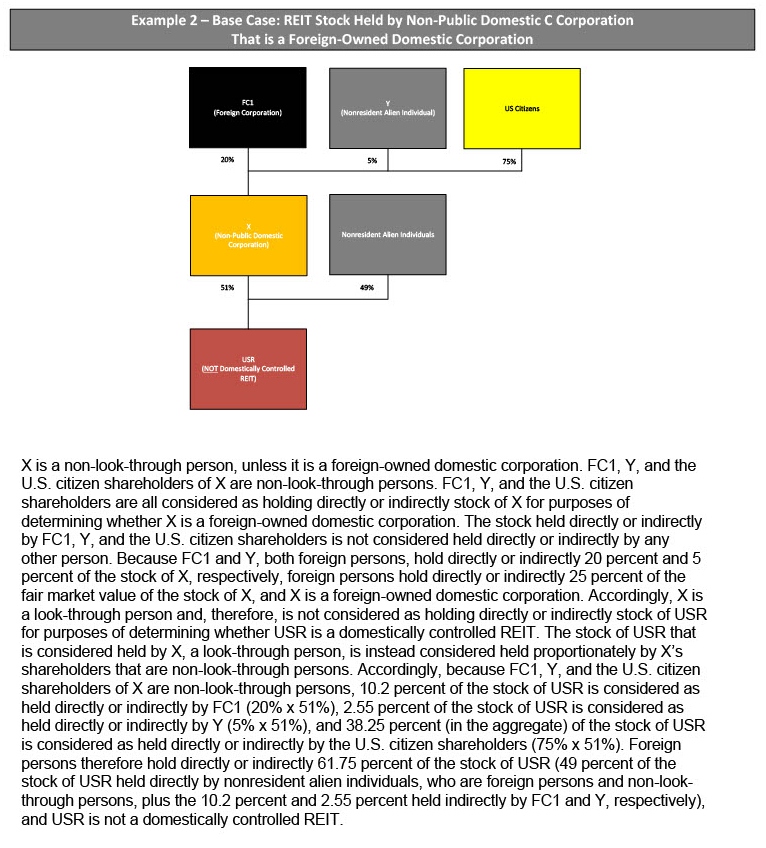

The IRS considered whether a foreign-owned US corporation should be viewed as a US person for purposes of determining whether a REIT is domestically controlled in Private Letter Ruling 200923001 (June 5, 2009) (the Ruling). The REIT that was the subject of the ruling was held by two domestic corporations that were owned in part by foreign shareholders. The IRS concluded that the REIT was considered to be “domestically controlled” even though the REIT was indirectly owned by a foreign corporation. The Ruling refers to Section 1.897-1(c)(2)(i), which provides that “the actual owners of stock, as determined under Section 1.857-8, must be taken into account.” Section 1.857-8(b) provides that the actual owner of stock of a REIT is the person who is required to include in gross income any dividends received on the stock. The Proposed Regulations do not retain the reference to Section 1.857-8 in Section 1.897-1(c)(2)(i).

The Ruling concluded that the domestic C corporations would be considered domestic holders of REIT stock, even though the domestic corporations were owned by foreign shareholders, on the rationale that the corporations were fully taxable as domestic C corporations and were required to include in their income, and pay tax on, any distributions from the REIT.

In addition, the legislative history of the Protecting Americans from Tax Hikes Act of 2015 (the PATH Act) supports this conclusion. The legislative history cited the Ruling’s conclusion that the term ‘‘directly or indirectly’’ for purposes of Section 897(h)(4)(B) does not require looking through domestic C corporations.

IV. Determination of domestically controlled REIT status under the Proposed Regulations

Look-through persons and non-look-through persons

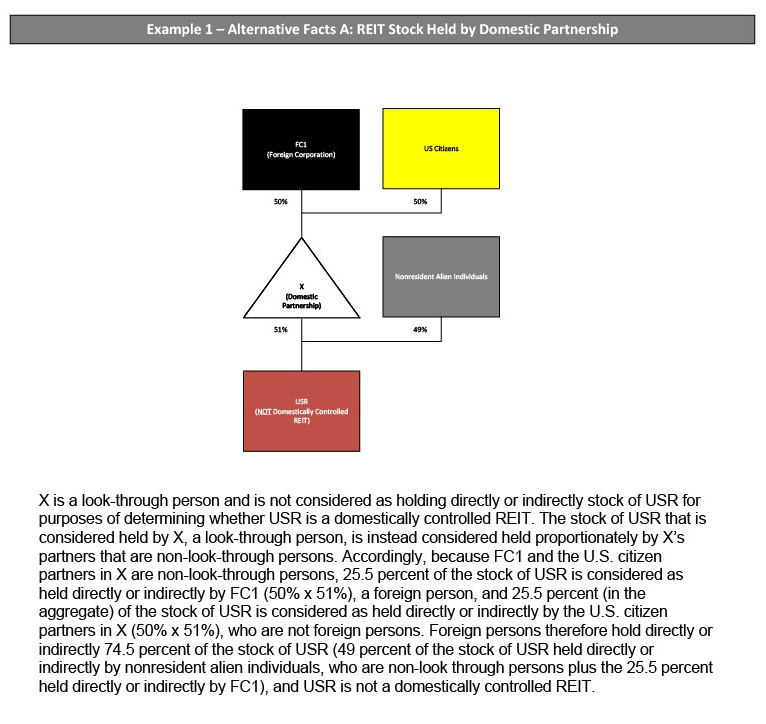

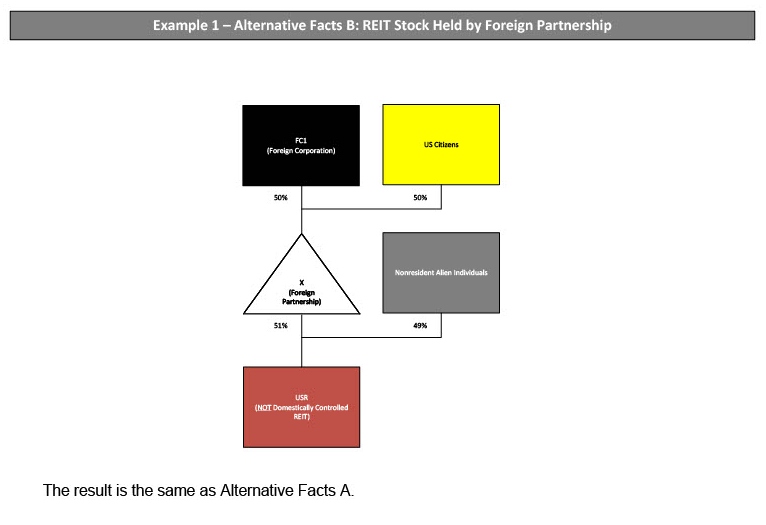

The Proposed Regulations introduce a new concept of look-through persons and non-look-through persons. Under the Proposed Regulations, in order to determine if a REIT is domestically controlled, it is necessary to review each look-through person until you reach a non-look-through-person.

A look-through person is any person other than a non-look-through person and includes a regulated investment company, a REIT, an S corporation, a non-publicly traded partnership (domestic or foreign) and a trust (domestic or foreign). A public REIT is treated as a foreign person that is a non-look-through person unless it is a domestically controlled REIT, in which case the public REIT is treated as a US person that is a non-look-through person.

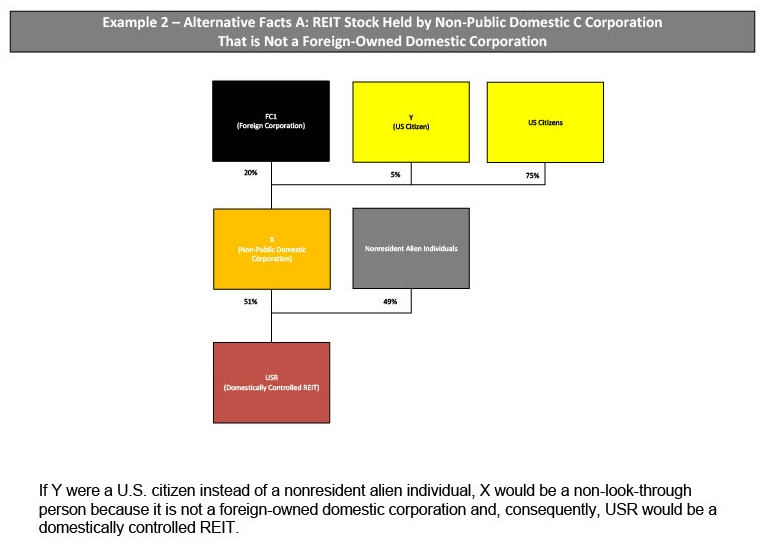

A non-look-through person is an individual, a domestic C corporation (other than a foreign-owned domestic corporation), a nontaxable holder, a foreign corporation (including a foreign government pursuant to Section 892(a)(3)), a publicly traded partnership (domestic or foreign), an estate (domestic or foreign), an international organization (as defined in Section 7701(a)(18)), a qualified foreign pension fund within the meaning of Section 897(l) (a QFPF) (including any part of a QFPF) or an entity wholly owned by one or more QFPFs (a Qualified Controlled Entity). A person holding less than five percent of US publicly traded REIT stock is treated as a US person that is a non-look-through person with respect to that stock, unless the REIT has actual knowledge that such person is not a US person.

A non-public domestic C corporation is treated as a look-through-person if it is a foreign-owned domestic corporation. A foreign-owned domestic corporation is any non-public domestic C corporation if foreign persons hold directly or indirectly 25 percent or more of the fair market value of the non-public domestic C corporation’s outstanding stock. This means that, contrary to prior guidance discussed above, a REIT shareholder that is a private taxable domestic C corporation is a look-through person if 25 percent or more of the value of its outstanding stock is held by shareholders which are foreign persons. The Treasury Department and the IRS intend this new foreign-owned domestic corporation rule to prevent the use of intermediary domestic C corporations to create domestically controlled REITs.

No attribution or constructive ownership rules

While the Proposed Regulations import this new concept of look-through persons and non-look-through persons, they continue to rely only on actual chains of ownership and do not import the attribution or constructive stock ownership rules found in other parts of the Code (eg, Sections 267 and 318).

QFPFs treated as foreign persons

A technical reading of Section 897(l) might lead one to conclude that a QFPF or Qualified Controlled Entity is essentially viewed as a US person for purposes of exempting such entity from FIRPTA and such QFPF or Qualified Controlled Entity would count as a US person for purposes of the domestically controlled test. The Proposed Regulations clarify that such a technical reading is not the intent and that QFPFs and Qualified Controlled Entities are treated as foreign persons for the purposes of domestically controlled REIT status.

Illustrative examples

The Proposed Regulations are complex and require careful analysis in each case. Helpfully, they include some examples illustrating the rules. We have diagrammed and included these examples as an appendix to this alert.

V. Next steps for the Treasury Department and the IRS

While these changes in law are only proposed regulations at this time, the preamble to the Proposed Regulations noted that the IRS may challenge positions contrary to the Proposed Regulations before the issuance of final regulations. The Treasury Department will solicit comments from the public over the next 60 days, including on the definition of look-through person and non-look-through person. The preamble to the Proposed Regulations specifically notes that the Treasury Department and the IRS did consider an alternative rule that would treat all domestic C corporations as non-look-through persons. We anticipate that taxpayers will submit comments requesting the Treasury Department to reconsider this alternative rule which would be consistent with prior guidance.

VI. Next steps for real estate sponsors, fund managers and REITs

Prudent real estate sponsors, fund managers, and REITs (collectively, real estate sponsors) will review their tax structures, fund structures, JV structures, REIT structures, subscription agreements, fund organizational documents, JV organizational documents, REIT organizational documents and side letters to evaluate the impact of the Proposed Regulations. In particular, real estate sponsors are encouraged to review any domestically controlled REIT structure that contains foreign-owned domestic corporations. In order to make this determination, the real estate sponsor may need to request additional information from investors relating to ultimate ownership.

Finally, real estate sponsors should review side letters to determine what assurances/covenants relating to domestically controlled REIT status may have been provided to investors and what new representations relating to ultimate ownership may be required from investors.

To learn more about the impact of the Proposed Regulations, please contact any of the following members of the DLA Piper team:

Jesse Criz, Allen Ashley, Shiukay Hung, Jeffrey Zanchelli, Emily Snyder, John Sullivan, Barbara Trachtenberg, Rob Bergdolt, Chris Stambaugh, Carrie Hartley, Laura Sirianni, Katie LaKoma, Joshua Lingerfelt, Kentaro Murase, Matthew Hilowitz and Allan Bowen

[1] All section references are to the Code and the Treasury Regulations thereunder unless otherwise stated.

[1] All section references are to the Code and the Treasury Regulations thereunder unless otherwise stated.