2 minute read

Global Tax Summit 2025

17-19 September, Cascais, PortugalWe are delighted that you can join us for our exclusive annual Global Tax Summit, which will take place from 17-19 September in Cascais, Portugal.

The Summit is set to be two days of stimulating technical sessions as well as social and networking activities. You will have the chance to catch up on the latest global tax developments and network with your peers and members of our global Tax team in a beautiful and relaxed setting.

Keynote Speaker

Agenda

17:00

Registration opens

During registration you will be issued with your conference name badge and itinerary which we recommend you have with you during core conference sessions.

18:30

Drinks and dinner

TECHNICAL SESSIONS

08:45 – 10:00

Navigating a shifting political and fiscal landscape

Roundtable discussion on how changing political leadership and increased global competition are reshaping tax priorities and global tax negotiations.

Following a wave of national and international elections in 2024 and early 2025, over the past months political alliances have been evolving, and leadership dynamics have been redefined. Across many jurisdictions, governments are intensifying efforts to boost revenue – leveraging both economic growth and innovative fiscal strategies. This session brings together leading voices from policy, business and international institutions to unpack the latest development in global tax policy, with particular focus on the OECD's evolving framework, the G7 agreement on the side-by-side approach and the implications of the EU-US Trade Agreement.

Keynote speaker

John Peterson, OECD

Moderator

Sorina van Kommer

Panelists

Markus Küpfer (Swiss Federal Tax Administration), Phil Hogan, Evan Migdail, Velio Alessandro (Generali Group)

10:00 – 13:00

Panel discussions focusing on:

10:00 – 11:00

Outlook for global direct and indirect tax policy and controversy challenges as well as trends arising from the US administration's legislative agenda and public statements

- Practical challenges and emerging trends in direct and indirect enquires and disputes

The discussion will highlight practical trends in audits, litigation, and dispute resolution, with a particular focus on strategies to reduce risk exposure and improve outcomes. One of our speakers will also bring valuable insights from the US, offering a comparative perspective on global enforcement dynamics. Speakers

Moderator

Jason Collins

Panelists

Sarah Blakelock (Astra Zeneca), Wade Owen (Visa), Henry Cheng, Randall Fox, Antonio Tomassini, Stuart Walsh

11:00 – 11:30

Break

11:30 – 12:15

- Recent developments in transfer pricing and evolving geopolitical dynamics

We will also explore practical ways to manage these risks, focusing on the role of Advance Pricing Agreements (APAs). Panellists will discuss whether APAs still deliver certainty, how different tax authorities approach negotiations, and what businesses should consider when deciding whether to pursue them. The discussion will also touch on the VAT implications of transfer pricing adjustments, offering the audience clear takeaways on how to manage risk in a more holistic way. Speakers

Moderator

Juan Osman Moreno

Panelists

Stephanie Pearson, Lucia Sahin, César Salagaray, Richard Woolich, Wade Owen (Visa)

12:15 – 13:00

- Global supply chains

Given the current climate, there might never have been a better time for businesses to reconsider their supply chains! In this panel discussion we will explore if and how we can transform disruption into business opportunities. Speakers

Moderator

Aloïs Charpenet

Panelists

Daan Arends, David Pope, Tina Xia, Marcella Tagni (Ferrari Group)

13:00 – 14:00

Lunch

14:30 – 17:00

Activities - as selected in your registration form and displayed on your personalised lanyard.

Biking in Cascais and Guincho

Join us for an unforgettable guided biking trail through the breathtaking landscapes of the Cascais coastline. You will be taken along some of the most stunning spots in the region, including Boca do Inferno, Praia do Guincho and Quinta da Marinha.

Please note that this trail is moderately challenging, but it primarily features flat terrain.

Historic cultural tour

Join us on an enlightening walking tour through the historic streets of Cascais, where you'll step back in time to explore the magnificent Museu Conde Castro Guimarães.

Guided by our expert historians, you will uncover the rich cultural heritage and history of this museum, which houses remarkable collections of art and artifacts.

Please note this tour will require a considerable amount of walking.

Jeep experience

You will experience all the thrills of off-road driving, plunging through the Sintra parks and reserves and enjoying magnificent views of Peninha, Praia da Adraga, Fojo da Adraga and Cabo da Roca.

Please note that when driving off-road it may not be suitable for those with back problems or if you are pregnant. If you would like to attend the jeep experience but have any mobility issues, please let us know and we can organise for you to be transported separately for the off-road sections.

Sintra tour

Discover the beautiful sights of Sintra, including the National Palace, the only medieval royal palace in Portugal still intact, renowned for its rich history, striking architecture, and artistic heritage.

After the palace, there will be some free time to explore the village and enjoy a tasting of queijadinhas de Sintra.

Please note this tour will require a considerable amount of walking.

17:00 – 17:30

Return to hotel

19:00 – 20:00

Pre-dinner drinks at Furnas do Guincho

We will be running a shuttle service to the restaurant. Alternatively it is a 40 minute walk from the hotel.

20:00

Dinner at Furnas do Guincho

08:45 – 13:00

Breakout sessions - as selected in your preferences and displayed on your personalised lanyard.

Direct tax technical sessions for multinational companies

- Essential in-country tax updates – hot topics in the key jurisdictions of the EU, UK, Middle East, Singapore and the US This session will revisit key themes from last year's summit discussion and provide timely updates on global tax developments affecting multinational companies. The panel comprising speakers from DLA Piper global platform will explore evolving risks and opportunities across jurisdictions, with focus on global mobility, anti-hybrid rules, beneficial ownership, global minimum taxation and jurisdiction-specific updates. Speakers

- EU Omnibus proposal – discussion on key changes and potential implications for businesses of the EU's Omnibus proposal covering the CSRD, EU Taxonomy, CSDDD and CBAM This session will explore the European Commission's first Omnibus proposal, a landmark comprehensive simplification package aimed at reducing regulatory burdens while maintaining the EU's sustainability ambitions. It is part of a broader strategy to enhance competitiveness, attract investment, and foster a more favorable business environment across the EU. Through a series of expert-led segments, we will unpack the policy context, implications for ESG and trade and the evolving role in shaping Europe's tax and economic future. Speakers

- BEPS 2.0 – assessing the current state of global coordination efforts The Pillar 2 project has so far been viewed as one of the most significant reforms to the international tax landscape in decades, but how will implementation be impacted by the US' current stance as well as the G7 agreement? This session builds on the discussion from the introductory panel of day 1 of the summit, responding to key developments in global tax policy with focus to the G7 agreement, the evolving Pillar 2 framework, and the strategic implications of multinational enterprises. The panel will explore jurisdictional responses, competitive dynamics and the future of tax incentives and compliance. Speakers

Moderator

Maura Dineen

Panelists

Raphaël Béra, Ton Van Doremalen, Christian Montinari, Konrad Rohde, César Salagaray, Barbara Voskamp, Jacques Wantz, Tina Xia, Nicolas Englemann, Roland Kleimann, Rachit Agarwal, Carlos Vaca Valverde, Shiukay Hung

Moderator

Richard Sterneberg

Panelists

Federico Pacelli, Chris Thompson, Giovanni Iaselli

Moderator

Pie Geelen

Panelists

Guillermo Aguayo, Nicolas Engelmann, Marica De Rosa

Indirect tax technical sessions for multinational companies

- VAT and Indirect Tax – focus on topical challenges and solutions for international businesses Input Tax recovery forms the cornerstone of the principle of neutrality, which is the very essence of VAT. Many factors may impact how businesses may recover VAT paid on their costs and, as always, careful planning is key to secure this right.

In this interactive workshop, Indirect Tax experts will explore key aspects of input VAT recovery. They will discuss – for instance – partial exemption issues, incorrectly charged VAT, input VAT connected with fraudulent activities as well as VAT incurred by intermediaries or third parties.

The workshop is designed for all participants to exchange best practices and practical recommendations on how to optimize VAT recovery. Speakers

Moderator

Richard Woolich

Panelists

Daan Arends, Aloïs Charpenet, Björn Enders, Giovanni Iaselli, Chris Thompson, Stuart Walsh

2025 Tax Trends in the Middle East and Africa

- Implications for Global Businesses – panel discussion providing a focused overview of the most impactful tax developments in 2025 in MEA This breakout session will focus on the latest tax developments across the Middle East and Africa, two regions undergoing significant policy and legislative reform. The session is designed to offer practical insights into the current environment, highlighting recent regulatory changes and emerging trends that are reshaping the way businesses operate in these markets. The speakers will also touch on transfer pricing developments, including the evolution of advance pricing agreements programs, the introduction of rules in new jurisdiction and how multinational businesses are managing cross-border transactions in these markets.

Designed to be practical and interactive, the discussion will give attendees a clear view of where tax risk is emerging in these regions and what steps companies can take to stay ahead. Speakers

Moderator

Ton Van Doremalen

Panelists

Rachit Agarwal, Raneem Alrakhaimi, Andrew Lewis, Adly Adly (Agility), Sebastine Odimma (Yellow Card)

13:00 – 14:00

Lunch

14:00

Summit closes

Travel

Transportation information

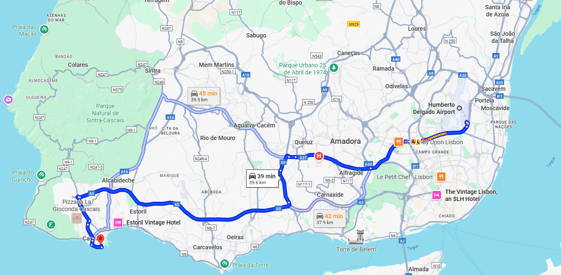

We recommend that you get a taxi (approx. 40 minutes) from Humberto Delgado Airport to Grande Real Villa Itália Hotel & Spa.

The hotel's address is:

Grande Real Villa Itália Hotel & Spa

Frei Nicolau de Oliveira 100, 2750-319

Cascais, Portugal

Directions

Location map

Venue

Grande Real Villa Itália Hotel & Spa

Frei Nicolau de Oliveira 100, 2750-319 Cascais, Portugal

The Summit will be held at the Grande Real Villa Itália Hotel & Spa, located in front of the sea, in Cascais, and results from the recovery of the former houses of the last King of Italy – Umberto II.

Reservations for the conference must be made through the conference registration process. Please do not make reservations directly with the venue or through a third-party booking site.

Check-in: 15:00

Check-out: 12:00

Further information

Registration

Your conference invitation includes:

- accommodation on 17 and 18 September

- all meals and drinks during your stay

- full programme of conference sessions

- social activities on 18 September

Please note that invited guests will be responsible for all other related expenses, including rail/air/car transportation, hotel transfers, charges for accommodation outside of the Summit dates, travel insurance and any social activities outside of those planned.

Dress code

There is no dress code for the conference. Most delegates will be in smart / business casual attire.

Recording

Please be advised that the technical and breakout sessions will be recorded. By attending, you consent to the recording and its use for promotional and educational purposes.

If you have any concerns or questions regarding this, please do contact us.

Emergency contact details

Amanda Barker, Senior Marketing & Business Development Manager: +44 7971 142116 or amanda.barker@dlapiper.com